Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

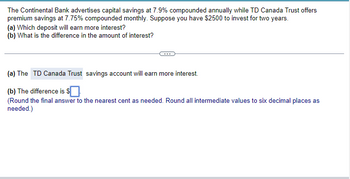

Transcribed Image Text:The Continental Bank advertises capital savings at 7.9% compounded annually while TD Canada Trust offers

premium savings at 7.75% compounded monthly. Suppose you have $2500 to invest for two years.

(a) Which deposit will earn more interest?

(b) What is the difference in the amount of interest?

(a) The TD Canada Trust savings account will earn more interest.

(b) The difference is $

(Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as

needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A bank is currently offering a savings account paying an interest rate of 6.0 percent compounded quarterly. It would like to offer another account ,with the same effective annual rate ,but compounded monthly. What is the equivalent rate of compound monthly.?arrow_forwardi need the answer quicklyarrow_forwardI hope you could write the formula and process more clearly. Thank youarrow_forward

- One bank offers to loan you money at an interest rate of 12% compounded quarterly, and another bank offers to loan you money at 11.8% compounded continuously. Which loan would you prefer, and why?arrow_forwardGive me right solution according to the question options also given A person deposits $150 per month into a savings account for 2 years. if $75 is withdrawn in months 5,7 and 8 (in addition to the deposits), construct the cash flow diagram to determine how much will be in the account after 2 years at i=8% per year, compound quarterly. Assume there is no interperiod interest. A. $ 2,045 B. $3609 C. $3090 D. $4050arrow_forwardYou want to invest $18,000 and are looking for safe investment options. Your bank is offering you a certificate of deposit that pays a nominal rate of 6% that is compounded semiannually. What is the effective rate of return that you will earn from this investment?arrow_forward

- A commercial bank is willing to make you a loan of P10,000. The bank wants a 12 percent interest rate and requires five equal annual payments to repay both interest and principal. What will be the dollar amount of the annual payment?arrow_forwardIf you could solve option 5 with the formulas please Option 5: Half the required money is taken out of an investment account that pays monthly interest at a 3% annual rate. The rest of the money is borrowed from a bank at a 4% annual interest rate, should payback within 3 years in equal monthly payments. Find the future value of the money taken from the investment account at the end of the shop development and periodic payments to the bank. Calculate Cumulative interest and principal payments.arrow_forwardYou have the chance to buy a guaranteed promissory note for $850. The note pays $1,000 in 15 months (i.e., exactly 456 days). You have $850 in a bank account that pays a 7% nominal rate compounded daily. Which is a better investment, the note or the bank account? Answer this question using three approaches: (1) compare your future value if you buy the note versus leaving your money in the bank; (2) compare the PV of the note with your current bank balance; and (3) compare the effective rate or return on the note with that of the bank account.arrow_forward

- Which do you prefer: a bank account that pays 5.0% per year (EAR) for three years or a. An account that pays 2.5% every six months for three years? b. An account that pays 7.5% every 18 months for three years? c. An account that pays 0.50% per month for three years? (Note: Compare your current bank EAR with each of the three alternative accounts. Be careful not to round any intermediate steps less than six decimal places.) If you deposit $1 into a bank account that pays 5.0% per year for three years: The amount you will receive after three years is $ (Round to five decimal places.)arrow_forwardA bank offers two alternative interest schedules for a savings account of $100,000 locked in for 3 years: (a) a monthly rate of 1% and (b) an annually, continuously compounded rate of 12%. Which alternative should you choose? Hint: convert APR to EAR, then compare the two optionsarrow_forwardTeal and Associates needs to borrow $65,000. The best loan they can find is one at 12% that must be repaid in monthly installments over the next 5 1/2 1 2 years. How much are the monthly payments? (a) State the type. A. ordinary annuityB.sinking fund C.present valueD.amortizationE.future value (b) Answer the question. (Round your answer to the nearest cent.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education