ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

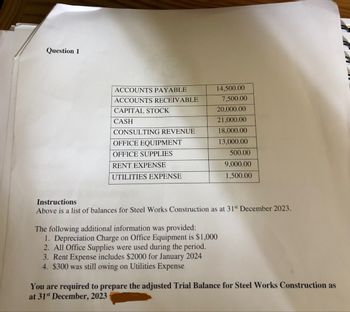

Transcribed Image Text:Question 1

ACCOUNTS PAYABLE

14,500.00

ACCOUNTS RECEIVABLE

7,500.00

CAPITAL STOCK

20,000.00

CASH

21,000.00

CONSULTING REVENUE

18,000.00

OFFICE EQUIPMENT

13,000.00

OFFICE SUPPLIES

500.00

RENT EXPENSE

9,000.00

UTILITIES EXPENSE

1,500.00

Instructions

Above is a list of balances for Steel Works Construction as at 31st December 2023.

The following additional information was provided:

1. Depreciation Charge on Office Equipment is $1,000

2. All Office Supplies were used during the period.

3. Rent Expense includes $2000 for January 2024

4. $300 was still owing on Utilities Expense

You are required to prepare the adjusted Trial Balance for Steel Works Construction as

at 31st December, 2023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 43-44arrow_forwardLetang Tsipane started a business restaurant called Letang Coffee on 1 May 2023 The following balances and totals were in the General Ledger on 1 May 2023: Capital R 45 000 Trading stock R 38 744 Debtors control R 27 800 Bank R 2008 Sales R 30 586 Cost of sales R 20 389 The following balance occurred in the Debtors ledger on 1 May 2023: T. Jacobs P. Khumalo R 3 000 R 5700 REQUIRED: Record the given transactions in the following Journals: 1. Cash Receipts Journal, with Analysis columns for Analysis of receipts, Bank, Sale Cost of Sales, Debtors control and Sundry accounts; 2. Debtors Journal, with Analysis columns for Sales and Cost of sales 3. Post from the Journals to the following accounts in the General ledger: Capital, Bank, Trading Stock; Debtors Control; Sales, Cost of sales 4. Post to the applicable accounts in the Debtors ledger of Letang Coffee 5. Prepare the List of Debtors. TRANSACTION FOR MAY 2023: 1. Received EFT payment from the owner Letang Tladi for R250 000 as her…arrow_forward1.Mr Adrian own a construction company with an asset worth RM400,000. Adrian proudly told to some of his fellow directors that his revenues were typically RM35,000 per month, while his operating cost for fuel was RM8,000 and maintenance RM5,000 per month. The estimated depreciation was RM10,000 per month. An office space similar to Peter 's office space can be rented for RM15,000 per month. If Peter was working for one of his competing construction companies, he would have earned RM5,000 per month. a.List the items that Adrian would consider to compute his explicit costs. b.List the items that Adrian would consider to compute his implicit costs. c.Compute Adrian monthly total economic cost. d.Should Adrian continue his business? Explain.arrow_forward

- Give typing answer with explanation and conclusion Chanveida finds a home listed for $48k. Similar homes in good condition sell for $60k (market value). She buys the home and then sells it. Her adjusted cost basis is $44,000, net sell price is $55,000, and overall tax rate is 30%. Assume no financing is used and there is no depreciation taken. Determine Chanveida's Net Profit from sale.arrow_forward3 Question 3 options: At any point in time, the cost of equipment less any depreciation to date is known asarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- 6. CONSOL Energy purchased a new continuous miner to mine coal in one of their underground coal mines for $261,653. Calculate the depreciation using MACRS for year 3. (Use asset class 10.0)arrow_forwardWhat is the expected after-tax cash flow from selling a piece of equipment if Probst purchases the equipment today for $542,980.00, the tax rate is 34.3 percent, the equipment will be sold in 3 years for $103,000.00, and the equipment will be depreciated to $60,600.00 over 12 years using straight-line depreciation? $212,549.05 (plus or minus $10) $240,125.11 (plus or minus $10) $109,035.08 (plus or minus $10) -$41,878.05 (plus or minus $10) None of the above is within $10 of the correct answerarrow_forwardplease,don't provied handwriting solution.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education