Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

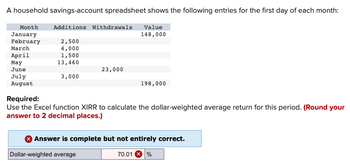

Transcribed Image Text:A household savings-account spreadsheet shows the following entries for the first day of each month:

Month

January

February

March

April

May

June

July

August

Additions Withdrawals Value

148,000

2,500

4,000

1,500

13,460

3,000

23,000

198,000

Required:

Use the Excel function XIRR to calculate the dollar-weighted average return for this period. (Round your

answer to 2 decimal places.)

Dollar-weighted average

Answer is complete but not entirely correct.

70.01%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Based on the following data for the current year, what is the days' sales in receivables? Assume 365 days a year. Line Item Description Amount Sales on account during year $444,688 Cost of goods sold during year 188,576 Accounts receivable, beginning of year 45,189 Accounts receivable, end of year 51,774 Inventory, beginning of year 80,151 Inventory, end of year 112,830 Round your answer up to the nearest whole day.arrow_forwardSuppose you deposit $1,016.00 into an account 4.00 years from today. Exactly 13.00 years from today the account is worth $1,741.00. What was the account's interest rate? Submit Answer format: Percentage Round to 3 decimal places (Example: 9.243%, % sign required. Will accept decimal format rounded to 5 decimal places (ex. 0.09243))arrow_forwardThe total amount of money in an account with P dollars invested in it is given by the formula A=P+PrtA=P+Prt, where r is the rate expressed as a decimal and t is time (in years).If $525$525 is invested at 14%14%, how much money will be in the account after 3030 months? Round your answer to two decimal places if necessary.arrow_forward

- Calculate the monthly finance charge for the credit card transaction. Assume that it takes 10 days for a payment to be received and recorded, and that the month is 30 days long. (Round your answers to the nearest cent.) $3,000 balance, 11%, $90 payment (a) previous balance method $ Correct: Your answer is correct. (b) adjusted balance method $ Incorrect: Your answer is incorrect. (c) average daily balance method $ Incorrect: Your answer is incorrect.arrow_forwardSuppose you deposit $ 1296 today and your account will accumulate to $ 5637 in 9 years. What is the rate of interest? Input your answer in decimals, not percentages. Round your answer to four decimals places.arrow_forwardSuppose that on the statement for a money market account, the initial balance was $7744.70, the statement was for 34 days, the final balance was $7770.84, and there were no deposits or withdrawals. Calculate the APY. Give your answer in percent to 2 decimal places.arrow_forward

- When $8,600 is invested in a savings account paying simple interest for the year, the interest, i in dollars, can be obtained from the equation i=8,600r, where r is the rate of interest in decimal form. Graph i=8,600r, for r up to and including a rate of 16%. If the rate is 7%, how much interest is earned? OA. $6,020 OB. $602 OC. $586 OD. $622arrow_forwardFrom this partial advertisement: $86.83 per month for 60 months $3,700 used car cash price $50 down payment a. Calculate the amount financed. Amount financed Finance charge $ b. Calculate the finance charge. Note: Round your answer to the nearest cent. 3,650 Deferred payment price S 1,559 80 c. Calculate the deferred payment price, Note: Round your answer to the nearest cent. S 5.250.00arrow_forwardHi! Please answer thank you! The second picture is the second part of the questionarrow_forward

- PLEASE MAKE IT IN EXCEL AND SHOW THE FORMULAS (Take screenshots) La Resolana, S.A., has credit sales of $180,000 per year, with net payment terms of 30 days, which is also the average collection period. La Resolana does not currently offer any cash discounts, so customers take the 30 days to pay. What is the average accounts receivable balance? What is the accounts receivable turnover?arrow_forwardA company reports the following: Sales $838,040 Average accounts receivable (net) 51,100 Round your answers to one decimal place. Assume a 365-day year. a. Determine the accounts receivable turnover. b. Determine the number of days' sales in receivables.arrow_forwardH5.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education