Prepare the necessary

Prepare the Adjusted

Prepare the company’s multiple-step income statement for the period ending

June 30, 2022

Prepare the company’s statement of owner’s equity at June 30, 2022

Prepare the company’s classified

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Prepare the company’s statement of owner’s equity at June 30, 2022

Prepare the company’s classified

Please prepare classified

Prepare the company’s statement of owner’s equity at June 30, 2022

Prepare the company’s classified

Please prepare classified

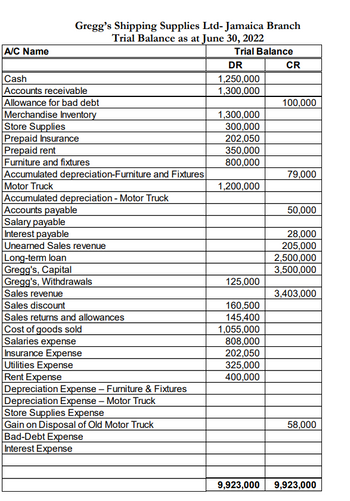

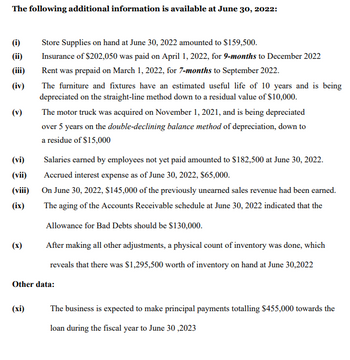

- A dog training business began on December 1. The following transactions occurred during its first month. December 1 Receives $21,000 cash as an owner investment in exchange for common stock. December 2 Pays $6,120 cash for equipment. December 3 Pays $3,660 cash (insurance premium) for a 12-month insurance policy. Coverage began on December 1. December 4 Pays $1,020 cash for December rent expense. December 7 Provides all-day training services for a large group and immediately collects $1,150 cash. December 8 Pays $205 cash in wages for part-time help. December 9 Provides training services for $2,420 and rents training equipment for $610. The customer is billed $3,030 for these services. December 19 Receives $3,030 cash from the customer billed on Dec. 9. December 20 Purchases $2,010 of supplies on credit from a supplier. December 23 Receives $1,620 cash in advance of providing a 4-week training service to a customer. December 29 Pays $1,305 cash as a partial payment toward the accounts…arrow_forwardc) Prepare the closing entries as at 31 December 2020.arrow_forwardPrepare the necessary adjusting journal entries on June 30, 2022. Prepare the Adjusted Trial balance at June 30, 2022. Prepare the company’s multiple-step income statement for the period ending June 30, 2022 Prepare the company’s statement of owner’s equity at June 30, 2022Prepare the company’s classified balance sheet at June 30, 2022arrow_forward

- Pharoah Salon Inc.'s general ledger at April 30, 2025, included the following: Cash $5,400, Supplies $540, Equipment $25,920, Accounts Payable $2,270, Notes Payable $10,800, Unearned Service Revenue (from gift certificates) $1,080, Common Stock $5,400, and Retained Earnings $12,310. The following events and transactions occurred during May Paid rent for the month of May $1,080. Paid $1,190 of the account payable at April 30. Issued gift certificates for future services for $1,620 cash. Received $1,300 cash from customers for services performed. Paid $1,300 in salaries to employees. Received $860 in cash from customers for services performed. Customers receiving services worth $760 used gift certificates in payment. Paid the remaining accounts payable from April 30. Received $1.080 in cash from customers for services performed. 22 Purchased supplies of $760 on account. All of these were used during the month Received a bill for advertising for $540. This bill is due on June 13. Received…arrow_forwardAdjusting Entries and Financial Statements You have the following unadjusted trial balance for Rogers Corporation at December 31, 2019: Rogers Corporation Unadjusted Trial Balance December 31, 2019 Account Debit Credit Cash $ 3,100 Accounts Receivable 15,900 Supplies 4,200 Prepaid Rent 9,500 Equipment 625,000 Accumulated Depreciation $ 104,000 Other Assets 60,900 Accounts Payable 9,400 Unearned Service Revenue 11,200 Note Payable (due 2022) 50,000 Common Stock 279,500 Retained Earnings, 12/31/2018 37,000 Service Revenue 598,000 Wages Expense 137,000 Rent Expense 229,000 Interest Expense 4,500 Total $1,089,100 $1,089,100 At year end, you have the following data for adjustments: An analysis indicates that prepaid rent on December 31 should be $2,300. A physical inventory shows that $650 of office…arrow_forwardNeed to fill out Owner's Equityarrow_forward

- Income StatementThe revenues and expenses of Sentinel Travel Service for the year ended August 31, 2019, follow:Fees earned$958,865Office expense220,540Miscellaneous expense19,175Wages expense460,255 Prepare an income statement for the year ended August 31, 2019.Sentinel Travel ServiceIncome StatementFor the Year Ended August 31, 2019 $Expenses: $ Total expenses $arrow_forwardClosing entry post closing entry financial statement analysis H AND H TOOLS INC. december 2021arrow_forwardPlease help me to solve this problemarrow_forward

- Please do not give image formatarrow_forwardFinancial statements and closing entriesThe Gorman Group is a financial planning services firm owned andoperated by Nicole Gorman. As of October 31, 2019, the end of the fiscal year, the accountant for The Gorman Group prepared an end-of-periodspreadsheet, part of which follows: (attached) Instructions1. Prepare an income statement, a statement of stockholders'equity, and a balance sheet. During the year, no additional commonstock was issued. 2. Journalize the entries that were required to close the accounts atOctober 31.3. If the balance of Retained Earnings had instead increased$115,000 after the closing entries were posted, and the dividendsremained the same, what would have been the amount of netincome or net loss?arrow_forwardYou have been provided with the following trial balance of Comvita for year ended 31st March and the management have requested you to apply accounting principles to prepare balance sheet and income statement for year ending 31st March 2019 and based on it provide an financial statement analysis reflecting the financial position of the Comvita to inform internal and external stakeholders. Trial Balance for Comvita Year Ended March 31, 2019 All figures are in ‘000 Account Name Debt Account Name Credit Accounting Fee 9000 Accounts payable 63600 Accounts receivable 286650 Accumulated Depreciation – Motor Vehicle 30000 Advertising 6000 Accumulated Depreciation – Office Equipment 6000 Bad Debts 1500 Mortgage-non current 282600 Bank 60240 Discount Received 31200 Bank Fees 300 Allowance for Doubtful Debts 2865 Freight Out 36000 Retained earnings 1365000 Cost of goods sold 630000 Sales 1218300…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education