FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

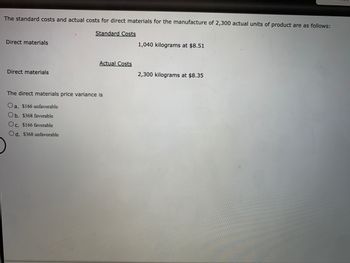

Transcribed Image Text:The standard costs and actual costs for direct materials for the manufacture of 2,300 actual units of product are as follows:

**Standard Costs**

- Direct materials: 1,040 kilograms at $8.51

**Actual Costs**

- Direct materials: 2,300 kilograms at $8.35

The direct materials price variance is:

- a. $166 unfavorable

- b. $368 favorable

- c. $166 favorable

- d. $368 unfavorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 2. Acme Inc. has the following information available: Actual price paid for material Standard price for material Actual quantity purchased and used in production Standard quantity for units produced Actual labor rate per hour Standard labor rate per hour Actual hours Standard hours for units produced A. Compute the material price and quantity, and the labor rate and B. C. D. E. unfavorable variances. $1.00 $0.90 100 90 15 $ $ 16 200 220 efficiency variances. Describe the possible causes for this combination of favorable andarrow_forwardThe standard costs and actual costs for factory overhead for the manufacture of 2,800 units of actual production are as follows: Line Item DescriptionValueFixed overhead (based on 10,000 hours)3 hours per unit at $0.71 per hourVariable overhead3 hours per unit at $1.98 per hour Actual Costs Total variable cost, $18,200 Total fixed cost, $8,200 The fixed factory overhead volume variance is Group of answer choices $1,136 unfavorable $909 unfavorable $909 favorable $0arrow_forwardAssume the following: • The variable portion of the predetermined overhead rate is $1.50 per direct labor-hour. • The standard labor-hours allowed per unit of finished goods is 3 hours. • The variable overhead efficiency variance is $1,500 F. • The company produced 15,000 units of finished goods during the period. What is the actual quantity of direct labor-hours worked during the period? Multiple Choice о о O O 44,000 hours 44,500 hours 43,500 hours 43,000 hoursarrow_forward

- Benoit Company produces three products—A, B, and C. Data concerning the three products follow (per unit): Product A B C Selling price $ 92.00 $ 66.00 $ 82.00 Variable expenses: Direct materials 27.60 18.00 12.00 Other variable expenses 27.60 31.50 45.40 Total variable expenses 55.20 49.50 57.40 Contribution margin $ 36.80 $ 16.50 $ 24.60 Contribution margin ratio 40% 25% 30% The company estimates that it can sell 950 units of each product per month. The same raw material is used in each product. The material costs $3 per pound with a maximum of 6,100 pounds available each month. Required: 1. Calculate the contribution margin per pound of the constraining resource for each product. 2. Which orders would you advise the company to accept first, those for A, B, or C? Which orders second? Third? 3. What is the maximum contribution margin that the company can earn per month if it makes optimal use of its 6,100 pounds of materials?arrow_forwardThe standard costs and actual costs for factory overhead for the manufacture of 2,500 units of actual production are as follows: Standard Costs 3 hours per unit at $0.71 per hour 3 hours per unit at $1.92 per hour Fixed overhead (based on 10,000 hours) Variable overhead Actual Costs Total variable cost, $18,200 Total fixed cost, $8,100 The variable factory overhead controllable variance is Oa. $3,800 unfavorable Ob. $3,800 favorable Oc. $3,040 favorable Od. Soarrow_forwardTrini Company set the following standard costs per unit for its single product Direct materials (30 pounds @ $4.40 per pound) Direct labor (6 hours @ $14 per hour) Variable overhead (6 hours @ $8 per hour) Fixed overhead (6 hours @ $11 per hour) $ 132.00 84.00 48.00 66.00 $ 330.00 Standard cost per unit Overhead is applied using direct labor hours. The standard overhead rate is based on a predicted activity level of 80% of the company's capacity of 50,000 units per quarter. The following additional information is available. Production (in units) Standard direct labor hours (6 DLH per unit) Budgeted overhead (flexible budget) Fixed overhead Variable overhead Operating Levels 70% 80% 90% 35,000 210,000 40,000 240,000 45,000 270,000 $ 2,640,000 $ 1,680,000 $ 2,640,000 $ 2,640,000 $ 1,920,000 $ 2,160,000 During the current quarter, the company operated at 90% of capacity and produced 45,000 units; actual direct labor totaled 266,000 hours. Units produced were assigned the following…arrow_forward

- The Russell Company provides the following standard cost data per unit of product: Direct material (2 gallons @ $3 per gallon) Direct labor (1 hours @ $13 per hour) During the period, the company produced and sold 26,000 units, incurring the following costs: Direct material Direct labor 55,000 gallons @ $ 2.9 per gallon 26,500 hours @ $12.75 per hour $ 6 $13 The direct material price variance was:arrow_forwardThe standard costs and actual costs for factory overhead for the manufacture of 2,700 units of actual production are as follows: Fixed overhead (based on 10,000 hours) Variable overhead Actual Costs Total variable cost, $17,800 Total fixed cost, $8,200 The total factory overhead cost variance is Oa. $1,600 unfavorable Ob. $2,930 favorable Oc. $2,930 unfavorable Od. $4,260 favorable Standard Costs 3 hours per unit at $0.70 per hour 3 hours per unit at $2.00 per hourarrow_forward56. When the actual amount of a raw material used in production is greater than the standard amount allowed for the actual output, the journal entry would include: Debit A. Materials Qty. Variance B. Materials Qty. Variance Credit Raw Materials Work in Process Credit c. Raw Materials d. Work in Process Credit Materials Qty. Variance Materials Qty. Variancearrow_forward

- Help pleasearrow_forwardJSON-5313 Inc. produces Products X5, Y8, and Z9. The following table provides per unit information relating to the three products: Product Y8 X5 Z9 Selling price $ 72.00 $ 54.00 $ 62.00 Variable expenses: Direct materials 21.60 18.00 9.00 21.60 22.50 34.40 43.20 43.40 Other variable expenses Total variable expenses Contribution margin Contribution margin ratio 40.50 $13.50 $28.80 $18.60 40% 25% 30% JSON-5313 has enough demand to sell 700 units of each product per month. Each product requires the same direct materials in its production. The direct materials cost $3 per pound. The company will at most have 4,800 pounds of the direct materials available every month. What is the maximum contribution margin that JSON-5313 can earn per month using its 4,800 pounds of direct materials optimally? O $ 10,800 O $ 13,020 O $ 23,820 O $ 26,320arrow_forwardFind the values of the missing items (a) through (x). Assume the actual sales volume equals actual production volume. Marketing and Administrative Sales Price Variance Variance Units Sales Revenue Less: Variable Manufacturing Costs Variable marketing and administrative costs Contribution margin Fixed manufacturing costs Fixed marketing and administrative costs Operating Profit PreviousNext Reported income statement (based on actual sales volume) Manufacturing variance (a) (g) (n) (q) (r) (t) $4,320 $3,600 (0) $1,800 U $ 400 F (u) (p) (s) (v) (w) $3,600 F (X) $3,600 F Flexible Budget (based on actual sales volume (b) (h) (m) Sales Activity Variance 4,000 F (1) $19,200 (i) $4,800 $800 U $12,000 (k) $3,000 $4,000 (1) Master Budget (based on budgeted sales volume) 20,000 $30,000 (c) (d) (e) (f) $16,000 $10,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education