FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

What is the change in the cash balance for the period January-March

Please Fast Answer

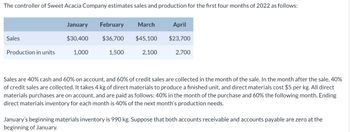

Transcribed Image Text:The controller of Sweet Acacia Company estimates sales and production for the first four months of 2022 as follows:

Sales

Production in units

January

$30,400

1,000

February March

$36,700

$45,100

1,500

2,100

April

$23,700

2,700

Sales are 40% cash and 60% on account, and 60% of credit sales are collected in the month of the sale. In the month after the sale, 40%

of credit sales are collected. It takes 4 kg of direct materials to produce a finished unit, and direct materials cost $5 per kg. All direct

materials purchases are on account, and are paid as follows: 40% in the month of the purchase and 60% the following month. Ending

direct materials inventory for each month is 40% of the next month's production needs.

January's beginning materials inventory is 990 kg. Suppose that both accounts receivable and accounts payable are zero at the

beginning of January.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- vable Prepare Jun's journal entry assuming the note is honored by the customer on October 31 of that same year. (Do not round intermediate calculations. Round your answers to nearest whole dollar value. Use 360 days a year.) View transaction list Journal entry worksheet 1 Record cash received on note plus interest.arrow_forwardAn invoice dated April 22 shows a net price of $175.00 with the terms 3/10, n/30. What is the latest date the cash discount is allowed?arrow_forwardDilly Farm Supply is located in a small town in the rural west. Data regarding the store's operations follow: • Sales are budgeted at $305,000 for November, $325,000 for December, and $225,000 for January. • Collections are expected to be 65% in the month of sale and 35% in the month following the sale. The cost of goods sold is 80% of sales. • The company desires to have an ending merchandise inventory at the end of each month equal to 70% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase. • Other monthly expenses to be paid in cash are $22,600. Monthly depreciation is $28,500. . Ignore taxes. Assets Cash: Balance Sheet October 31 Accounts receivable Merchandise inventory Property, plant and equipment, net of $624,000 accumulated depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings Total liabilities and stockholders' equity The difference between cash receipts and cash…arrow_forward

- Preparing a Schedule of Cash Collections on Accounts Receivable Kailua and Company is a legal services firm. All sales of legal services are billed to the client (there are no cash sales). Kailua expects that, on average, 20% will be paid in the month of billing, 50% will be paid in the month following billing, and 25% will be paid in the second month following billing. For the next 5 months, the following sales billings are expected: May $84,000 June 100,800 July 77,000 August 86,700 September 92,000 Required: Prepare a schedule showing the cash expected in payments on accounts receivable in August and in September. If an amount box does not require an entry, leave it blank or enter "0". Be sure to enter percentages as whole numbers. Kailua and Company Schedule August September June: 2$ % July: 2$ % 24 % August: 2$arrow_forwardBramble Corporation is a small wholesaler of gourmet food products. Data regarding the store's operations follow: • Sales are budgeted at $230,000 for November, $210,000 for December, and $200,000 for January. • Collections are expected to be 40% in the month of sale and 60% in the month following the sale. The cost of goods sold is 65% of sales. The company would like to maintain ending merchandise inventories equal to 55% of the next month's cost of goods sold. Payment for merchandise is made in the month following the purchase. Other monthly expenses to be paid in cash are $22,900. Monthly depreciation is $13,900. Ignore taxes. ● ● ● ● Assets Cash Balance Sheet October 31 Accounts receivable Merchandise inventory Property, plant and equipment, net of $574,300 accumulated depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings Total liabilities and stockholders' equity The difference between cash receipts and cash disbursements…arrow_forwardShould we record account payable at 12/31, if the invoice date is after 12/31, lets say 1/3, for example the utility or telephone bill for December.arrow_forward

- A household savings-account spreadsheet shows the following entries for the first day of each month: Month January February March April May June July August Additions Withdrawals Value 148,000 2,500 4,000 1,500 13,460 3,000 23,000 198,000 Required: Use the Excel function XIRR to calculate the dollar-weighted average return for this period. (Round your answer to 2 decimal places.) Dollar-weighted average Answer is complete but not entirely correct. 70.01%arrow_forwardDd.1. What are cash payments on account for February? 2. What is the ending balance in accounts payable for March? 3. What is the change in the cash balance for the period January–March?.arrow_forwardConsider the following information: Suppliers’ payment period 40 days Receivables’ collection period 40 days Finished goods holding period 15 days Work – in progress holding period 10 days Raw materials inventory holding period 20 days b)What is the cash cycle? Select one: A. 35 days B. 45 days C. 30 days D. None of the abovearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education