Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

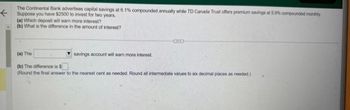

Transcribed Image Text:The Continental Bank advertises capital savings at 6.1% compounded annually while TD Canada Trust offers premium savings at 5.9% compounded monthly

Suppose you have $2500 to invest for two years.

(a) Which deposit will earn more interest? -

(b) What is the difference in the amount of interest?

CD

(a) The

(b) The difference is $

(Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed)

savings account will earn more interest

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- write down an answer, without showing any work, you will receive only half credit for that problem if you are correct (anc rong). The point is that I want to see that you know how to set up each problem. Question 1 Calculate the effective interest rate for each nominal annual interest rate and compounding frequency shown. Round your answer to 2 decimal places. a. 12% Quarterly compounding b. 7% Semiannual compounding C. 14% Continuous compounding Upload Choose a File Question 2 You are looking at buying a new sorting machine for recycling plastics that sod 6 11-15odarrow_forwardThe Royal Bank of Canada offers a rate of 2.0% compounded semi-annually on its three-year GIC. What monthly compounded rate should the bank offer on three-year GICS to make investors indifferent between the alternatives? Show your work using the FORMULA method to find the answer (round to two decimals)arrow_forwardBank A offers you a loan at 8.52% compounded 5 times a year. Bank B offers to loan you the same amount at 0.10% less than the rate offered by Bank A but compounded twice as often as the Bank A rate is. Which bank's loan should you accept? As your answer, enter the effective rate (in percent, to two decimal places at least) offered by the bank whose loan you should accept.arrow_forward

- Suppose you borrow $14,000. The interest rate is 11%, and it requires 4 equal end-of-year payments. Set up an amortization schedule that shows the annual payments, interest payments, principal repayments, and beginning and ending loan balances. Round your answers to the nearest cent. If your answer is zero, enter "0". Beginning Repayment Ending Year Balance Payment Interest of Principal Balance 1 $ fill in the blank 60 $ fill in the blank 61 $ fill in the blank 62 $ fill in the blank 63 $ fill in the blank 64 2 $ fill in the blank 65 $ fill in the blank 66 $ fill in the blank 67 $ fill in the blank 68 $ fill in the blank 69 3 $ fill in the blank 70 $ fill in the blank 71 $ fill in the blank 72 $ fill in the blank 73 $ fill in the blank 74 4 $ fill in the blank 75 $ fill in the blank 76 $ fill in the blank 77 $ fill in the blank 78 $ fill in the blank 79arrow_forwardHow long will it take $200 to double if it earns the following rates? Compounding occurs once a year. Round your answers to two decimal places. 4%. year(s) 13%. year(s) 17%. year(s) 100%. year(s)arrow_forwardFlybynightSavings.com is offering a savings account that pays 32% compounded continuously. How much interest would a deposit of $4,000 earn over 5 years? (Round your answer to the nearest cent.) $= What is the annually compounded interest rate (in percent) that would correspond to this investment? (Round your answer to two decimal places.) %arrow_forward

- How long will it take $800 to double if it earns the following rates? Compounding occurs once a year. Round your answers to two decimal places. 6%. year(s) 11%. year(s) 17%. year(s) 100%. year(s)arrow_forwardYou have found three investment choices for a one-year deposit: 10.4% APR compounded monthly, 10.4% APR compounded annually, and 9.7% APR compounded daily. Compute the EAR for each investment choice. (Assume that there are 365 days in the year.) (Note: Be careful not to round any intermediate steps less than six decimal places.) The EAR for the first investment choice is _____%. (Round to three decimal places.) Part 2 The EAR for the second investment choice is _____%. (Round to three decimal places.) Part 3 The EAR for the third investment choice is______%. (Round to three decimal places.)arrow_forwardCompute The present value of a $5500 deposit in year 1, and another $5000 deposit at the end of year 4 using an 8% interest rate. ( do not round intermediate calculations and around your final answer to two decimal places)arrow_forward

- Presently the Smiths invest $100,000 for A months in a certificate paying interest at the nominal rate of 6% compounded monthly. How much will they have at the end? We have A=117 Round your answer to the first decimal. (for instance, 43.232 gives 43.23, 124.756 gives 124.76). The decimal separator is a point.arrow_forwardSuppose you make equal quarterly deposits of $2,500 into a fund that pays interest at a rate of 5% compounded monthly. Find the balance at the end of year 3. Hint: You will need an effective interest rate in your calculations. As a proportion, round this value to 4 places after the decimal when you use this in subsequent calculations. Note: Note: When entering your answer, do not use any dollar symbols or any other units. Enter only the value rounded to the nearest integer (nearest dollar). Also, for longer values, do not use any commas.arrow_forwardThe amount of interest on $X for two years is $330. The amount of discount on $X for one year is $144. Find the annual effective interest rate i and the value of X. (Round your answer for i to two decimal places. Round your answer for X to the nearest cent.) ¡ = 9.42 X X = $ 1672.66 X Submit Answer %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education