Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

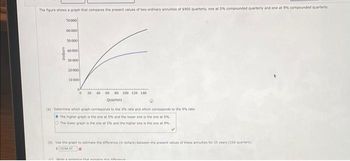

Transcribed Image Text:The figure shows a graph that compares the present values of two ordinary annuities of $900 quarterly, one at 5% compounded quarterly and one at 9% compounded quarterly.

Dollars

70000

60000

50000

40 000

30.000

20 000

10000

0 20 40 60 80 100 120 140

Quarters

@

(a) Determine which graph corresponds to the 5% rate and which corresponds to the 9% rate.

The higher graph is the one at 5% and the lower one is the one at 9%

O The lower graph is the one at 5% and the higher one is the one at 9%

(b) Use the graph to estimate the difference (in dollars) between the present values of these annuities for 25 years (100 quarters)

$1078497

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Urmilabenarrow_forward1) Determine how much is in each account on the basis of the indicated compounding after the specified years have passed; P is the initial principal, and r is the annual rate given as a percent. (Round your answers to the nearest cent.) P = $5000 and r = 3.1%, compounded annually (a) after 6 years$ (b) after 10 years$ (c) after 15 years$ (d) after 34 years$arrow_forwardCompute the number of years (t) if future value (FV) = $10174, present value (FV) = $1498, and interest rate (r) = 14.7%,. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.):arrow_forward

- Determine how much is in each account on the basis of the indicated compounding after the specified years have passed; P is the initial principal, and r is the annual rate given as a percent. (Round your answers to the nearest cent.) after one year where P = $7200 and r = 2.5% (a) compounded annually$ (b) compounded quarterly$ (c) compounded monthly$ (d) compounded weekly$ (e) compounded daily$arrow_forwardComplete the table for the time t (in years) necessary for P dollars to triple when interest is compounded annually at rate r. (Round your answers to two decimal places.) 2% 3% 4% 5% 6% 54.93 r t Create a scatter plot of the data. r 60 50 40 30 20 10 60 50 40 30 20 10 t 2 2 3 36.62 3 4 4 X 5 5 27.47 6 6 7 7 8 8 21.97 t r X r 60 50 40 30 20 10 60 50 40 t 30 20 0> 10 18.31 X 2 2 3 3 4 4 7% 15.69 X 5 5 6 6 7 7 8 8 t rarrow_forwardSuppose the real rate is 2.32 percent and the inflation rate is 2.68 percent. What rate (in percent) would you expect to earn on a Treasury bill? Use the exact formula. Answer to two decimals.arrow_forward

- Suppose you saw a sign at your local bank that said, "3.3% rate compounded quarterly – 3.7% Annual Percentage Yield (APY)." Is there anything wrong with the sign? Explain. Select the correct choice below and, if necessary, fill in the answer box to complete your choice. A. Yes. The APY is incorrect. The correct APY is ------%. (Round to the nearest hundredth as needed.) B. Yes. The number of compounding periods is incorrect. Interest should be compounded daily. C. No. The information on the sign is correct.arrow_forwardUsing the simple interest formula I= Prt, compute the amount of interest earned on $1141.00 at 8.06% p.a. for 193 days. The interest eamed is $. (Round the final answer to the nearest cent as needed. Round all internadiate values to six decimal places as needed.) Enter your answer in the answer box.arrow_forwardClick here to view factor tables. $50,570 payable at the end of the seventh, eighth, ninth, and tenth periods at 11%. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 458,581.) Present value $arrow_forward

- The figure shows a graph that compares the present values of two ordinary annuities of $900 quarterly, one at 6% compounded quarterly and one at 9% compounded quarterly. Determine which graph corresponds to the 6% rate and which corresponds to the 9% rate.arrow_forwardHh3.arrow_forwardDetermine the following (1–18) measures for 20Y2, rounding to one decimal place, except the dollar amount, which should be rounded to the nearest cent. Use the rounded answer to the requirement for subsequent requirements, if required. Assume 365 days a year. Show each formula and calculation on the worksheet. amount which should be rounded to the nearest cent. use the rounded answer to the requirment for subsequent requirements, if required. Assume 365 days a year. Formula Calculation and Answer 1 Working Capital Stargel Inc. 2 Current ratio Comparative Retained Earnings Statement 3 Quick ratio For the Years Ended December 31, 20Y2 and 20Y1 4 Accounts receivable turnover 20Y2 20Y1 5 Number of days' sales in receivables days Retained…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education