FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

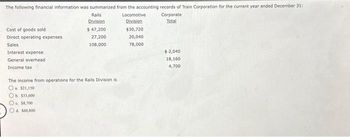

Transcribed Image Text:The following financial information was summarized from the accounting records of Train Corporation for the current year ended December 31:

Locomotive

Division

Cost of goods sold

Direct operating expenses

Sales

Interest expense

General overhead.

Income tax

Rails

Division

$ 47,200

27,200

108,000

The income from operations for the Rails Division is

O $21,150

Ob. $33,600

O $8,700

O d. $60,800

$30,720

20,040

78,000

Corporate

Total

$2,040

18,160

4,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A professional services firm has been analysing the cost of collecting management information by using its employees' hourly charge-out rates to estimate the costs of different activities. The firm has calculated that the following costs have been incurred during the last month: Staff completing timesheets Managers analysing costs incurred on assignments compared to fees agreed with clients Credit control team updating the receivables ledgers to write off bad debts 5,000 3,000 500 Using the information provided, what are the firm's direct data capture costs for the last month? - $500 $5,000 $8,000 $8,500arrow_forwardCompute operating income for Jonas Company based on the following data: Line Item Description Amount Sales $764,000 Operating expenses 52, 500 Cost of goods sold 538,000arrow_forwardThe following financial information was summarized from the accounting records of Train Corporation for the current year ended December 31: RailsDivision LocomotiveDivision CorporateTotal Cost of goods sold $46,700 $29,300 Direct operating expenses 26,400 20,400 Sales 98,200 69,700 Interest expense $2,200 General overhead 19,900 Income tax 4,500 The net income for Train Corporation is a.$73,800 b.$91,900 c.$18,500arrow_forward

- Seaforce Manufacturing Inc. Income Statement Year Ended December 31, 20X5 Sale $ 340,000 Cost of goods sold $ 250,100 Gross Profit $ 89,900 Operating Expenses $ 55,000 Loss on Sale of equipment $ 2,500 $ 57,500 Profit from Operations $ 32,400 Other expenses Interest Expense $ 3,500 Profit before Income Tax $ 28,900 Income Tax Expense $ 12,000 Profit $ 16,900 Additional Information: Operating expenses include depreciation expense of $10,000 Accounts Payable related to the purchase of inventory Equipment that cost $12,500 was sold at a loss of $2,500 New equipment was purchased during the year for $8,500 Dividends declared and paid in 20X5 totaled $3,000 Common shares were sold for $12,000 cash Interest payable in 20X5 was $800 greater than interest payable in 20X4 The company uses IFRS and do not treat dividends as part of operations Seaforce Manufacturing Inc. comparative balance sheet at December 31 20X5…arrow_forwardIncome statements for Burch Company for Year 3 and Year 4 follow: BURCH COMPANY Income Statements Year 4 Year 3 $200,000 124,000 20,000 18,000 $240,000 180,000 Sales Cost of goods sold Selling expenses Administrative expenses 26,000 12,000 7,500 $225,500 14,500 1,200 $ 13,300 8,000 $170,000 30,000 3,000 $ 27,000 Interest expense Total expenses Income before taxes Income taxes expense Net income Required a. Perform a horizontal analysis, showing the percentage change in each income statement component between Year 3 and Year 4. b. Perform a vertical analysis, showing each income statement component as a percentage of sales for each year. Complete this question by entering your answers in the tabs below. Required A Required 8 Perform a horizontal analysis, showing the percentage change in each income statement component between Year 3 and Year 4. (Negative answers should be indicated by a minus sign. Round your answers to 1 decimal place, (i.e., 0.234 should be entered as 23.4).) BURCH…arrow_forwardPROVIDE Answer with calculationarrow_forward

- Grandy productions reported the following items for the current year sales 15,250,000; cost of goods 8750,000; depreciation expense 335,000; taxes925,000 administrative expenses; 275,000 interest, expenses; 97,500 and marketing expenses 385,000. What is grandes operating income?arrow_forwardSolve this problemarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education