FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

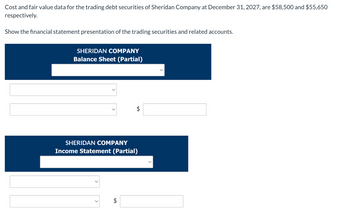

Transcribed Image Text:Cost and fair value data for the trading debt securities of Sheridan Company at December 31, 2027, are $58,500 and $55,650

respectively.

Show the financial statement presentation of the trading securities and related accounts.

SHERIDAN COMPANY

Balance Sheet (Partial)

A

SHERIDAN COMPANY

Income Statement (Partial)

+A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In footnotes to its year-end annual report, Bancfirst Corp. reported that held-to-maturity debt securities with an amortized cost of $8,730 thousand had an estimated fair value of $8,806 thousand. The balance sheet reported: Select one: a. Held-to-maturity assets of $8,730 thousand b. Held-to-maturity assets of $8,806 thousand c. Accumulated other comprehensive income of $76 thousand related to held-to-maturity assets d. Both A and C e. Both B and Carrow_forwardN1. Account Calculate the following ratios for Lake of Egypt Marina, Inc. as of year-end 2021. (Use sales when computing the inventory turnover and use total stockholders' equity when computing the equity multiplier. Round your answers to 2 decimal places. Use 365 days a year.)arrow_forwardWhat is the debit to asset ratio?arrow_forward

- The following information is available in respect of Vegas plc for the last 2 years ended 31 December. Non-current Assets (at Net Book Value) Current Assets: Inventory Trade receivables Cash at bank Equity and Liabilities: Equity Share capital £1 Share premium Revenue reserve Vegas plc: Statement of Financial Position 31.12.2021 Non-current Liabilities: Loan Current Liabilities: Trade payables Taxation (accrual) Operating profit Taxation £000 390 462 80 88 142 £000 2,100 932 3.032 900 50 852 1,802 1,000 230 3.032 274 (156) 118 (87) 31 31.12.2020 Vegas plc: Income Statement (Extract) for the year ended 31.12.2021 £000 Dividends Retained profit for the year The following information is also available: • There were no non-current asset disposals during the year. • Depreciation for the year was £240,000. £000 210 346 50 73 137 £000 1,975 606 2.581 700 821 1,521 850 210 2.581 Prepare, in a suitable format, the Statement of Cash Flow for Vegas plc for the year ended 31.12.2021, presenting…arrow_forwardWe are given the following information for Pettit Corporation. Sales (credit) Cash Inventory Current liabilities Asset turnover Current ratio Debt-to-assets ratio Receivables turnover $2,068,000 150,000 923,000 763,000 a. Accounts receivable b. Marketable securities c. Capital assets. d. Long-term debt $ Current assets are composed of cash, marketable securities, accounts receivable, and inventory. Calculate the following balance sheet items: LA LA LA $ $ 1.00 times 2.60 times $ 40 % 4 times 517000arrow_forwardCalculate debt to equity, long-term debt to equity and specify as a percent to 2 decimal placesarrow_forward

- Solar Electric Inc. Balance Sheet 32 Marks ACB As at December 31, 2023 Account Title Debit Credit Assets Current Assets Cash 100,649 Accounts Receivable 35,860 Interest Rceivable 9,113 Prepaid Insurance 7,370 Short-Term Investment- Citi Inc 237,000 Short-Term Investment- Bonds 135,000 Inventory 90,640 Valuation Allowance for Fair Value Adjustment 50,700 Total Current Assets 666,332 Non-current Assets Investment in HSBC Inc. Common Shares 503,840 Long-Term Investment- Bond 145,000 Property, Plant & Equipment 280,000 Accumulated Depreciation 86,000 Total Non-Current Assets 842,840 Total Assets 1,509,172 Liabilities Current Liabilities Accounts Payable 212,400 Interest Payable 31,167 Unearned Revenue 21,000 Total Current Liabilities 264,567 Long-Term Liabilities Bonds Payable 340,000 Discount on Bonds Payable 15,741 Bank Loan 225,000 Total-Long Term Liabilities 549,259 Total Liabilities 813,826 Shareholders Equity Common Shares 362,000 Preferred Shares 80,000 Retained Earnings 348,385…arrow_forwardSunland Company reported the following information for 2025: Sales revenue Cost of goods sold Operating expenses Unrealized holding gain on available-for-sale debt securities Cash dividends received on the securities O $490300. O $404600. $480700. $2420000 O $85700. 1754000 271000 85700 For 2025, Sunland would report comprehensive income (ignoring tax effects) of 9600arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

- Determine the amount of long-term debt for ABC Co. using the following balance sheet information: cash balance of $24,700, accounts payable of $96,526, common stock of $401,347, retained earnings of $501,930, inventory of $205,420, other assets equal to $77,911, net plant and equipment of $706,520, short-term notes payable of $30,000, and accounts receivable of $142,714. Long-Term Debt %24arrow_forwardcarrow_forwardBelow are Laiho Industries' 2017 and 2018 balance sheet items: Cash Accounts Receivable Long-Term Debt Accounts Payable Common Stock (total value) Notes Payable Net Fixed Assets Accruals Inventories Retained Earnings $ $ $ $ LA $ LA $ LA $ LA LA 2018 102,850.00 103,365.00 76,264.00 30,761.00 100,000.00 $ $ $ $ Sm 16,717.00 $ 67,165.00 $ 30,477.00 $ 38,444.00 $ 57,605.00 2017 89,725.00 85,527.00 63,914.00 23,109.00 90,000.00 14,217.00 42,436.00 22,656.00 34,982.00 38,774.00 Sales for 2018 were $455,150, and EBITDA was 15% of sales. Furthermore, depreciation and amortization were 11% of net fixed assets, interest was $8,575, the corporate tax rate was 40%, and Laiho pays 40% of its net income as dividends. Given this information, construct the firm's 2018 income statement, statement of cash flows, and statement of owner's equity. Then answer the questions below.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education