FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

I. Prepare all the

II. Prepare the working paper of Victory Company.

Transcribed Image Text:I.

II.

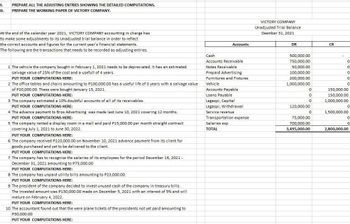

PREPARE ALL THE ADJUSTING ENTRIES SHOWING THE DETAILED COMPUTATIONS.

PREPARE THE WORKING PAPER OF VICTORY COMPANY.

At the end of the calendar year 2021, VICTORY COMPANY accounting in charge has

to make some adjustments to its Unadjusted trial balance in order to reflect

the correct accounts and figures for the current year's financial statements.

The following are the transactions that needs to be recorded as adjusting entries.

1 The vehicle the company bought in February 1, 2021 needs to be depreciated. It has an estimated

salvage value of 25% of the cost and a usefull of 4 years.

PUT YOUR COMPUTATIONS HERE:

2 The office tables and chairs amounting to P100,000.00 has a useful life of 3 years with a salvage value

of P20,000.00. These were bought January 15, 2021.

PUT YOUR COMPUTATIONS HERE:

3 The company estimated a 10% doubtful accounts of all of its receivables.

PUT YOUR COMPUTATIONS HERE:

4 The advance payment to Bros Advertising was made last June 10, 2021 covering 12 months.

PUT YOUR COMPUTATIONS HERE:

5 The company rented a display room in a mall and paid P15,000.00 per month straight contract

covering July 1, 2021 to June 30, 2022.

PUT YOUR COMPUTATIONS HERE:

6 The company received P220,000.00 on November 10, 2021 advance payment from its client for

goods purchased and yet to be delivered to the client.

PUT YOUR COMPUTATIONS HERE:

7 The company has to recognize the salaries of its employees for the period December 16, 2021 -

December 31, 2021 amounting to P75,000.00

PUT YOUR COMPUTATIONS HERE:

8 The company has unpaid utility bills amounting to P23,000.00.

PUT YOUR COMPUTATIONS HERE:

9 The president of the company decided to invest unused cash of the company in treasury bills.

The invested amount was P130,000.00 made on December 5, 2021 with an interest of 5% and will

mature on February 4, 2022.

PUT YOUR COMPUTATIONS HERE:

10 The accountant found out that the were plane tickets of the presidents not yet paid amounting to

P30,000.00

PUT YOUR COMPUTATIONS HERE:

Accounts

Cash

Accounts Receivable

Notes Receivable

Prepaid Advertising

Furnitures and Fixtures

Vehicle

Accounts Payable

Loans Payable

Legaspi, Capital

Legaspi, Withdrawal

Service revenue

Transportation expense

Salaries exp

TOTAL

VICTORY COMPANY

Unadjusted Trial Balance

Deember 31, 2021

DR

500,000.00

750,000.00

50,000.00

100,000.00

200,000.00

1,000,000.00

0

0

0

120,000.00

0

75,000.00

700,000.00

3,495,000.00

CR

0

0

0

0

0

150,000.00

150,000.00

1,000,000.00

0

1,500,000.00

0

0

2,800,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- a list of each customer account and thre balance owed is a:arrow_forwardME15Accounts are listed on the trial balance in: a) Chronological orderb) The order that they appear in the ledger c) Alphabetical orderd) The order in which they are postedarrow_forwardThe following transactions occurred for Luminary Engineering: View the transactions. Journalize the transactions of Luminary Engineering. Include an explanation with each journal entry. Use the following accounts: Cash; Accounts Receivable; Supplies; Equipment; Accounts Payable; Notes Payable; Luminary, Capital; Luminary, Withdrawals; Service Revenue; and Utilities Expense. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) July 2: Received $15,000 contribution from Bobby Luminary, owner, in exchange for capital. Date Jul. 2 Transactions Jul. 2 Accounts and Explanation Jul. 4 Jul. 5 Jul. 10 Jul. 12 Jul. 19 Jul. 21 Jul. 27 Debit Received $15,000 contribution from Bobby Luminary, owner, in exchange for capital. Paid utilities expense of $440. Purchased equipment on account, $2,600. Performed services for a client on account, $3,500. Borrowed $7,200 cash, signing a notes payable. Luminary withdrew $650 cash from the business. Purchased…arrow_forward

- 1. How do the relationships between the balance sheet, income statement, job cost ledger, and equipment ledger help determine the changes made by each transaction?arrow_forwardIs Warehouse included in a post closing trial balance?arrow_forwardWhich of the following is not one of the general ledger and reporting activities? A. Updating the general ledger by posting entries from the accounting subsystems and treasurer B. Posting adjusting entries to the general ledger C. Preparation of managerial reports D. Recording entries in general journalarrow_forward

- Journalize the entries to record the transactions, post to the Raw Materials Inventory account, and determine the ending balance in Raw Materials Inventory.arrow_forwardRequirements Sheet in Workbook Requirement 1—Prepare the Journal Entries in the General Journal Journal Entries Requirement 2—Post Journal Entries to the General Ledger General Ledger Requirement 3—Prepare a Trial Balance Trial Balance Requirement 4—Prepare the Adjusting Entries Adjusting Entries Requirement 5—Post Adjusting Entries to the General Ledger General Ledger Requirement 6—Prepare an Adjusted Trial Balance Adjusted Trial Balance Requirement 7—Prepare the Financial Statements Financial Statements Requirement 8—Prepare the Closing Entries Closing Entries Requirement 9—Post Closing Entries to the General Ledger General Ledger Requirement 10—Prepare the Post Closing Trial Balance Post-Closing Trial Balance During its first month of operation, the Quick Tax Corporation, which specializes in tax preparation, completed the following transactions. July 1 Began business by making a deposit in a company…arrow_forward12. Which of the following shows the first four stages of the writing process in the correct order? A. Prewriting, outlining, revising, drafting B. Prewriting, outlining, drafting, revising C. Outlining, prewriting, revising, drafting D. Proofreading, editing, revising, drafting Mark for review (Will be highlighted on the review page)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education