FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

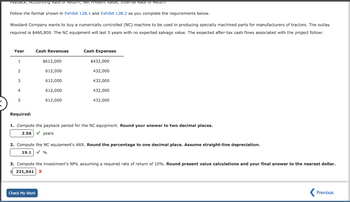

Transcribed Image Text:Payback, Accounting Rate of Return, Net Present valde, Internal Rate of Retum

Follow the format shown in Exhibit 12B.1 and Exhibit 12B.2 as you complete the requirements below.

Woodard Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of tractors. The outlay

required is $460,800. The NC equipment will last 5 years with no expected salvage value. The expected after-tax cash flows associated with the project follow:

Year

1

2

3

4

5

Required:

Cash Revenues

$612,000

612,000

612,000

612,000

612,000

Cash Expenses

$432,000

432,000

432,000

432,000

432,000

1. Compute the payback period for the NC equipment. Round your answer to two decimal places.

2.56 ✓ years

Check My Work

2. Compute the NC equipment's ARR. Round the percentage to one decimal place. Assume straight-line depreciation.

19.1 ✓ %

3. Compute the investment's NPV, assuming required rate of return of 10%. Round present value calculations and your final answer to the nearest dollar.

$221,541 X

Previous

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help figuring out the attached imagearrow_forwardcoparrow_forwardHI Corporation is considering the purchase of a machine that promises to reduce operating costs by the same amount for every year of its 6-year useful life. The machine will cost $208,780 and has no salvage value. The machine has a 14% internal rate of return. (Ignore income taxes.) Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. Required: What are the annual cost savings promised by the machine? (Round your intermediate calculations and final answer to the nearest whole dollar amount.) Annual cost savings 2$ 53,685arrow_forward

- Baird Rentals can purchase a van that costs $110,000; it has an expected useful life of five years and no salvage value. Baird uses straight-line depreciation. Expected revenue is $40,425 per year. Assume that depreciation is the only expense associated with this Investment. Required a. Determine the payback period. Note: Round your answer to 1 decimal place. b. Determine the unadjusted rate of return based on the average cost of the investment. Note: Round your answer to 1 decimal place. (l.e., .234 should be entered as 23.4). a. Payback period b. Unadjusted rate of return years %arrow_forwardA machine costs $600,000 and is expected to yield an after-tax net income of $23,000 each year. Management predicts this machine has a 12-year service life and a $120,000 salvage value, and it uses straight-line depreciation. Compute this machine's accounting rate of return. Choose Numerator: Annual after-tax net income $ 1 23,000 / Accounting Rate of Return Choose Denominator: Annual average investment $ = 360,000 = Insertarrow_forwardBelmont Corporation is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual A in net operating income of $210,000. The equipment will have an initial cost of $1,000,000 and an 8-year useful ife, if there is no salvage value of the equipment, what is the accounting rate of return? Multiple Choice O O 21.0% 16.0% O 42.0% O 13.5%arrow_forward

- The management of Kunkel Company is considering the purchase of a $21,000 machine that would reduce operating costs by $5,000 per year. At the end of the machine’s five-year useful life, it will have zero salvage value. The company’s required rate of return is 12%. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. Required: 1. Determine the net present value of the investment in the machine. 2. What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine?arrow_forwardPayback, Accounting Rate of Return, Net Present Value, Internal Rate of Return Blaylock Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of trenching machines. The outlay required is $800,000. The NC equipment will last five years with no expected salvage value. The expected after-tax cash flows associated with the project follow: Year Cash Revenues Cash Expenses 1 $1,300,000 $1,100,000 2 1,300,000 1,100,000 3 1,300,000 1,100,000 4 1,300,000 1,100,000 5 1,300,000 1,100,000 Required: Compute the payback period for the NC equipment. Round your answer to one decimal place. Payback period = fill in the blank, yearsarrow_forwardi need the answer quicklyarrow_forward

- rarrow_forwardAssume XYZ wishes to purchase a machine for $500k that will produce widgets which will sell for $50 each. Assume variable costs of $30/unit and other fixed costs will be $100k per year. Assume a tax rate of 25%, and assume that assets purchased will be in a CCA class with a rate of 20%. Assume further the assets purchased will have a salvage value of $20,000 after the 5 year life of the project, and that interest rates are 10%. a. Compute the after-tax contribution margin. b. Find the PV break-even volume.arrow_forwardssarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education