FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

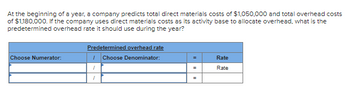

Transcribed Image Text:At the beginning of a year, a company predicts total direct materials costs of $1,050,000 and total overhead costs

of $1,180,000. If the company uses direct materials costs as its activity base to allocate overhead, what is the

predetermined overhead rate it should use during the year?

Choose Numerator:

Predetermined overhead rate

/ Choose Denominator:

1

1

=

=

Rate

Rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume the following: 1. Estimated fixed manufacturing overhead for the coming period of $220,000 2. Estimated variable manufacturing overhead of $2.00 per direct labor hour 3. Actual manufacturing overhead for the period of $320,000 4. Actual direct labor-hours worked of 54,000 hours 5. Estimated direct labor-hours to be worked in the coming period of 55,000 hours. The amount of overhead applied to production during the period is closest to: Note: Round your intermediate value of "Predetermined overhead rate" to two decimal places. Multiple Choice $325,926. $324,000. $336,004.arrow_forward1.arrow_forwardA company estimates its manufacturing overhead will be $525,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? When required, round your answers to nearest cent. A. Budgeted direct labor hours: 42,000 per direct labor hour B. Budgeted direct labor expense: $1,050,000 per direct labor dollar C. Estimated machine hours: 70,000 per machine hourarrow_forward

- d. Assume that the actual level of activity next year was 36,000 direct labor hours and that manufactur- ing overhead was $341,550. Determine the underapplied or overapplied manufacturing overhead at the end of the year. e. Describe two ways of handling any underapplied or overapplied manufacturing overhead at the end of the year. e. Describe two ways of handling any underapplied or overapplied manufacturing overhead at the end of the year.arrow_forwardSwifty Corporation provide the information from its accounting records for 2019: Expected production 80000 labor hours, Actual production 76000 labor hours, Budgeted overhead 1500000, Actual overhead 1440000. How much is the overhead application rate if Swifty Corporation bases it on direct labor hours?arrow_forwardBenson Corporation expects to incur indirect overhead costs of $98,000 per month and direct manufacturing costs of $13 per unit. The expected production activity for the first four months of the year are as follows. Estimated production in units January 5,300 Required a. Calculate a predetermined overhead rate based on the number of units of product expected to be made during the first four months of the year. Required A Required B b. Allocate overhead costs to each month using the overhead rate computed in Requirement a. c. Calculate the total cost per unit for each month using the overhead allocated in Requirement b. Complete this question by entering your answers in the tabs below. Required C February March 8,500 4,600 April 6,100 per unit Calculate a predetermined overhead rate based on the number of units of product expected to be made during the first four months of the year. Predetermined overhead ratearrow_forward

- Total Cost FormulaDavis Company has analyzed its overhead costs and derived a general formula for their behavior: $55,000 + $14 per direct labor hour employed. The company expects to use 50,000 direct labor hours during the next accounting period. What overhead rate per direct labor hour should be applied to jobs worked during the period? Round answer to two decimal places. Overhead rate per direct labor hour $_________arrow_forwardThe chief cost accountant for Voltaire Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning May 1 would be $2,340,000 and total direct labor costs would be $1,800,000. During May, the actual direct labor cost totaled $145,000 and factory overhead cost incurred totaled $192,100. Question Content Area a. What is the predetermined factory overhead rate based on direct labor cost? Enter your answer as a whole percent not in decimals. fill in the blank 1772e2fb3039fb1_1 % Question Content Area b. Journalize the entry to apply factory overhead to production for May. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select - Question Content Area c. What is the May 31 balance of the account Factory Overhead—Blending Department? Amount: $fill in the blank 1ea1070e903a021_1 Debit or Credit? d. Does the balance in part (c) represent overapplied or underapplied factory…arrow_forwardSolution method please.arrow_forward

- Corporation bases its predetermined overhead rate on the estimated machinehours for the upcoming yearfor the upcoming year appear below Estimated machine - hours Estimated variable manufacturing overhead Estimated total fixed manufacturing overhead 36,000 3.01 per machine-hour 1,058,040 The predetermined overhead rate for the recently completed year was closest toarrow_forwardSandler Corporation bases its predetermined overhead rate on the estimated machine-hours for the upcoming year. Data for the upcoming year appear below: Estimated machine hours 73,000 Estimated variable manufacturing overhead 3.49 per machine hour Estimated total fixed manufacturinf overhead 838,770 Required: Compute the company's predetermined overhead rate.arrow_forwardA manufacturing company applies factory overhead based on direct labor hours. At the beginning of the year, it estimated that factory overhead costs would be $360,000 and direct labor hours would be 30,000. Actual factory overhead costs incurred were $377,200, and actual direct labor hours were 36,000. What is the amount of overapplied or underapplied manufacturing overhead at the end of the year? a.$54,800 underapplied b.$54,800 overapplied c. $6,000 overapplied d.$6,000 underappliedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education