FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

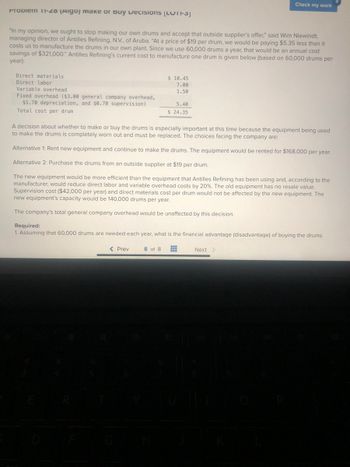

Transcribed Image Text:Propiem 11-20 (Aigo) Makе оr вuу Decisions (LUTI-SJ

"In my opinion, we ought to stop making our own drums and accept that outside supplier's offer," said Wim Niewindt,

managing director of Antilles Refining, N.V., of Aruba. "At a price of $19 per drum, we would be paying $5.35 less than it

costs us to manufacture the drums in our own plant. Since we use 60,000 drums a year, that would be an annual cost

savings of $321,000." Antilles Refining's current cost to manufacture one drum is given below (based on 60,000 drums per

year):

Direct materials

Direct labor

Variable overhead

Fixed overhead ($3.00 general company overhead,

$1.70 depreciation, and $0.70 supervision)

Total cost per drum

$10.45

7.00

1.50

5.40

$ 24.35

< Prev

Check my work

A decision about whether to make or buy the drums is especially important at this time because the equipment being used

to make the drums is completely worn out and must be replaced. The choices facing the company are:

Alternative 1: Rent new equipment and continue to make the drums. The equipment would be rented for $168,000 per year.

Alternative 2: Purchase the drums from an outside supplier at $19 per drum.

The new equipment would be more efficient than the equipment that Antilles Refining has been using and, according to the

manufacturer, would reduce direct labor and variable overhead costs by 20%. The old equipment has no resale value.

Supervision cost ($42,000 per year) and direct materials cost per drum would not be affected by the new equipment. The

new equipment's capacity would be 140,000 drums per year.

The company's total general company overhead would be unaffected by this decision.

Required:

1. Assuming that 60,000 drums are needed each year, what is the financial advantage (disadvantage) of buying the drums

8 of 8 #

Next >

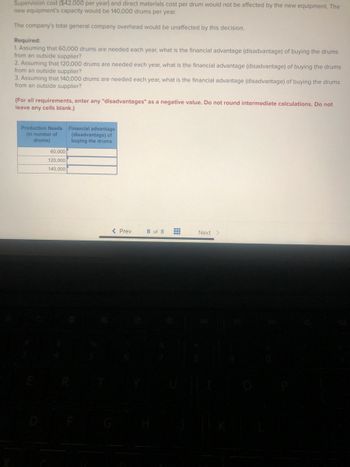

Transcribed Image Text:Supervision cost ($42,000 per year) and direct materials cost per drum would not be affected by the new equipment. The

new equipment's capacity would be 140,000 drums per year.

The company's total general company overhead would be unaffected by this decision.

Required:

1. Assuming that 60,000 drums are needed each year, what is the financial advantage (disadvantage) of buying the drums

from an outside supplier?

2. Assuming that 120,000 drums are needed each year, what is the financial advantage (disadvantage) of buying the drums

from an outside supplier?

3. Assuming that 140,000 drums are needed each year, what is the financial advantage (disadvantage) of buying the drums

from an outside supplier?

(For all requirements, enter any "disadvantages" as a negative value. Do not round intermediate calculations. Do not

leave any cells blank.)

Production Needs Financial advantage

(in number of

drums)

60,000

120,000

140,000

(disadvantage) of

buying the drums

< Prev

8 of 8

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Determination of advantage or disadvantage of buying drums from outside supplier for 60,000

VIEW Step 2: Determination of advantage or disadvantage of buying drums from outside supplier for 120,000

VIEW Step 3: Determination of advantage or disadvantage of buying drums from outside supplier for 140,000

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- A bicycle manufacturer currently produces 247,000 units a year and expects output levels to remain steady in the future. It buys chains from an outside supplier at a price of < $2.20 a chain. The plant manager believes that it would be cheaper to make these chains rather than buy them. Direct in-house production costs are estimated to be only $1.40 per chain. The necessary machinery would cost $277,000 and would be obsolete after 10 years. This investment could be depreciated to zero for tax purposes using a 10-year straight-line depreciation schedule. The plant manager estimates that the operation would require $26,000 of inventory and other working capital upfront (year 0), but argues that this sum can be ignored since it is recoverable at the end of the 10 years. Expected proceeds from scrapping the machinery after 10 years are $20,775, If the company pays tax at a rate of 28% and the opportunity cost of capital is 15%, what is the net present value of the decision to produce the…arrow_forwardThe Knot manufactures men’s neckwear at its Spartanburg plant. The Knot is considering implementing a JIT production system. The following are the estimated costs and benefits of JIT production: a. Annual additional tooling costs $250,000 annually. b. Average inventory would decline by 80% from the current level of $1,000,000. c. Insurance, space, materials-handling, and setup costs, which currently total $400,000 annually, would decline by 20%. d. The emphasis on quality inherent in JIT production would reduce rework costs by 25%. The Knot currently incurs $160,000 in annual rework costs. e. Improved product quality under JIT production would enable The Knot to raise the price of its product by $2 per unit. The Knot sells 100,000 units each year. The Knot’s required rate of return on inventory investment is 15% per year. Q. Suppose The Knot implements JIT production at its Spartanburg plant. Give examples of performance measures The Knot could use to evaluate and control JIT…arrow_forwardPlease help me. Fast solution please. Thankyou.arrow_forward

- 5. What is the maximum price that Silven should be willing to pay the outside supplier for a box of 24 tubes? 6. Instead of sales of 130,000 boxes of tubes, revised estimates show a sales volume of 161,000 boxes of tubes. At this higher sales volume, Silven would need to rent extra equipment at a cost of $51,000 per year to make the additional 31,000 boxes of tubes. Assuming that the outside supplier will not accept an order for less than 161,000 boxes of tubes, what is the financial advantage (disadvantage) in total (not per box) if Silven buys 161,000 boxes of tubes from the outside supplier? Given this new information, should Silven Industries make or buy the tubes? 7. Refer to the data in Required 6. Assume that the outside supplier will accept an order of any size for the tubes at a price of $1.95 per box. How many boxes of tubes should Silven make? How many boxes of tubes should it buy from the outside supplier?arrow_forward"I'm not sure we should lay out $335,000 for that automated welding machine," said Jim Alder, president of the Superior Equipment Company. "That's a lot of money, and it would cost us $91,000 for software and installation, and another $56,400 per year just to maintain the thing. In addition, the manufacturer admits it would cost $54,000 more at the end of three years to replace worn-out parts." "I admit it's a lot of money," said Franci Rogers, the controller. "But you know the turnover problem we've had with the welding crew. This machine would replace six welders at a cost savings of $121,000 per year. And we would save another $8,200 per year in reduced material waste. When you figure that the automated welder would last for six years, I'm sure the return would be greater than our 18% required rate of return." "I'm still not convinced," countered Mr. Alder. "We can only get $20,500 scrap value out of our old welding equipment if we sell it now, and in six years the new machine will…arrow_forwardMighty Safe Fire Alarm is currently buying 57,000 motherboards from MotherBoard, Inc., at a price of $63 per board. Mighty Safe is considering making its own boards. The costs to make the board are as follows: direct materials, $33 per unit; direct labor, $12 per unit; and variable factory overhead, $15 per unit. Fixed costs for the plant would increase by $90,000. Which option should be selected and why? Oa. a. buy, $90,000 increase in profits Ob. make, $80,940 increase in profits c. make, $171,000 increase in profits Od. buy, $80,940 increase in profitsarrow_forward

- The Chimes Clock Company sells a particular clock for $40. The variable costs are $23 per clock and the breakeven point is 230 clocks. The company expects to sell 280 clocks this year. If the company actually sells 430 clocks, what effect would the sale of additional 150 clocks have on operating income? Explain your answer. The sale of an additional 150 clocks would operating income by the amount of The total effect would amount toarrow_forwardThe pipes and plastic company manufactures wiring tools. The company is currently producing well below its full capacity. An Accra based company has approached pipes and plastics limited with an offer to buy 10,000 tools at ghc 1.75 each. Pipes and plastic limited sells its tools wholesale for ghc 1.85each; the average cost per unit is gh1.83 of which ghc 0.27 is fixed costs. If pipes and plastics were to accept the Accra based company's offer, what will be the increase in pipes and plastic operating profit?arrow_forwardHit or Miss Sports is introducing a new product this year. If its see-at-night soccer balls are a hit, the firm expects to be able to sell 42,800 units a year at a price of $70 each. If the new product is a bust, only 20,700 units can be sold at a price of $45. The variable cost of each ball is $26 and fixed costs are zero. The cost of the manufacturing equipment is $5.86 million, and the project life is estimated at 10 years. The firm will use straight-line depreciation over the 10-year life of the project. The firm's tax rate is 35% and the discount rate is 14%. a. If each outcome is equally likely, what is the expected NPV? ( Use the minus sign for negative value. Round your answer to the nearest dollar.) NPV $ Will the firm accept the project? The firm will (Click to select) v the project. b. Suppose now that the firm can abandon the project and sell off the manufacturing equipment for $5.2 million if demand for the balls turns out to be weak. The firm will make the decision to…arrow_forward

- Hit or Miss Sports is introducing a new product this year. If its see-at-night soccer balls are a hit, the firm expects to be able to sell 42,700 units a year at a price of $64 each. If the new product is a bust, only 22,200 units can be sold at a price of $41. The variable cost of each ball is $27 and fixed costs are zero. The cost of the manufacturing equipment is $5.92 million, and the project life is estimated at 9 years. The firm will use straight-line depreciation over the 9-year life of the project. The firm's tax rate is 35% and the discount rate is 13%. Now suppose that Hit or Miss Sports can expand production if the project is successful. By paying its workers overtime, it can increase production by 20,100 units; the variable cost of each ball will be higher, equal to $32 per unit. By how much does this option to expand production increase the NPV of the project? Assume that the firm decides whether to expand production after it learns the first-year sales results. (Round…arrow_forwardA bicycle manufacturer currently produces 237,000 units a year and expects output levels to remain steady in the future. It buys chains from an outside supplier at a price of $2.20 a chain. The plant manager believes that it would be cheaper to make these chains rather than buy them. Direct in-house production costs are estimated to be only $1.60 per chain. The necessary machinery would cost $293,000 and would be obsolete after 10 years. This investment could be depreciated to zero for tax purposes using a 10-year straight-line depreciation schedule. The plant manager estimates that the operation would require $44,000 of inventory and other working capital upfront (year 0), but argues that this sum can be ignored since it is recoverable at the end of the 10 years. Expected proceeds from scrapping the machinery after 10 years are $21,975. If the company pays tax at a rate of 35% and the opportunity cost of capital is 15%, what is the net present value of the decision to produce the…arrow_forwardBrandon Corporation, the maker of a variety of rubber products, is in the midst of a business downturn and has many idle facilities. Nationwide Tire Company has approached Brandon to produce 400,000 oversized tire tubes for $3.00 each. Brandon predicts that its variable costs will be $3.20 each. Its fixed costs, which had been averaging $2.50 per unit on a variety of products, will now be spread over twice as much volume. The president commented, "Sure we will lose $.20 each on the variable costs, but we will gain $1 per unit by spreading our fixed costs over more units. Therefore, we should take the offer because it would gain us $.80 per unit." Brandon currently has a volume of 400,000 units, sales of $1,600,000, variable costs of $1,200,000, and fixed costs of $1,000,000. Required: a. Compute the impact on operating profit if the special order is accepted. b. Based on your calculations, explain why you agree or do not agree with the president. c. Would it be beneficial for Brandon…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education