Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

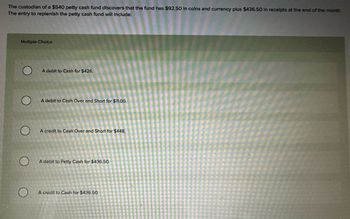

Transcribed Image Text:The custodian of a $540 petty cash fund discovers that the fund has $92.50 in coins and currency plus $436.50 In receipts at the end of the month.

The entry to replenish the petty cash fund will include:

Multiple Choice

A debit to Cash for $426.

A debit to Cash Over and Short for $11.00.

A credit to Cash Over and Short for $448.

O

A debit to Petty Cash for $436.50.

0.

A credit to Cash for $436.50.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On May 2 Kellie Company has decided to initiate a petty cash fund in the amount of $1,200. Prepare journal entries for the following transactions: A. On July 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $125, Supplies $368, Postage Expense $325, Repairs and Maintenance Expense $99, Miscellaneous Expense $259. The cash on hand at this time was $38. B. On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $425, Supplies $95, Postage Expense $240, Repairs and Maintenance Expense $299, Miscellaneous Expense $77. The cash on hand at this time was $80. C. On June 23, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $251, Supplies $188, Postage Expense $263, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $93. D. On June 29, the company determined that the petty cash fund needed to be decreased to $1,000. E. On June 30, the petty cash fund needed replenishment as it was month-end. The following are the receipts: Auto Expense $114, Supplies $75, Postage Expense $50, Repairs and Maintenance Expense $121, Miscellaneous Expense $39. The cash on hand at this time was $603.arrow_forwardOn September 1, French company has decided to initiate a petty cash fund in the amount of $800. Prepare journal entries for the following transactions: A. On September 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $37, Supplies $124, Postage Expense $270, Repairs and Maintenance Expense $168, Miscellaneous Expense $149. The cash on hand at this time was $48. B. On September 14, the petty cash fund needed replenishment and the following are the receipts: Auto Expense $18, Supplies $175, Postage Expense $50, Repairs and Maintenance Expense $269, Miscellaneous Expense $59. The cash on hand at this time was $210. C. On September 23, the petty cash fund needed replenishment and the following are the receipts: Auto Expense $251, Supplies $88, Postage Expense $63, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $20. D. On September 29, the company determined that the petty cash fund needed to be increased to $1,000. E. On September 30, the petty cash fund needed replenishment as it was month end. The following are the receipts: Auto Expense $18, Supplies $15, Postage Expense $57, Repairs and Maintenance Expense $49, Miscellaneous Expense $29. The cash on hand at this time was $837.arrow_forwardOn July 2 Kellie Company has decided to initiate a petty cash fund in the amount of $1,200. Prepare journal entries for the following transactions: A. On July 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $125, Supplies $368, Postage Expense $325, Repairs and Maintenance Expense $99, Miscellaneous Expense $259. The cash on hand at this time was $38. B. On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $425, Supplies $95, Postage Expense $240, Repairs and Maintenance Expense $299, Miscellaneous Expense $77. The cash on hand at this time was $110. C. On June 23, the petty cash fund needed replenishment and the following are the receipts: Auto Expense $251, Supplies $188, Postage Expense $263, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $93. D. On June 29, the company determined that the petty cash fund needed to be decreased to $1,000. E. On June 30, the petty cash fund needed replenishment, as it was month end. The following are the receipts: Auto Expense $14, Supplies $75, Postage Expense $150, Repairs and Maintenance Expense $121, Miscellaneous Expense $39. The cash on hand at this time was $603.arrow_forward

- Catherines Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?arrow_forwardThe custodian of a $450 petty cash fund discovers that the fund has $55.90 in coins and currency plus $389.50 in receipts at the end of the month. The entry to replenish the petty cash fund will include: Multiple Choice O A credit to Cash for $39410 A debit to Cash for $39410 A credit to Cash Over and Short for $460 A deba to Cash for $384.90 A debt to Potty Cash for $389 50.arrow_forwardThe custodian of a $735 petty cash fund discovers that the fund has $157.50 in coins and currency plus $553.50 in receipts at the end of the month. The entry to replenish the petty cash fund will include: Multiple Choice A debit to Cash for $530. A debit to Petty Cash for $553.50. A credit to Cash Over and Short for $578. A credit to Cash for $553.50 A dohit to Cach Over and Short for $24.00 Help I Save & Exitarrow_forward

- The custodian of a $450 petty cash fund discovers that the fund has $54.30 In coins and currency plus $391.50 In receipts at the end of the month. The entry to replenish the petty cash fund will include: Multiple Choice A credit to Cash Over and Short for $4.20. O A debit to Cash for $395.70. О A debit to Cash for $387.30. O A debit to Petty Cash for $391.50. O. A credit to Cash for $395.70.arrow_forwardAssume that the custodian of a $465 petty cash fund has $67.50 in coins and currency plus $391.50 in receipts at the end of the month. The entry to replenish the petty cash fund will include: Multiple Choice A debit to Cash for $386. A debit to Cash Over and Short for $6.00. A debit to Petty Cash for $391.50. A credit to Cash for $391.50. A credit to Cash Over and Short for $398.arrow_forwardThe custodian of a $600 petty cash fund discovers that the fund has $ 112.50 in coins and currency plus $ 472.50 in receipts at the end of the month. The entry to replenish the petty cash fund will include:arrow_forward

- Assume that the custodian of a $450 petty cash fund has $57.10 in coins and curency plus $387.00 in recipts at the end of the month. The entry to replenish the petty cash fund will include:?arrow_forwardSpencer Co. has a $430 petty cash fund. At the end of the first month the accumulated receipts represent $66 for delivery expenses, $219 for merchandise inventory, and $35 for miscellaneous expenses. The fund has a balance of $110. The journal entry to record the reimbursement of the account includes a: Multiple Choice Credit to Cash for $320. Credit to Cash Over and Short for $110. Debit to Cash Over and Short for $110. Credit to Inventory for $219. Debit to Petty Cash for $430.arrow_forwardThe petty cash fund for Sunflower Co. was established at $100. After the first month, the cash in the petty cash box amounted to $21. The receipts in the petty cash box included a receipt from Office Depot for $32, a receipt from a grocery store for $26, and a postage COD receipt for $16. Which of the following would be included in the journal entry to replenish the petty cash fund Credit to Supplies Expense; $32 Credit to Cash; $74 Debit to Cash Short (Over); $5 Credit to Cash Short (Over); $5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning