FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

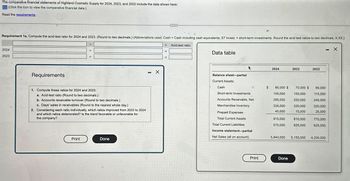

Transcribed Image Text:The comparative financial statements of Highland Cosmetic Supply for 2024, 2023, and 2022 include the data shown here:

(Click the icon to view the comparative financial data.)

Read the requirements.

Requirement 1a. Compute the acid-test ratio for 2024 and 2023. (Round to two decimals.) (Abbreviations used: Cash Cash including cash equivalents; ST invest. = short-term investments. Round the acid test ratios to two decimals, X.XX.)

Acid-test ratio

2024

2023

Requirements

+

1. Compute these ratios for 2024 and 2023:

a. Acid-test ratio (Round to two decimals.)

b. Accounts receivable turnover (Round to two decimals.)

c. Days' sales in receivables (Round to the nearest whole day.)

2. Considering each ratio individually, which ratios improved from 2023 to 2024

and which ratios deteriorated? Is the trend favorable or unfavorable for

the company?

Print

Done

- X

=

...

=

Data table

Balance sheet-partial

Current Assets:

Cash

Short-term Investments

Accounts Receivable, Net

Merchandise Inventory

Prepaid Expenses.

Total Current Assets

Total Current Liabilities

Income statement-partial

Net Sales (all on account)

Print

$

2024

85,000 $

155,000

295,000

335,000

45,000

915,000

570,000

5,840,000

Done

2023

70,000 $

155,000

250,000

320,000

15,000

810,000

625,000

5,150,000

2022

=

65,000

115,000

245,000

320,000

25,000

770,000

625,000

4,200,000

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 13 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Indicate the effect of the transactions listed in the following table on total current assets, current ration, and net income. Use (+) to indicate an increase, (-) to indicate a decrease, and (0) to indicate either no effect or an indeterminate effect. Be prepared to state any necessary assumptions and assume an initial current ratio of more than 1.0. Federal income tax due for the previous year is paid.arrow_forwardBalance Sheet Prepare a vertical analysis of the balance sheets for Year 4 and Year 3. Note: Percentages may not add exactly due to rounding. Round your answers to 2 decimal places. (L.e., .2345 should be entered as 23.45). Assats Current assets Cash Income Statement Marketable securities Accounts receivable (net) Inventories Prepaid Items Total current assets Investments Plant (net) Land Total long-term assets Total assets Liabilities and stockholders' equity Liabilities Current liabilities Notes payable Accounts payable Salaries payable Total current liabilities Noncurrent liabilities Bonds payable Other FANNING COMPANY Vertical Analysis of Balance Sheeta Year 4 Total noncurrent liabilales Total abilities Stockholders' equity Preferred stock (par value $10, 4% cumulative, nonparticipating: 6,600 shares authorized and issued) Common stock (no par; 50,000 shares authorized; 10,000 shares issued) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity…arrow_forwardThe following selected information (in thousands) is available for Steering Limited: Total assets Total liabilities Interest expense Income tax expense Net income Cash provided by operating activities Net capital expenditures Dividends paid on common shares 2021 $3,923 2,177 15 173 409 855 399 110 2020 $3,701 1,962 26 151 378 579 297 90arrow_forward

- Required information [The following information applies to the questions displayed below.] The balance sheets for Sports Unlimited for 2024 and 2023 are provided below. 2. Prepare a horizontal analysis of Sports Unlimited's 2024 balance sheet using 2023 as the base year. (Values to be deducted and decreases should be indicated by a minus sign. Round your percentage answers to 1 decimal place.) Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity SPORTS UNLIMITED Balance Sheets For the Years Ended December 31 Year $ $ $ $ 2024 211,500 $ 140,800 99,900 50,400 82,800 154,400 28,800 14,400 108,900 238,500 206,100 (76,500) 900,000 $…arrow_forwardJason Hilton, M.D., reported the following unadjusted trial balance as of September 30, 2025: View the trial balance. Calculate the debt ratio for Jason Hilton, M.D. Select the debt ratio formula on the first line and then calculate the ratio. (Round the percentage to the nearest whole percent.) Average total assets Average total equity Average total liabilities Net income Total assets + Total equity Total liabilities = Debt ratio % Trial Balance Account Title Cash Jason Hilton, M.D. Unadjusted Trial Balance September 30, 2025 Accounts Receivable Supplies Land Building Office Equipment Accounts Payable Utilities Payable Unearned Revenue Notes Payable Common Stock Dividends Service Revenue Salaries Expense Utilities Expense Advertising Expense Total $ Debit Balance 39,000 7,300 2,900 28,000 100,000 25,000 56,000 23,400 800 300 282,700 $ Credit 2,400 1,100 8,666 95,000 130,000 45,534 282,700 I Xarrow_forwardPrepare a vertical analysis of the balance sheets for Year 4 and Year 3. (Percentages may not add exactly due to rounding. Round your percentage answers to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).) Assets Current assets Cash Marketable securities Accounts receivable (net) Inventories Prepaid items Total current assets Investments Plant (net) Land Total long-term assets Total assets Liabilities and stockholders' equity Lishilitinn WALTON COMPANY Vertical Analysis of Balance Sheets Year 4 $ Amount 17,800 21,300 55,100 136,900 25,700 256,800 27,600 270,600 30,300 328,500 585,300 Percentage of Total % $ $ Amount Year 3 13,700 6,800 47,500 144,700 10,500 223,200 21,100 256,000 24,900 302,000 525,200 Percentage of Total %arrow_forward

- Given the data in the following table, the current ratio in 2023 was… % (table is attached) 1) 2.89 2 ) 2.61 3) 1.97 4) 2.08 52.14arrow_forwardRequired information [The following information applies to the questions displayed below.] The balance sheets for Sports Unlimited for 2024 and 2023 are provided below. Required: 1. Prepare a vertical analysis of Sports Unlimited's 2024 and 2023 balance sheets. Express each amount as a percentage of total assets for that year. (Amounts to be deducted should be indicated by a minus sign. Round your percentage answers to 1 decimal place.) Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investment in bonds Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity SPORTS UNLIMITED Balance Sheets For the Years Ended December 31 2024 $ $ $ $ Amount 211,500 99,900 82,800 28,800 108,900 238,500 206,100 (76,500)…arrow_forwardCarter Paint Company has plants in four provinces. Sales last year were $100 million, and the balance sheet at year-end is similar in percent of sales to that of previous years (and this will continue in the future). All assets and current liabilities will vary directly with sales. Assume the firm is already using capital assets at full capacity. Cash Accounts receivable. Inventory Current assets Capital assets Assets Total assets $9 15 10 34 34 $68 Balance Sheet (in $ millions) Liabilities and Shareholders' Equity Accounts payable Accrued vages Accrued taxes Current liabilities. Long-term debt Common stock Retained earnings Total liabilities and shareholders' equity $9 8 7 24 10 15 19 $68 The firm has an aftertax profit margin of 8 percent and a dividend payout ratio of 40 percent. a. If sales grow by 20 percent next year, determine how many dollars of new funds are needed to finance the expansion. (Do not round intermediate calculations. Enter the answer in millions. Round the final…arrow_forward

- Perform a horizontal analysis for the balance sheet entry "Cash" given below. That is, find the amount of increase or decrease (in $) and the associated percent (rounded to the nearest tenth).arrow_forwardRequired Prepare a vertical analysis of both the balance sheets and income statements for Year 4 and Year 3. Complete this question by entering your answers in the tabs below. Analysis Bal Sheet Analysis Inc Stmt Prepare a vertical analysis of an income statements for Year 4 and Year 3. (Percentages may not add exactly due to rounding. Round your answers to 2 decimal places. (i.e., .2345 should be entered as 23.45).) ALLENDALE COMPANY Vertical Analysis of Income Statements Year 4 Year 3 Amount % Total Amount % Total Revenues Sales (net) $ 230,000 100.00 % $ 210,000 100.00 % Other revenues 8,000 5,000 Total revenues 238,000 215,000 Expenses Cost of goods sold 120,000 103,000 Selling, general, and administrative expense 55,000 50,000 Interest expense 8,000 7,200 Income tax expense 23,000 22,000 Total expenses 206,000 182,200 Net income $ 32,000 % $ 32,800 %arrow_forwardCompute the following for Stanley Limited. Round your answers to two decimal places. All answers MUST be expressed in the unit as specified in the question, if any. Show your workings. (a) Gross Profit Rate (in %) (b) Current Ratio (c) Quick Ratio B Stanley Limited Statement of Financial Position 31 December 2021 ($ in million) Stanley Limited Income Statement For the year ended 31 December 2021 ($ in million) Question B5 (continued) (d) Accounts Receivable Turnover Rate (e) Return on Equity (%) (f) Debt Ratio (in %) (g) Price-Earnings Ratioarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education