ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:F1

DR

RDT

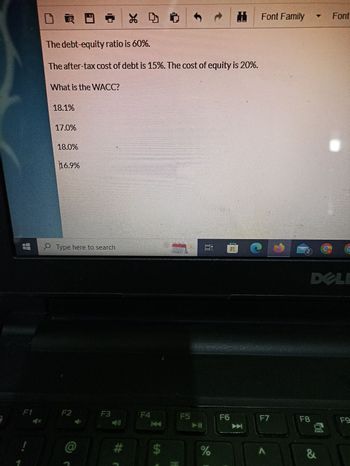

What is the WACC?

18.1%

The debt-equity ratio is 60%.

The after-tax cost of debt is 15%. The cost of equity is 20%.

17.0%

18.0%

16.9%

Type here to search

F2

@

F3

X 4 O

#

F4

KA

$

Ĵ

F5

100

t

%

F6

Font Family

F7

A

F8

- Font

G

DELI

&

00

FO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Letang Tsipane started a business restaurant called Letang Coffee on 1 May 2023 The following balances and totals were in the General Ledger on 1 May 2023: Capital R 45 000 Trading stock R 38 744 Debtors control R 27 800 Bank R 2008 Sales R 30 586 Cost of sales R 20 389 The following balance occurred in the Debtors ledger on 1 May 2023: T. Jacobs P. Khumalo R 3 000 R 5700 REQUIRED: Record the given transactions in the following Journals: 1. Cash Receipts Journal, with Analysis columns for Analysis of receipts, Bank, Sale Cost of Sales, Debtors control and Sundry accounts; 2. Debtors Journal, with Analysis columns for Sales and Cost of sales 3. Post from the Journals to the following accounts in the General ledger: Capital, Bank, Trading Stock; Debtors Control; Sales, Cost of sales 4. Post to the applicable accounts in the Debtors ledger of Letang Coffee 5. Prepare the List of Debtors. TRANSACTION FOR MAY 2023: 1. Received EFT payment from the owner Letang Tladi for R250 000 as her…arrow_forwardA proposed cost-saving device has an installed cost of $610,000. It is in Class 8 (CCA rate = 20%) for CCA purposes. It will actually function for five years, at which time it will have no value. There are no working capital consequences from the Investment, and the tax rate is 35%. a. What must the pre-tax cost savings be for us to favour the Investment? We require an 10% return. (Hint: This one is a variation on the problem of setting a bid price.) (Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Cost savings $ 94,000 b. Suppose the device will be worth $85,000 in salvage (before taxes). How does this change your answer? (Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Cost savings $80,769.23arrow_forwardProviding for Doubtful Accounts At the end of the current year, the accounts receivable account has a debit balance of $1,088,000 and sales for the year total $12,330,000. a. The allowance account before adjustment has a credit balance of $14,700. Bad debt expense is estimated at 1/4 of 1% of sales. b. The allowance account before adjustment has a credit balance of $14,700. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $47,000. c. The allowance account before adjustment has a debit balance of $8,000. Bad debt expense is estimated at 3/4 of 1% of sales. d. The allowance account before adjustment has a debit balance of $8,000. An aging of the accounts in the customer ledger indicates estimated doubtful accounts of $66,400. Determine the amount of the adjusting entry to provide for doubtful accounts under each of the assumptions (a through d) listed above. a. $ b. $ C. $ d. $arrow_forward

- Keler Cosmetics maintains an operating profit margin of 8% and asset turnover ratio of 5. a. What is its ROA? (Round your answer to 2 decimal places.) ROA 40.00 % b. If its debt-equity ratio is 1, its interest payments and taxes are each $9500, and EBIT is $27,500, what is its ROE? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) ROE 37% Cesarrow_forwardThe homestead exemption is a legal regime that protects the equity that homeowners have in their principal residences from general liens and property taxes. The protection varies by state. What is the maximum equity that a general lienholder could attach for a property valued at $200,000 and a mortgage balance of $145,397 in a state with a $25,000 homestead exemption? (Input your answer rounded to the nearest whole dollar and without the $ sign, e.g., 1000)arrow_forwardA corporation in 2018 expects a gross income of $680,000, total operating expenses of $480,000, and capital investments of $29,000. In addition the corporation is able to declare $53,000 of depreciation charges for the year. The federal income tax rate is 21%. What is the expected taxable income and total federal income taxes owed for the year 2018?arrow_forward

- Teresa and Marvin are married and file a joint return. The standard deduction for their filing status is $10,000. They have the following itemized deductions: Medical bills above the limit $400 Interest expense $3,500 State income taxes $1,500 Miscellaneous deductions $250 Should Teresa and Marvin itemize their deductions or use the standard deduction?arrow_forwardA state has a corporate tax rate of 9.6%. If the federal tax rate is 21%, what is the combined incremental tax rate?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education