FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

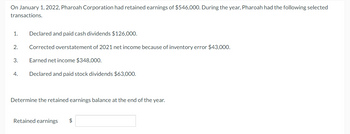

Transcribed Image Text:On January 1, 2022, Pharoah Corporation had retained earnings of $546,000. During the year, Pharoah had the following selected

transactions.

1.

2.

3.

4.

Declared and paid cash dividends $126,000.

Corrected overstatement of 2021 net income because of inventory error $43,000.

Earned net income $348,000.

Declared and paid stock dividends $63,000.

Determine the retained earnings balance at the end of the year.

Retained earnings $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Concord Corporation has retained earnings of $713,600 at January 1, 2025. Net income during 2025 was $1,675,300, and cash dividends declared and paid during 2025 totaled $78,500. Prepare a retained earnings statement for the year ended December 31, 2025. (List items that increase retained earnings first.) : CONCORD CORPORATION Retained Earnings Statement < $ $arrow_forwardIdentify and Compute NOPATFollowing is the income statement for Lowe’s Companies Inc. LOWE’S COMPANIES INC. Consolidated Statement of Earnings Twelve Months Ended (In millions) Feb. 1, 2019 Net sales $142,618 Cost of sales 96,802 Gross margin 45,816 Expenses Selling, general and administrative 34,826 Depreciation and amortization 2,954 Operating income 8,036 Interest expense, net 1,248 Pretax earnings 6,788 Income tax provision 2,160 Net earnings $4,628 Compute its net operating profit after tax (NOPAT) for the 12 months ended February 1, 2019, assuming a 22% total statutory tax rate.Note: Round your answer to the nearest whole dollar (millions).arrow_forwardOrigami Inc. reported the following items on its financial statements for the year ended December 31, 2020: Sales $780,000 Selling and general expenses 20,000 Dividends 5,000 Cost of sales 700,000 Other expenses 15,000 Income tax expense 12,500 What amount will be reported as retained earnings on the December 31, 2020 balance sheet, assuming this is the first year of operations? Select one: a. Cannot be determined from the information provided b. $22,500 c. $42,500 d. $27,500arrow_forward

- Tamarisk Corporation's adjusted trial balance contained the following accounts at December 31, 2020: Retained Earnings $126,000, Common Stock $765,600, Bonds Payable $109,700, Paid-in Capital in Excess of Par-Common Stock $208,700, Goodwill $59,300, Accumulated Other Comprehensive Loss $154,700, and Noncontrolling Interest $34,200. Prepare the stockholders' equity section of the balance sheet.arrow_forwardComparative Statements of Retained Earnings for Renn-Dever Corporation were reported as follows for the fiscal years ending December 31, 2022, 2023, and 2024. RENN-DEVER CORPORATION Statements of Retained Earnings For the Years Ended December 31 2024 2023 2022 Balance at beginning of year $ 6,970,692 $ 5,584,452 $ 5,694,552 Net income (loss) 3,315,700 2,310,900 (110,100) Deductions: Stock dividend (35,400 shares) 249,000 Common shares retired, September 30 (140,000 shares) 219,660 Common stock cash dividends 896,950 705,000 0 Balance at end of year $ 9,140,442 $ 6,970,692 $ 5,584,452 At December 31, 2021, paid-in capital consisted of the following: Common stock, 1,910,000 shares at $1 par $ 1,910,000 Paid in capital—excess of par 7,490,000 No preferred stock or potential common shares were outstanding during any of the periods shown. Required: Compute Renn-Dever’s earnings per share as it would have appeared in income statements for the…arrow_forwardYou are provided with the following information taken from Splish Brothers Inc.’s March 31, 2022, balance sheet. Cash $ 12,330 Accounts receivable 20,370 Inventory 36,900 Property, plant, and equipment, net of depreciation 120,500 Accounts payable 22,640 Common stock 153,800 Retained earnings 12,460 Additional information concerning Splish Brothers Inc. is as follows. 1. Gross profit is 26% of sales. 2. Actual and budgeted sales data: March (actual) $47,000 April (budgeted) 73,100 3. Sales are both cash and credit. Cash collections expected in April are: March $18,800 (40% of $47,000) April 43,860 (60% of $73,100) $62,660 4. Half of a month’s purchases are paid for in the month of purchase and half in the following month. Cash disbursements expected in April are: Purchases March $22,640…arrow_forward

- Lowell reports retained earnings at the end of fiscal 2019 of $41115 and retained earnings at the end of fiscal 2018 of $35180. The company reported dividends of $5026. How much net income did the firm report in fiscal 2019? (Round your answer to zero decimal places and omit the "$" sign. Add a minus sign if needed. For example, if your answer is $1,000.2, type in "1000") 1arrow_forwardGrant Inc. reported retained earnings of $287,000 on its balance sheet on 12/31/2020, and it had $66,000 of net income during the year. The year before, on 12/31/2019, the company had reported $238,000 of retained earnings. No shares were issued or repurchased during 2020. How much dividends did the firm pay in 2020?arrow_forwardThe changes in account balances for Elder Company for 2021 are as follows: Assets $ 480,000 debit Common stock 250,000 credit Liabilities 160,000 credit Paid-in capital-excess of par 30,000 credit Assuming the only changes in retained earnings in 2021 were for net income and a $50,000 dividend, what was net income of 2021? 1. A) $40,000. 2. B) $60,000. 3. C) $70,000. 4. D) $90,000. O A O B O Darrow_forward

- Please help mearrow_forwardFor the year ending December 31, 2022, Sheridan Inc. reports net income $147,000 and cash dividends $88,500. Determine the balance in retained earnings at December 31, assuming the balance in retained earnings on January 1, 2022, was $223,500. Balance in retained earnings %24arrow_forwardSelected information from the accounts of Arch Inc. on December 31, 2021 reveals that the total income since incorporation is $42,000; the total cash dividends paid is $13,000; the total value of property dividends distributed is $3,000; and the excess of proceeds over cost of treasury shares sold is $11,000. In its December 31, 2021 statement of changes in equity, what amount should the firm report as accumulated profits (retained earnings)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education