FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

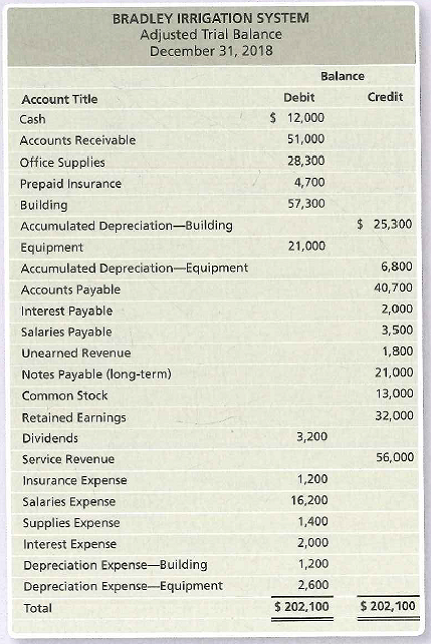

Preparing financial statements including a classified

The adjusted

Requirements

- Prepare the company’s income statement for the year ended December 31, 2018.

- Prepare the company’s statement of

retained earnings for the year ended December 31, 2018. - Prepare the company’s classified balance sheet in report form at December 31, 2018.

- Journalize the closing entries for Bradley Irrigation System.

- Compute the company’s current ratio at December 31, 2018. At December 31, 2017, the current ratio was 1.7. Did the company’s ability to pay current debts improve or deteriorate, or did it remain the same?

Transcribed Image Text:BRADLEY IRRIGATION SYSTEM

Adjusted Trial Balance

December 31, 2018

Balance

Account Title

Debit

Credit

Cash

$ 12,000

Accounts Receivable

51,000

Office Supplies

28,300

Prepaid Insurance

4,700

Building

57,300

Accumulated Depreciation-Building

$ 25,300

Equipment

21,000

Accumulated Depreciation-Equipment

6,800

Accounts Payable

40,700

Interest Payable

2,000

Salaries Payable

3,500

Unearned Revenue

1,800

Notes Payable (long-term)

21,000

Common Stock

13,000

Retained Earnings

32,000

Dividends

3,200

Service Revenue

56,000

Insurance Expense

1,200

Salaries Expense

16,200

Supplies Expense

1,400

Interest Expense

2,000

Depreciation Expense-Building

1,200

Depreciation Expense-Equipment

2,600

Total

$ 202,100

$ 202,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following partial work sheet covers the affairs of Masanto and Company for the year ended June 30. Required: 1. Journalize the six adjusting entries. 2. Journalize the closing entries. 3. Journalize the reversing entry as of July 1, for the salaries that were accured in the June adjusting entry.arrow_forwardEpping Ltd. is a listed company based in Essex County. The company prepares its financial statements as at 31 December each year. The following trial balance is for the period ending 31 December 2019: Required: Prepare the following financial statements for Epping Ltd. for the year ended 31 December 2019 in accordance with IAS 1, Preparation of Financial Statements. Show all workings. 1)A statement of comprehensive income for the year ending 31 December 2019. 2)A statement of changes in equity for the year ending 31 December 2019. 3)A statement of financial position as at 31 December 2019.arrow_forwardsarrow_forward

- Lamp Light Company maintains and repairs warning lights, such as those found on radio towersand lighthouses. Lamp Light prepared the following end-of-period spreadsheet at December 31,2018, the end of the fiscal year: Instructions1. Prepare an income statement for the year ended December 31.2. Prepare a retained earnings statement for the year ended December 31.3. Prepare a balance sheet as of December 31.4. Based upon the end-of-period spreadsheet, journalize the closing entries.5. Prepare a post-closing trial balance.arrow_forwardRecover Rehabilitation Hospital has the following balances that are extracted from its December 31, 2019, trial balance: Account Debit Credit Nursing Services Expense. . . . . . . . . . Professional Fees Expense. . . . . . . . . . . . . . . . . . . . . . . General and Administrative Expense . . . . . . . . . . . . Depreciation Expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . Interest Expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Asset Whose Use Is Limited . . . . . . . . . . . . . . . . . . . . . Repairs and Maintenance Expense . . . . . . . . . . . . . . . . Provision for Uncollectible Accounts . . . . . . . . . . . . . . Contractual Adjustments . . . . . . . . . . . . . . . . . . . . . . . . . Patient Service Revenues. . . .. . . . . . . . . . .. . . . . . . . Seminar Income.. . . .. . . . . . . . . . .. . . . . . . . Child Day Care Income. . . .. . . . . . . . . . .. . . . . . . . Parking Fees. . . .. . . . . . . . . . .. .…arrow_forwardSelected accounts and related amounts for Druid Hills Co. for the fiscal year ended May 31, 20Y8, are presented in Problem 6-5A. Adjunt problem 6-5A Instructions 1. Prepare a single-step income statement in the format shown in Exhibit 12. 2. Prepare closing entries as of May 31, 20Y8.arrow_forward

- Prepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. supplies actual count at year end, $6,500 B. remaining unexpired insurance, $6,000 C. remaining unearned service revenue, $1,200 D. salaries owed to employees, $2,400 E. depreciation on property plant and equipment, $18,000arrow_forwardUse the information from the Adjusted Trial Balance and Financial Statement templates provided in the module under Test 2 information you completed to answer questions 36 - 50. (Also copied below.) For Question 36, how much revenue should be recorded on the Income Statement? Elliptical Consulting Adjusted Trial Balance For the Year Ended June 30, 2019 Account Title Debit Credit Cash 27,000 Accounts Receivable 53,500 Supplies 900 Office Equipment 30,500 Accumulated Depreciation – Office Equipment 6,000 Accounts Payable 3,300 Salaries Payable 375 Jayson Neese, Capital 82,200 Jayson Neese, Drawing 2,000 Fees Earned 60,000 Salary Expense 32,375 Supplies Expense 2,100 Depreciation Expense 1,500 Miscellaneous Expense 2,000 Totals 151,875 151,875 Notice that the accounts are listed in order of the accounting…arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education