ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

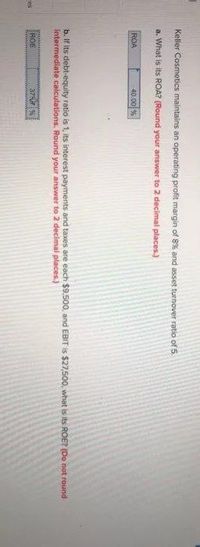

Transcribed Image Text:Keler Cosmetics maintains an operating profit margin of 8% and asset turnover ratio of 5.

a. What is its ROA? (Round your answer to 2 decimal places.)

ROA

40.00 %

b. If its debt-equity ratio is 1, its interest payments and taxes are each $9500, and EBIT is $27,500, what is its ROE? (Do not round

Intermediate calculations. Round your answer to 2 decimal places.)

ROE

37%

Ces

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The Johnson Corporation reported the following income statement and balance sheet amounts and additional information for the end of the current year. End of current year End of prior year Net sales revenue (all credit) $800,000 Cost of goods sold $504,000 Gross profit $296,000 Selling/general expenses $184,000 $ 32,000 Interest expense Net income Current assets $ 80,000 $71,000 $329,000 Long-term assets Total assets $400,000 Current liabilities $56,000 Long-term liabilities $ 84,000 Common stockholders' equity $260,000 Total liabilities and stockholders' equity $400,000 Inventory and prepaid expenses account for $28,000 of the current year's current assets. Average inventory for the current year is $12,000. Average net accounts receivable for the current year is $32,000. There are 40,000 shares of common stock outstanding. Total dividends paid during the current year were $60,000. The market price per share of common stock is $25. What is the company's current ratio for the current…arrow_forwardPLease Helparrow_forwardLetang Tsipane started a business restaurant called Letang Coffee on 1 May 2023 The following balances and totals were in the General Ledger on 1 May 2023: Capital R 45 000 Trading stock R 38 744 Debtors control R 27 800 Bank R 2008 Sales R 30 586 Cost of sales R 20 389 The following balance occurred in the Debtors ledger on 1 May 2023: T. Jacobs P. Khumalo R 3 000 R 5700 REQUIRED: Record the given transactions in the following Journals: 1. Cash Receipts Journal, with Analysis columns for Analysis of receipts, Bank, Sale Cost of Sales, Debtors control and Sundry accounts; 2. Debtors Journal, with Analysis columns for Sales and Cost of sales 3. Post from the Journals to the following accounts in the General ledger: Capital, Bank, Trading Stock; Debtors Control; Sales, Cost of sales 4. Post to the applicable accounts in the Debtors ledger of Letang Coffee 5. Prepare the List of Debtors. TRANSACTION FOR MAY 2023: 1. Received EFT payment from the owner Letang Tladi for R250 000 as her…arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Trading Cards, Incorporation Selected financial information ($ millions) 2020 2021 296 364 168 223 51 65 32 45 34 29 47 87 39 44 310 186 Net sales Cost of goods sold Depreciation Net income Finished goods inventory Accounts receivable Accounts payable Net fixed assets Year-end cash balance 415 123 Financial information for Trading Cards, Inc is given above. How much cash (in millions of dollars) did Trading Cards, Inc. collect from sales during 2021?arrow_forwardUrgent...arrow_forwardTex-House builds and sells houses for $200,000 each. The firms fixed costs are $3,000,000. 50 houses are built and sold each year. Profits total about $2,000,000. The firm estimates that it can change its production process by adding 4,000,000 to investment and $1,000,000 to fixed costs. This would reduce variable costs by $30,000 and increase output by 30 units. To permit sales of the new output, prices would have to be lowered by $20,000 per unit. Should the firm make the change? At the new production level, what price would make profits equal zero? Will the new production situation expose the firm to more or less risk?arrow_forward

- please,don't provied handwriting solution.arrow_forwardThe following data relate to the operations of Shilow Company, a wholesale distributor of consumer goods: Current assets as of March 31: Cash Accounts receivable Inventory Buildings and equipment, net Accounts payable Common shares Retained earnings a. The gross margin is 25% of sales. b. Actual and budgeted sales data are as follows: March (actual) April May June $50,000 $60,000 $72,000 $ 8,000 20,000 36,000 120,000 21,750 150,000 12,250 July $90,000 $48,000 c. Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following sale. The accounts receivable at March 31 are the result of March credit sales. d. Each month's ending inventory should equal 80% of the following month's budgeted cost of goods sold. e. One-half of a month's inventory purchases is paid for in the month of purchase; the other one-half is paid for in the following month. The accounts payable at March 31 are the result of March purchases of inventory. f. Monthly expenses are as follows:…arrow_forwardPLS HELP ASAP ON BOTHarrow_forward

- Lanni sells the software product to Microsoft, which will market it to the public under the Microsoft name. Lanni accepts payment in the form of 1,500 shares for $80 per share. Prepare the balance sheet after Lanni accepts the payment of shares from Microsoft. (Omlt the "S" sign In your response.) C- 1. Assets Liabilities & Shareholders' Equity Microsoft shares Bank loan Computers Shareholders' equity Total Totalarrow_forward1. Phil's Carvings, Inc. wants to have a weighted average cost of capital of 8%. The firm has an after- tax cost of debt of 5% and a cost of equity of 11%. What debt-equity ratio is needed for the firm to achieve its targeted weighted average cost of capital? * (1 Point) 0.40 0.50 0.60 0000arrow_forwardA new drill press costs $12,000. It would potentially produce an additional $4,000 of revenue per year and have an operating expense of $1,200. What is the PW of the drill press if the new equipment is expected to last 8 years and i = 10%? Select one: a. $15,534 b. $19,345 c. $14,938 d. $21,735arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education