Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

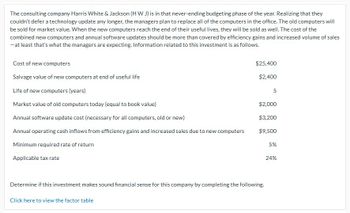

Transcribed Image Text:The consulting company Harris White & Jackson (H W J) is in that never-ending budgeting phase of the year. Realizing that they

couldn't defer a technology update any longer, the managers plan to replace all of the computers in the office. The old computers will

be sold for market value. When the new computers reach the end of their useful lives, they will be sold as well. The cost of the

combined new computers and annual software updates should be more than covered by efficiency gains and increased volume of sales

- at least that's what the managers are expecting. Information related to this investment is as follows.

Cost of new computers

Salvage value of new computers at end of useful life

Life of new computers (years)

Market value of old computers today (equal to book value)

Annual software update cost (necessary for all computers, old or new)

Annual operating cash inflows from efficiency gains and increased sales due to new computers

Minimum required rate of return

Applicable tax rate

$25,400

$2,400

Click here to view the factor table

Determine if this investment makes sound financial sense for this company by completing the following.

5

$2,000

$3,200

$9,500

5%

24%

Transcribed Image Text:(b)

* Your answer is incorrect.

Calculate the IRR for this investment. (Round answer to 2 decimal places, e.g. 15.25%.)

IRR

Save for Later

4.07 %

Attempts: 1 of 2 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Bilk.com, an online retailing company, proposes to spend $50 million on servers and other computer equipment for managing its Web site and processing orders. The company will depreciate the equipment over five years to zero. However, the company actually expects that it will be able to sell the equipment for $25 million at the end of five years. This equipment is expected to generate $30 million in sales in the first year and $21 million in cash operating costs in the first year. Both revenue and cash operating costs are expected to grow at an annual rate of 3% throughout the useful life of the equipment. There is no initial working capital requirement. However, the company will need to have a working capital balance at the end of each year equal to 20% of that year’s sales. The working capital can be fully recovered at the end of the project’s life. Bilk.com’s tax rate is 40%, and the cost of capital for this project is 8%. Calculate the cash flows in year 1. a. $2,825,000…arrow_forwardYour firm is contemplating the purchase of a new $410,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. You will save $125,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $35,000 at the beginning of the project. Working capital will revert back to normal at the end of the project. If the tax rate is 21 percent, what is the IRR for this project?arrow_forwardWhich one of these represents the most basic level of international participation by a business entity? Multiple choice question. Operating a single retail store in a singe foreign country Producing a single product in a foreign-built facility Importing and exporting goods and services Operating multiple facilities in various countries to spread riskarrow_forward

- Your firm is contemplating the purchase of a new $595,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $63,000 at the end of that time. You will save $225,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $78,000 (this is a one-time reduction). If the tax rate is 23 percent, what is the IRR for this project? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. IRR Answer is complete but not entirely correct. 8.96arrow_forwardYour firm is contemplating the purchase of a new $535,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $ 30,000 at the end of that time. You will save $165,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $60,000 (this is a one-time reduction). If the tax rate is 24 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardYour firm is contemplating the purchase of a new $540,000 computer - based order entry system. The system will be depreciated straight - line to zero over its five - year life. It will be worth $52, 000 at the end of that time. You will save $300,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $67,000 (this is a one - time reduction). If the tax rate is 23 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

- Your firm is contemplating the purchase of a new $540,000 computer - based order entry system. The system will be depreciated straight - line to zero over its five-year life. It will be worth $52,000 at the end of that time. You will save $300,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $67,000 (this is a one-time reduction). If the tax rate is 23 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardYour firm is contemplating the purchase of a new $515,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $53,000 at the end of that time. You will save $153,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $78,000 (this is a one-time reduction). If the tax rate is 21 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) IRR %arrow_forwardAn officer for a large construction company is feeling nervous. The anxiety is caused by a new excavator just released onto the market. The new excavator makes the one purchased by the company a year ago obsolete. As a result, the market value for the company’s excavator has dropped significantly, from $600,000 a year ago to $50,000 now. In ten years, it would be worth only $3,000. The new excavator costs only $950,000 and would increase operating revenues by $90,000 annually. The new equipment has a ten-year life and expected salvage value of $175,000. The tax rate is 35%, the CCA rate, 25% for both excavators, and the required rate of return for the company is 14%. What is the NPV of the new excavator?arrow_forward

- Your firm is contemplating the purchase of a new $615,000 computer-based order entry system. The system will be depreciated straight-line to zero over its 5-year life. It will be worth $97,000 at the end of that time. You will save $192,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $112,000 (this is a one-time reduction). If the tax rate is 23 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardThe plant manager of Orlando Electronics Company is considering the purchase of new automated assembly equipment. The new equipment will cost $275,000. The manager believes that the new investment will result in direct labor savings of $55,000 per year for 10 years. Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. What is the payback period on this project?fill in the blank 1 of 1 years b. What is the net present value, assuming a 10% rate of return? Use the table provided above. Round to the nearest whole dollar.Net present value fill in the blank 1 of 1$ c. What else should the manager consider in the analysis?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education