Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

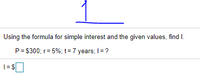

Transcribed Image Text:Using the formula for simple interest and the given values, find I.

P= $300; r= 5%; t = 7 years; I= ?

|=S

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the factor form equation to get EUAB/Annuity (A) ?arrow_forwardUse a calculator to evaluate an ordinary annuity formula nt 1 - [ (² + 4) * - -] 5 A = m for m, r, and t (respectively). Assume monthly payments. (Round your answer to the nearest cent.) $100; 6%; 11 yr. A = $arrow_forwardDetermine the present value P you must invest to have the future value A at simple interest rate r after time t. A = $19,000, r = 11.5%, t = 4 years The present value that must be invested to get $19,000 after 4 years at an interest rate of 11.5% is $. (Round up to the nearest cent.)arrow_forward

- Compute the simple interest INT for the specified length of time and the future value FV at the end of that time. Round all answers to the nearest cent. You borrow $78,000 for 10 months at 0.03% per month. X INT = $ FV = $arrow_forwardAssume the returns from holding an asset are normally distributed. Also assume the average annual return for holding the asset a period of time was 15.3 percent and the standard deviation of this asset for the period was 33.2 percent. Use the NORMDIST function in Excel® to answer the following questions. a. What is the approximate probability that your money will double in value in a single year? (Do not round intermediate calculations and enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.) b. What is the approximate probability that your money will triple in value in a single year? (Do not round intermediate calculations and enter your answer as a percent rounded to 8 decimal places, e.g., 32.16161616.)arrow_forwardj. Find the PV and the FV of an investment that makes the following end-of-year payments. The interest rate is 8%. Year 1 $100, Year 2 $200, Year 3 $400 Year Payment 1 100 2 200 3 400 Rate 8% To find the PV, use the NPV function: Pv= $581.59 Year Payment x (1+ I)^(N- t) = FV 1 100 2 200 3 400arrow_forward

- Determine the present value, P, you must invest to have the future value, A, at simple interest rate r after time t. Round answer to the nearest dollar. A=$5,000, r=8.2%, t=5 yearsarrow_forwardDetermine the present value P you must invest to have the future value A at simple interest rate r after time t. A = $14,000, r = 7.5%, t = 8 yearsarrow_forwardUse a calculator to evaluate the amortization formula for the values of the variables P, r, and t (respectively). Assume n = 12. (Round your answer to the nearest cent.) $14,000; 5%; 4 yrarrow_forward

- Questions: 1. Using simple interest computations, find the future value of $3,620 at 2 38%/2 38% 2. Now, using compound interest computations, find the future value of $3,620 at 2 38%/2 38% Time Value of Money Solver). Show what you put into the calculator for your work. 3. Now, using compound interest computations, find the future value of $3,620 at 2 38%/2 38% Time Value of Money Solver). Show what you put into the calculator for your work. 4. Explain why the future values are different in questions 1-3. Explain who would benefit from more frequent compounding. Who would be at a disadvantage from more frequent compounding.arrow_forwardFind the present value PV of the given future value. (Round your answer to the nearest cent.) future valye $1,118 at 3.625 simple interest for 518 days PV = $arrow_forwardIf the present value of an ordinary, 6-year annuity is $8,800 and interest rates are 9.5 percent, what’s the present value of the same annuity due? (Round your answer to 2 decimal places.) PV = $_______.__arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education