FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

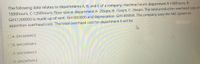

Transcribed Image Text:The following data relates to departments A, B, and C of a company; machine hours: department A-1000hours, B-

1500hours, C-1200hours; floor space: department A- 20sqm, B- 15sqm, C- 25sqm. The total production overhead cost of

GHC1200000 is made up of rent- GHC800000 and depreciation- GHC400000. The company uses the ABC system to

apportion overhead cost. The total overhead cost for department A will be

O A. GHC249549.5

OB. GHC245949.5

OC. GHC349549.5

OD. GHC345949.5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- P5-1A. Calculating Manufacturing Overhead Rates Glassman Company accumulated the following data for the current year. Milling Department manufacturing overhead... Finishing Department manufacturing overhead. Machine hours used a. Milling Department... Finishing Department. Labor hours used Milling Department.. Finishing Department. $484,000 $260,000 10,000 hours 2,000 hours 1,000 hours 1,000 hours Required Calculate the company-wide manufacturing overhead rate using machine hours as the allocation base.arrow_forwardAccount balances from Boilermakers Company are as follows: Manufacturing Overhead Work in Process Finished Goods Cost of Goods Sold $240,000 underapplied 100,000 300,000 800,000 Under- or overapplied overhead is material and is allocated to Work in Process, Finished Goods, and Cost of Goods Sold (based on ending account balances), Cost of Goods Sold after adjustment would have a balance of Oa. $1,440,000. Ob. $640,000. Oc. $960,000. Od. $1,040,000.arrow_forwardDarwin Company reports the following information: Sales Direct materials used Depreciation on factory equipment Indirect labor Direct labor Factory rent Factory utilities Sales salaries expense Office salaries expense Indirect materials Product costs are Oa. $35,000 Ob. $30,300 Oc. $24,500 Od. $29,200 $76,500 7,300 4,700 5,900 10,500 4,200 1,200 15,600 8,900 1,200arrow_forward

- c) Having carried out the allocation and apportionment process of its operations, the management accountant of Flowers Ltd is left with the reapportionments to carry out. The data below represent the current state of the overhead distribution summary and the additional detail that is needed to answer the question that follows. Flower Ltd overhead distribution summary Production department T M Amount in Amount in Kes Kes 25,000 20,000 Total b/d Reapportionment percentages A (%) B (%) Required Production department M T 30 20 20 25 F Amount in Kes 30,000 F 25 30 i. The repeated distribution method ii. Algebraic method Service department A Amount in Kes 10,000 Service department A - B Amount in Kes 20,000 25 B 25 a) Reapportion the service department overheads into the production departments on the basis of each of the following:arrow_forwardTt.11.arrow_forwardA7 please help.........arrow_forward

- Subject: accountingarrow_forwardUse the information provided for Darwin Company to answer the question that follow. Darwin Company Sales Direct materials used Depreciation on factory equipment Indirect labor Direct labor Factory rent Factory utilities Sales salaries expense Office salaries expense Indirect materials Darwin Company's period costs are Oa. $35,000 Ob. $30,300 Oc. $29,200 Od. $24,500 $76,500 7,300 4,700 5,900 10,500 4,200 1,200 15,600 8,900 1,200arrow_forwardThe following cost data were taken from the records of A Manufacturing Company: Depreciation on factory equipment, P 1,000; Depreciation on sales office, P 500; Advertising, P 7,000; Freight-out (shipping), P 3,000; Wages of production workers, P 28,000; Raw materials used, P 47,000; Sales salaries and commissions, P 10,000; Factory rent, P 2,000; Factory insurance, P 500; Materials handling, P 1,500; administrative salaries, P 2,000. Required: Total manufacturing costs *arrow_forward

- Please organize the list (picture) into the corresponding categories: Product Cost: Direct Materials Product Cost: Direct Labor Product Cost: Manufacturing Overhead Period Cost: Selling Expense Period Cost: Administrative Expensearrow_forwardThe following information provides the amount of cost incurred in Merch for the cost items indicated. During March 8,500 units of the firm's single product were manufactured Factory depreciation exper rect Ser Production servi Сперитет гента и an is Required 141.200 a. How much cost would you expect to be incurred for each of these items during Apr when 9.700 units of the product are planned for production? (Do not round intermedine calcul Factory on exper D Potion superviso Frey 1 of 13 Next >arrow_forwardUsing the step method, how much of NUBD Corporation’s Utilities Department cost is allocated between Departments A and B?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education