Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

What is the estimate of the overheads?

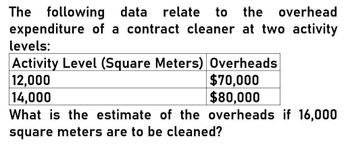

Transcribed Image Text:The following data relate to the overhead

expenditure of a contract cleaner at two activity

levels:

Activity Level (Square Meters) Overheads

12,000

14,000

$70,000

$80,000

What is the estimate of the overheads if 16,000

square meters are to be cleaned?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardIf a company bases its predetermined overhead rate on 100,000 machine hours, and It actually has 100,000 machine hours, would there be an under applied or over applied overhead?arrow_forwardThe predetermined overhead rate equals a. actual overhead divided by actual activity level for a period. b. estimated overhead divided by estimated activity level for a period. c. actual overhead minus estimated overhead. d. actual overhead multiplied by actual activity level for a period. e. one-twelfth of estimated overhead.arrow_forward

- A company has the following information relating to its production costs: Compute the actual and applied overhead using the companys predetermined overhead rate of $23.92 per machine hour. Was the overhead over applied or under applied, and by how much?arrow_forwardA company calculated the predetermined overhead based on an estimated overhead of $70.000, and the activity for the cost driver was estimated as 2,500 hours. If product A utilized 1,350 hours and product 8 utilized 1,100 hours, what was the total amount of overhead assigned to the products? A. $35000 B. $30.800 C. $37,800 D. $68,600arrow_forwardMountaIn Peaks applies overhead on the basis of machine hours and reports the following information: A. What is the predetermined overhead rate? B. How much overhead was applied during the year? C. Was overhead over- or under applied, and by what amount? D. What is the journal entry to dispose of the over- or under applied overhead?arrow_forward

- Compute the profit or loss on the job in (a) dollars and (b) as a percentage of the bid price. Express labor plus overhead as a percentage of total costs. (Round to one decimal place.)arrow_forwardCoops Stoops estimated its annual overhead to be $85,000 and based its predetermined overhead rate on 24,286 direct labor hours. At the end of the year, actual overhead was $90,000 and the total direct labor hours were 24,100. What is the entry to dispose of the over applied or under applied overhead?arrow_forwardThe actual overhead for a company is $73,175. Overhead was based on 4,500 machine hours and was $3,325 over applied for the year. What is the overhead application rate per direct labor hour? What is the journal entry to dispose of the under applied overhead?arrow_forward

- Kimble Company applies overhead on the basis of machine hours. Given the following data, compute overhead applied and the under- or overapplication of overhead for the period: Estimated annual overhead cost Actual annual overhead cost Estimated machine hours Actual machine hours $1,560,000 applied and $15,000 overapplied $1,600,000 applied and $15,000 overapplied $1,560,000 applied and $15,000 underapplied $1,575,000 applied and neither under- nor overapplied ● An A ♫ $1,600,000 $1,575,000 400,000 W 390,000 D P & E farrow_forward(1) calculate the overhead assigned rate (note their order from above): Overhead Cost Items Estimated Overhead Cost Driver Activity Levels Activity Rate Purchasing $70,000 ? ? ? Handling materials $33,350 ? ? ? Machine setups $70,500 ? ? ? Inspections $25,500 ? ? ? Utilities $45,000 ? ? ? (2) calculate the total order cost (again, note their order from above): Activity Cost Drivers Activity Levels Activity Rate Assigned Costs ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? Total Order Cost ?arrow_forwardFiguring a predetermined overhead rate using direct materials as the allocation base. $130500 estimated manufacturing overhead cost and $87000 as allocation base. Then whats next in the formulaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning