Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

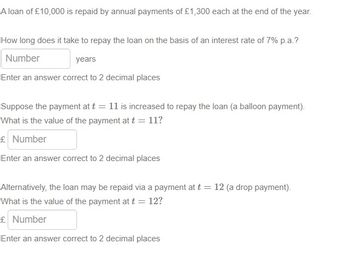

Transcribed Image Text:A loan of £10,000 is repaid by annual payments of £1,300 each at the end of the year.

How long does it take to repay the loan on the basis of an interest rate of 7% p.a.?

Number

years

Enter an answer correct to 2 decimal places

Suppose the payment at t = 11 is increased to repay the loan (a balloon payment).

What is the value of the payment at t = 11?

£ Number

Enter an answer correct to 2 decimal places

Alternatively, the loan may be repaid via a payment at t = 12 (a drop payment).

What is the value of the payment at t = 12?

£ Number

Enter an answer correct to 2 decimal places

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- D K Dan borrowed $906.00 today and is to repay the loan in two equal payments. The first payment is in three months, and the second payment is in nine months. If interest is 5% per annum on the loan, what is the size of the equal payments? Use today as the focal date. The size of the equal payments is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardA loan is to be repaid by an annuity payable monthly in arrears over a 5-year period. The annuity starts at a rate of £200 per month and increases each month by £5. Repayments are calculated using a rate of interest of 8% per annum effective. (i) Calculate the amount of the original loan to the nearest £. (ii) (iii) Calculate the capital outstanding at the end of the first year (after the payment due has been made) to the nearest £0.01. Hence, or otherwise, calculate the capital and interest components of the 13th and 14th payments.arrow_forwardFind the total amount that must be repaid on the following note described. $8,573 borrowed at 18.5% simple interest What is the total amount to be repaid 3 years, 125 days later? (Round your answer to the nearest cent.)arrow_forward

- A demand loan for $10,088.75 with interest at 7.1% compounded annually is repaid after 4 years, 8 months. What is the amount of interest paid? The amount of interest is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardIf the nominal rate of interest on a loan is 16.3% and interest is compounded monthly, what is the Annual Percentage Rate (APR)? Your answer should be accurate to three decimal places. A9. (a) Given an annual interest rate of 4.3%, what is the maximum amount one will be willing to pay now, as a lump sum, to obtain a pension of £6,720 per year for the next 9 years, if payments are made at end of each year? Your answer should be accurate to two decimal places. (b)arrow_forwardA loan of £13,000 is repaid by annual payments of £1,800 each at the end of the year. How long does it take to repay the loan on the basis of an interest rate of 10% p.a.? 数字 years Enter an answer correct to 2 decimal places Suppose the payment at t = 13 is increased to repay the loan (a balloon payment). What is the value of the payment at t = 13? £ 数字 Enter an answer correct to 2 decimal places Alternatively, the loan may be repaid via a payment at t = 14 (a drop payment). What is the value of the payment at t = 14? £ 数字 Enter an answer correct to 2 decimal placesarrow_forward

- Suppose you borrow $14,000. The interest rate is 11%, and it requires 4 equal end-of-year payments. Set up an amortization schedule that shows the annual payments, interest payments, principal repayments, and beginning and ending loan balances. Round your answers to the nearest cent. If your answer is zero, enter "0". Beginning Repayment Ending Year Balance Payment Interest of Principal Balance 1 $ fill in the blank 60 $ fill in the blank 61 $ fill in the blank 62 $ fill in the blank 63 $ fill in the blank 64 2 $ fill in the blank 65 $ fill in the blank 66 $ fill in the blank 67 $ fill in the blank 68 $ fill in the blank 69 3 $ fill in the blank 70 $ fill in the blank 71 $ fill in the blank 72 $ fill in the blank 73 $ fill in the blank 74 4 $ fill in the blank 75 $ fill in the blank 76 $ fill in the blank 77 $ fill in the blank 78 $ fill in the blank 79arrow_forwardAssuming that interest is the only finance charge, how much interest would be paid on a $5,000 installment loan to be repaid in 24 monthly installments of $235.54? Round the answer to the nearest cent. $ What is the APR on this loan? Round the answer to 2 decimal places. %arrow_forwardAn individual borrows £15,000 to be repaid in 10 years with monthly payments at the end of each month. The initial interest rate applied to the loan is 3% p.a. effective. a)Find the monthly repayment P1arrow_forward

- What is the size of the payments that must be deposited at the beginning of each 6-month period in an account that pays 8.6%, compounded semiannually, so that the account will have a future value of $170,000 at the end of 20 years? (Round your answer to the nearest cent.)$_____arrow_forwardI hope you could write the formula and process more clearly. Thank youarrow_forwardAnswer the question by hands, pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education