FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

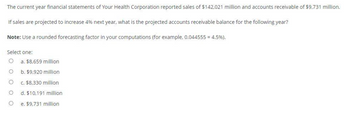

Transcribed Image Text:The current year financial statements of Your Health Corporation reported sales of $142,021 million and accounts receivable of $9,731 million.

If sales are projected to increase 4% next year, what is the projected accounts receivable balance for the following year?

Note: Use a rounded forecasting factor in your computations (for example, 0.044555 = 4.5%).

Select one:

O a. $8,659 million

O

O

O

O

b. $9,920 million

c. $8,330 million

d. $10,191 million

e. $9,731 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Determine the percentage increase in annual operating income if Pharoah Corporation increases its selling price by 20% and all other factors (including demand) remain constant. ( Round answer to 2 decimal places, e.g. 15.25% .) Percent increase in profit %arrow_forwardPlease write clearly for practice problemsarrow_forwardNeed help with this practice problem, please write clearly thank youarrow_forward

- Suppose a company has had the historic sales figures shown below. What would be the forecast for next years sales using the average approach?arrow_forwardYour company has sales of $97,200 this year and cost of goods sold of $71,200. You forecast sales to increase to $113,100 next year. Using the percent of sales method, forecast next year's cost of goods sold.arrow_forwardUse the table for the question(s) below. FCF Forecast ($ million) Year Sales 1 270 12.5% 32.40 Less: Income Tax (37%) (6.48) Less Increase in NWC (12% of Change in Sales) 3,60 Free Cash Flow 22.32 Growth versus Prior Year EBIT (10% of Sales) 0 240 OA. $4.27 OB. $7.47 OC. $12.8 OD. $5.12 2 290 7.4% 34.80 (6.96) 2.40 25.44 ACCE 3 310 6.9% 37.20 (7.44) 2.40 27.36 Banco Industries expect sales to grow at a rapid rate over the next 3 years, but settle to an industry growth rate of 4% in year 4. The spreadsheet above shows a simplified pro forma for Banco Industries. Banco industries has a weighted average cost of capital of 10%, $30 million in cash, $60 million in debt, and 18 million shares outstanding. If Banco Industries can reduce its operating expenses so that EBIT becomes 12% of sales, by how much will its stock price increase? 4 325.5 5.0% 39.06 (7.81) 1.86 29.388arrow_forward

- The following table shows CLV for A company. What is the CLV of the first year (please round it up)? Profit per Annual Customer Annual Year CustomerRetention Accounts Discount Discount ($) Probability RemainingRate 0 1 50 2 70 3 ↑ 75 41 42 43 44 45 90% 87% 85% 100 90 78.3 66.5 0.1 0.1 Cumulative Discounted Cash Flow ($)0 0.1 Factor 0.91 0.83 0.75arrow_forwardUse the "percent of sales method" of preparing pro forma financial statements to determine the projection for next year's accounts receivable. Make the following assumptions: current year's sales are $55,750,000; current year's cost of goods sold is $25,350,000; sales are expected to rise by 25%, The firm's investment in accounts receivable in the current year is $12,600,000. The firm's marginal tax rate is 35%. What is the projection for next year's accounts receivable? $10,320,000 $11,345,000 O $15,750,000 $8,772,000arrow_forwardSuppose a firm has had the historical sales figures shown as follows. What would be the forecast for next year's sales using the average approach? Year 2017 2018 Sales $ 750,000 500,000 Multiple Choice O $695,000 $700,000 $750,000 $775.000 2019 $ 700,000 2020 $ 750,000 2021 $ 775,000arrow_forward

- Need both questions. ....attempt if you will solve both questions. ...thanksarrow_forwardThe figure shows a graph that compares the present values of two ordinary annuities of $900 quarterly, one at 5% compounded quarterly and one at 9% compounded quarterly. Dollars 70000 60000 50000 40 000 30.000 20 000 10000 0 20 40 60 80 100 120 140 Quarters @ (a) Determine which graph corresponds to the 5% rate and which corresponds to the 9% rate. The higher graph is the one at 5% and the lower one is the one at 9% O The lower graph is the one at 5% and the higher one is the one at 9% (b) Use the graph to estimate the difference (in dollars) between the present values of these annuities for 25 years (100 quarters) $1078497arrow_forwardSuppose a firm has had the following historic sales figures. What would be the forecast for next year's sales using the average approach? You must use the built-in Excel function to answer this question. Input area: Year Sales 2016 2017 2018 es es e $ 1,500,000 $ 1,750,000 $ 1,400,000 2019 $ 2,000,000 2020 $ 1,600,000 Output area: Next year's salesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education