FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

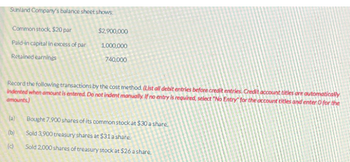

Transcribed Image Text:Sunland Company's balance sheet shows:

Common stock, $20 par

Paid-in capital in excess of par

Retained earnings

$2,900,000

1,000,000

740,000

Record the following transactions by the cost method. (List all debit entries before credit entries. Credit account titles are automatically

indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter 0 for the

amounts)

(a)

(b)

(c)

Bought 7,900 shares of its common stock at $30 a share.

Sold 3,900 treasury shares at $31 a share

Sold 2,000 shares of treasury stock at $26 a share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Note: please dont use excel and show ur solution. (NO NEED TO CONVERT INTO PERCENTAGE. TWO DECIMAL POINTS ONLY.) What is the Debt to equity ratio of GLOBE?arrow_forward(b) Prepare the journal entries for these transactions, assuming that the common stock is no-par with a stated value of $3 per share. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record entries in the order displayed in the problem statement.) Date Account Titles and Explanation Debit Creditarrow_forwarddo not give solution in image formatarrow_forward

- Consider the following account balances of Evan McGruder, Incorporated, as of December 31, Year 3: Accounts Payable $ 113,420 Retained Earnings $ 56,000 Equipment 422,900 Notes Payable, due Year 5 344,500 Common Stock 206,500 Accounts Receivable 203,800 Income Tax Payable 4,030 Cash 97,750 Required:Prepare a classified balance sheet at December 31, Year 3.arrow_forwardPlease do not give solution in image format ?arrow_forwardSmithson Floor Coverings reported the following summarized data at December 31, 2024. Accounts appear in no particular order, and all have normal balances. (Click the icon to view Smithson Floor Coverings accounts.) Prepare the trial balance of Smithson Floor Coverings at December 31, 2024. Account Title Total Smithson Floor Coverings Trial Balance December 31, 2024 Balance Debit Credit C Data table Service Revenue Equipment Rent Expense Common Stock Accounts Payable Dividends $ 26,000 36,000 17,000 24,000 2,200 16,100 Print Salaries Payable Salaries Expense Cash Accounts Receivable Interest Payable Utilities Expense Done $ 25,000 1,600 7,000 3,600 6,000 1,900 - Xarrow_forward

- Required information [The following information applies to the questions displayed below.] The general ledger of Zips Storage at January 1, 2024, includes the following account balances: Accounts Cash Accounts Receivable Prepaid Insurance Land Accounts Payable Debits Credits $25,500 16,300 13,800 157,000 $7,600 6,700 Deferred Revenue Common Stock Retained Earnings Totals 152,000 46,300 $212,600 $212,600 The following is a summary of the transactions for the year. storage services for cash, $143,100, and on account, $56,700. on accounts receivable, 1. January 9 2. February 12 Provide Collect $52,400. 3. April 25 4. May 6 5. July 15 6. September 10 7. October 31 8. November 20 Receive cash in advance from customers, $13,800. Purchase supplies on account, $11,000. Pay property taxes, $9,409. Pay on accounts payable, $12,300. Pay salaries, $132,600. Issue shares of Common stock in dividends to exchange for $36,000 cash. 9. December 30 Pay $3,700 cash stockholders. 8-a. Prepare the income…arrow_forwardfinish...arrow_forwardPrepare the journal entries for these transactions, assuming that the common stock is no-par with a stated value of $3 per share. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record entries in the order displayed in the problem statement.)arrow_forward

- Build a T-account for each part of the expanded accounting equation. (1) Drag the debit "DR" and credit "CR" labels to the appropriate sides of the T-account. (2) Drag the normal balance label to the correct side of the T- account. (3) Label which side of the t-account increases "+" and decreases "" that account. view drag.and drop keyboard instructions Debit Normal Credit Balance Land Common Stock Dividends Depreciation Expense- Equipmerit Unearnied Revenue Service Revenuearrow_forwardSarasota Company's balance sheet shows: Common stock, $20 par Paid-in capital in excess of par Retained earnings Record the following transactions by the cost method. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) (a) (b) (c) $3,100,000 1,100,000 760,000 (a) Bought 8,200 shares of its common stock at $30 a share. Sold 4,200 treasury shares at $31 a share. Sold 1,800 shares of treasury stock at $26 a share. No. Account Titles and Explanation Debit Creditarrow_forwardĮThe following information applies to the questions displayed below.] On January 1, Year 1, the general ledger of a company includes the following account balances: Accounts Debit Credit Cash Accounts Receivable Allowance for Uncollectible Accounts $ 25,600 47,200 $ 4,700 Inventory Land 20,500 51,000 17,500 Equipment Accumulated Depreciation Accounts Payable Notes Payable (6%, due April 1, Year 2) Common Stock 2,000 29,000 55,000 40,000 31,100 $161,800 $161,800 Retained Earnings Totals During January Year 1, the following transactions occur: January 2 Sold gift cards totaling $9,000. The cards are redeemable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $152,000. January 15 The comapany sales for the first half of the month total $140,000. All of these sales are on account. The cost of the units sold is $76,300. January 23 Receive $125,900 from customers on accounts receivable. January 25 Pay $95,000 to inventory suppliers on…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education