Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

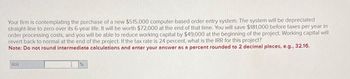

Transcribed Image Text:Your firm is contemplating the purchase of a new $515,000 computer-based order entry system. The system will be depreciated

straight-line to zero over its 6-year life. It will be worth $72,000 at the end of that time. You will save $181,000 before taxes per year in

order processing costs, and you will be able to reduce working capital by $49,000 at the beginning of the project. Working capital will

revert back to normal at the end of the project. If the tax rate is 24 percent, what is the IRR for this project?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

IRR

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- You are considering adding a new item to your company’s line of products. The machine required to manufacture the item costs $200000, and it depreciates straight-line over 4 years. The new item would require a $30000 increase in inventory and a $15000 increase in accounts payable. You plan to market the items for four years and then sell the machine for $40000. You expect to sell 2000 items per year at a price of $300. You expect manufacturing costs to be $220 per item and the fixed cost to be $3,000 per year. If the tax rate is 30% and your weighted average cost of capital is 12% per year, what is the net present value of selling the new item? ) $159,744 2) $73,903 3) $191,692 4) -$159,744 5) -$191,692arrow_forwardYour firm is contemplating the purchase of a new $410,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. You will save $125,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $35,000 at the beginning of the project. Working capital will revert back to normal at the end of the project. If the tax rate is 21 percent, what is the IRR for this project?arrow_forwardThe president of Real Time Inc. has asked you to evaluate the proposed acquisition of a new computer. The computer's price is $ 4 0,000, and it falls into the MACRS 3- year class. Purchase of the computer would require an increase in net operating working capital of $2,000. The computer would increase the firm's before-tax revenues by $ 24 ,000 per year but would also increase operating costs by $ 19 ,000 per year. The computer is expected to be used for 3 years and then be sold for $25,000. The firm's marginal tax rate is 40 percent, and the project's cost of capital is 14 percent. What is the operating cash flow in Year 2? Round it to a whole dollar, and do not include the $ sign. Year MACRS Percent 1 0.33 2. 0.45 3 0.15 0.07 Your Answer:arrow_forward

- The president of Real Time Inc. has asked you to evaluate the proposed acquisition of a new computer. The computer's price is $70,000, and it falls into the MACRS 3-year class. Purchase of the computer would require an increase in net operating working capital of $6,000. The computer would increase the firm's before-tax revenues by $30,000 per year but would also increase operating costs by $19,000 per year. The computer is expected to be used for 3 years and then be sold for $25,000. The firm's marginal tax rate is 40 percent, and the project's cost of capital is 14 percent.What is the net cash flow at t = 0? Cash outflow should be in negative number, e.g., -33,000, and do not include the $ sign.arrow_forwardAfter spending $9,600 on client-development, you have just been offered a big production contract by a new client. The contract will add $196,000 to your revenues for each of the next five years and it will cost you $96,000 per year to make the additional product. You will have to use some existing equipment and buy new equipment as well. The existing equipment is fully depreciated, but could be sold for $45,000 now. If you use it in the project, it will be worthless at the end of the project. You will buy new equipment valued at $29,000 and use the 5-year MACRS schedule to depreciate it. It will be worthless at the end of the project. Your current production manager earns $79,000 per year. Since she is busy with ongoing projects, you are planning to hire an assistant at$38,000 per year to help with the expansion. You will have to immediately increase your inventory from $20,000 to $30,000. It will return to $20,000 at the end of the project is 21% and your discount rate is 14.7%. What…arrow_forwardPrimus Corp. management is planning to convert an existing warehouse into a new plant that will increase its production capacity by 45%. The cost of this project will be $7,125,000. It will result in additional cash flows of $1,875,000 for the next 8 years. The dicount rate is 12 % What is the payback period?arrow_forward

- Cullumber Lumber, Inc; is considering purchasing a new wood saw that costs $65000. The saw will generate revenues of $100,000 per year for five years. The cost of materials and labor needed to generate these revenues will total $60,000 per year, and other cash expenses will be $10,000 per year. The machine is expected to sell for $4500 at the end of its five-year life and will be depreciated on a straight-line basis over five years to zero. Cullumber’s tax rate is 26 percent, and it’s opportunity cost of capital is 13.10 percent. What is the project’s NPV?arrow_forwardYour firm is contemplating the purchase of a new $595,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $63,000 at the end of that time. You will save $225,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $78,000 (this is a one-time reduction). If the tax rate is 23 percent, what is the IRR for this project? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. IRR Answer is complete but not entirely correct. 8.96arrow_forwardMarket Top Investors, Inc., is considering the purchase of a $350,000 computer with an economic life of five years. The computer will be fully depreciated over five years using the straight-line method, at which time it will be worth $66,000. The computer will replace two office employees whose combined annual salaries are $87,000. The machine will also immediately lower the firm’s required net working capital by $76,000. This amount of net working capital will need to be replaced once the machine is sold. The corporate tax rate is 21 percent. The appropriate discount rate is 9 percent. Calculate the NPV of this projectarrow_forward

- The president of Real Time Inc. has asked you to evaluate the proposed acquisition of a new computer. The computer's price is $40,000, and it falls into the MACRS 3-year class. Purchase of the computer would require an increase in net operating working capital of $2,000. The computer would increase the firm's before-tax revenues by $26,000 per year but would also increase operating costs by $18,000 per year. The computer is expected to be used for 3 years and then be sold for $25,000. The firm's marginal tax rate is 40 percent, and the project's cost of capital is 14 percent.What is the operating cash flow in Year 2? Round it to a whole dollar, and do not include the $ sign. Year MACRS Percent 1 0.33 2 0.45 3 0.15 4 0.07arrow_forwardYour firm is contemplating the purchase of a new $535,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $ 30,000 at the end of that time. You will save $165,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $60,000 (this is a one-time reduction). If the tax rate is 24 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardThe Elite Car Rental Corporation is contemplating expanding its short-term rental fleet by 30 automobiles at a cost of $900,000. It expects to keep the autos for only two years and to sell them at the end of that period for 60 percent, on average, of what they cost. The plan is to generate $21,000 of incremental revenue per additional auto in each year of operation. The controller estimates that other costs will amount to 20 cents per kilometre on an average of 40,000 kilometres per car per year. She also estimates that the new business will require an investment of $10,000 in additional working capital. The firm is in a 30 percent tax bracket and uses 12 percent as a cost of capital a. Calculate the NPV (Do not round the intermediate calculations. Round the final answer to the nearest whole dollar. Negative answer should be indicated by a minus sign. Omit $ sign in your response.) b. Should Elite purchase the automobiles? O a. a)NPV = $82,286 ± 0.1% and b)NO O b. a)NPV = -$72,386 ±…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education