*Using Matlab*

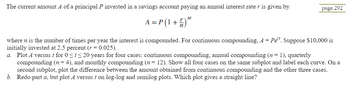

The current amount A of a principal P invested in a savings account paying an annual interest rate r is given by

A = P(1+r/n)^(nt)

where n is the number of times per year the interest is compounded. For continuous compounding, A = Pe^(rt). Suppose $10,000 is initially invested at 2.5 percent (r = 0.025).

a. Plot A versus t for 0 ≤ t ≤ 20 years for four cases: continuous compounding, annual compounding (n = 1), quarterly compounding (n = 4), and monthly compounding (n = 12). Show all four cases on the same subplot and label each curve. On a second subplot, plot the difference between the amount obtained from continuous compounding and the other three cases.

b. Redo part a, but plot A versus t on log-log and semilog plots. Which plot gives a straight line?

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- The principal represents an amount of money deposited in a savings account subject to compound interest at the given rate. A. Find how much money there will be in the account after the given number of years. B. Find the interest earned. Click the icon to view some finance formulas. A. The amount of money in the account after 2 years is $. (Round to the nearest hundredth as needed.) B. The amount of interest earned is $. (Round to the nearest hundredth as needed.) Principal $2000 Rate 5% 7 Compounded annually Time 2 yearsarrow_forwardPlease solve allarrow_forwardWhen $8,600 is invested in a savings account paying simple interest for the year, the interest, i in dollars, can be obtained from the equation i=8,600r, where r is the rate of interest in decimal form. Graph i=8,600r, for r up to and including a rate of 16%. If the rate is 7%, how much interest is earned? OA. $6,020 OB. $602 OC. $586 OD. $622arrow_forward

- This question has three partsarrow_forwardA bank features a savings account that has an annual percentage rate of r=3.4% with interest compounded weekly. Alfonso deposits $11,500 into the account. The account balance can be modeled by the exponential formula S(t)=P(1+r/n)^nt, where S is the future value, P is the present value, rr is the annual percentage rate, nn is the number of times each year that the interest is compounded, and tt is the time in years. What values should be used for P, r, and n?P= , r= , n= How much money will Alfonso have in the account in 10 years?Answer = $ .Round answer to the nearest penny. What is the effective annual rate for the savings account?effective rate = %.Round answer to 3 decimal places.arrow_forwardDetermine the annual rate of interest, to the nearest tenth of a percent, given that the investment of $34 500 is compounded monthly and after 6 years is worth $49 750. use tvm solver or graphing calculator N= 1%= PV= PMT= FV= P/Y= C/Y= PMT: END BEGINarrow_forward

- Compute the present value if future value (FV) = $4892, interest rate (r) = 14.0%, and number of years (t) = 16.arrow_forwardFind the accumulated amount A if the principal P is invested at the interest rate of r/year for t years. (Use a 365-day year. Round your answer to the nearest cent.) P = $120,000, r = 2.75%, t = 4, compounded dailyarrow_forwardAn investment accumulates at a force of interest δt = 0.01t / (3 + 0.01t^2) . Find the present value at time t = 0 of $3,900 due at the end of 7.5 year.arrow_forward

- Using Table 11-1, compute the amount of compound interest (in $) earned in 1 year and the annual percentage yield (APY) for the investment. (Round your answers to two decimal places.) Compound Interest Earned in 1 Year Annual Percentage Yield (APY) Nominal Interest Principal Rate (%) Compounded $33,000 12 monthly $ % Need Help? Read It 3 Type here to searcharrow_forwardWhen $8,600 is invested in a savings account paying simple interest for the year, the interest, i in dollars, can obtained from the equation i=8,600r, where r is the rate of interest in decimal form. Graph i=8,600r, for r up to including a rate of 16%. If the rate is 7%, how much interest is earned? OA. $6,020 OB. $602 O C. $586 OD. $622 Iarrow_forwardUsing Table 11-1, calculate the compound amount and compound interest (in $) for the investment. (Round your answers to the nearest cent.) Time Nominal Interest Compound Compound Principal Period (years) Rate (%) Compounded Amount Interest $5,100 8 quarterly Need Help? Read Itarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education