Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Calculate degree of operating leaverage

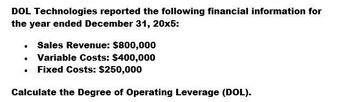

Transcribed Image Text:DOL Technologies reported the following financial information for

the year ended December 31, 20x5:

⚫ Sales Revenue: $800,000

⚫ Variable Costs: $400,000

⚫ Fixed Costs: $250,000

Calculate the Degree of Operating Leverage (DOL).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is horizon industries opereting leverage? General accountingarrow_forwardWhat is horizon industries opereting leverage?arrow_forwardThe following income statement applies to Finch Company for the current year: Income Statement Sales revenue (480 units × $30) $ 14,400 Variable cost (480 units × $15) (7,200 ) Contribution margin 7,200 Fixed cost (4,000 ) Net income $ 3,200 Required a. Use the contribution margin approach to calculate the magnitude of operating leverage. b. Use the operating leverage measure computed in Requirement a to determine the amount of net income that Fincharrow_forward

- The degree of opereting leverage?arrow_forwardThe degree of operating leverage is?arrow_forwardThe following income statement applies to Munoz Company for the current year: Income Statement Sales revenue (440 units x $34) Variable cost (440 units x $19) Contribution margin Fixed cost 3 Net income $14,960 (8,360) 6,600 (4,400) $2,200 Required a. Use the contribution margin approach to calculate the magnitude of operating leverage. b. Use the operating leverage measure computed in Requirement a to determine the amount of net income that Munoz Company will earn if it experiences a 10 percent increase in revenue. The sales price per unit is not affected. c-1. Verify your answer to Requirement b by constructing an income statement based on a 10 percent increase in sales revenue. The sales price is not affected. c-2. Calculate the percentage change in net income for the two income statements. Complete this question by entering your answers in the tabs below. Req A and B Req C1 Req C2 a. Use the contribution margin approach to calculate the magnitude of operating leverage. b.…arrow_forward

- Operating Leverage Haywood Co. reports the following data: Sales $6,160,000 Variable costs (4,620,000) Contribution margin $1,540,000 Fixed costs (440,000) Operating income $1,100,000 Determine Haywood Co.’s operating leverage. Round your answer to one decimal place.arrow_forwardJellico Inc.’s projected operating income (based on sales of 450,000 units) for the coming year isas follows:TotalSales $11,700,000Total variable cost 8,190,000Contribution margin $ 3,510,000Total fixed cost 2,254,200Operating income $ 1,255,800Required:1. Compute: (a) variable cost per unit, (b) contribution margin per unit, (c) contribution margin ratio, (d) break-even point in units, and (e) break-even point in sales dollars.2. How many units must be sold to earn operating income of $296,400?3. Compute the additional operating income that Jellico would earn if sales were $50,000 morethan expected.4. For the projected level of sales, compute the margin of safety in units, and then in salesdollars.5. Compute the degree of operating leverage. (Note: Round answer to two decimal places.)6. Compute the new operating income if sales are 10% higher than expected.arrow_forwardOperating Leverage Snellville Co. reports the following data: Sales Variable costs Contribution margin Fixed costs $897,700 (610,400) $287,300 (227,400) $59,900 Operating income Determine Snellville Co.'s operating leverage. Round your answer to one decimal place. Previous A Nexarrow_forward

- Financial Accountingarrow_forwardOperating leverage Haywood Co. reports the following data: Line Item Description Amount Sales $6,160,000 Variable costs (4,620,000) Contribution margin $1,540,000 Fixed costs (440,000) Operating income $1,100,000 Determine Haywood Co.’s operating leverage. Round your answer to one decimal place.arrow_forwardOpereting leverage?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub