FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

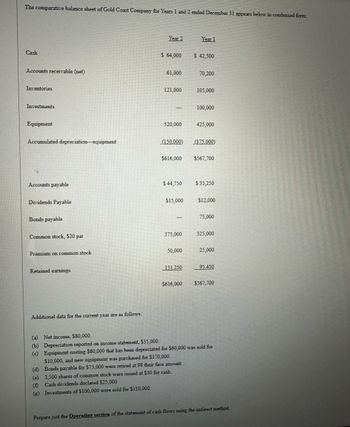

Transcribed Image Text:The comparative balance sheet of Gold Coast Company for Years 1 and 2 ended December 31 appears below in condensed form:

Year 2

Year 1

Cash

$ 64,000

$ 42,500

Accounts receivable (net)

61,000

70,200

Inventories

121,000

105,000

Investments

100,000

Equipment

520,000

425,000

Accumulated depreciation-equipment

(150,000)

(175,000)

$616,000

$567,700

Accounts payable

$44,750

$35,250

Dividends Payable

$15,000

$12,000

Bonds payable

75,000

Common stock, $20 par

375,000

325,000

Premium on common stock

50,000

25,000

131.250

95.450

Retained earnings

$616,000

$567,700

Additional data for the current year are as follows:

(a) Net income, $80,000.

(b) Depreciation reported on income statement, $35,000.

(c) Equipment costing $80,000 that has been depreciated for $60,000 was sold for

$10,000, and new equipment was purchased for $170,000.

(d) Bonds payable for $75,000 were retired at 98 their face amount.

(e) 2,500 shares of common stock were issued at $30 for cash.

(f) Cash dividends declared $25,000

(g) Investments of $100,000 were sold for $110,000.

Prepare just the Operating section of the statement of cash flows using the indirect method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Cash Flows from (Used for) Operating Activities The net income reported on the income statement for the current year was $137,500. Depreciation recorded on store equipment for the year amounted to $22,700. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: Endof Year Beginningof Year Cash $53,350 $48,550 Accounts receivable (net) 38,250 35,880 Merchandise inventory 52,230 54,620 Prepaid expenses 5,870 4,610 Accounts payable (merchandise creditors) 49,990 45,930 Wages payable 27,320 30,000 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.arrow_forwardMONTGOMERY INC.Comparative Balance SheetsDecember 31 Current Year Prior Year Assets Cash $ 30,800 $ 31,000 Accounts receivable, net 8,900 10,900 Inventory 79,800 63,000 Total current assets 119,500 104,900 Equipment 44,200 37,300 Accum. depreciation—Equipment (19,900 ) (13,800 ) Total assets $ 143,800 $ 128,400 Liabilities and Equity Accounts payable $ 21,200 $ 22,900 Salaries payable 400 500 Total current liabilities 21,600 23,400 Equity Common stock, no par value 102,400 94,100 Retained earnings 19,800 10,900 Total liabilities and equity $ 143,800 $ 128,400 MONTGOMERY INC.Income StatementFor Current Year Ended December 31…arrow_forwardCash Flows from (Used for) Operating Activities The net income reported on the income statement for the current year was $154,700. Depreciation recorded on store equipment for the year amounted to $25,500. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: Endof Year Beginningof Year Cash $61,730 $56,790 Accounts receivable (net) 44,260 41,970 Merchandise inventory 60,430 63,890 Prepaid expenses 6,790 5,400 Accounts payable (merchandise creditors) 57,840 53,720 Wages payable 31,610 35,100 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from operating activities: - Net income $ Adjustments to reconcile net income to net cash flows from (used for) operating…arrow_forward

- Assume a company had net income of $79,000 that included a gain on the sale of equipment of $4,000. It provided the following excerpts from its balance sheet: This Year Last Year Current assets: Accounts receivable $ 40,000 $ 46,000 Inventory $ 53,000 $ 50,000 Prepaid expenses $ 13,000 $ 11,000 Current liabilities: Accounts payable $ 38,000 $ 44,000 Accrued liabilities $ 18,000 $ 15,000 Income taxes payable $ 13,000 $ 10,000 If the credits to the company’s accumulated depreciation account were $21,000, then based solely on the information provided, the company’s net cash provided by (used in) operating activities would be: Multiple Choice $63,000. $55,000. $105,000. $97,000.arrow_forwardSubject-Acountingarrow_forwardBalance Sheet December 31 Assets Cash Inventory Equipment Accounts receivable Less: Accumulated depreciation $ 21,000 520,000 142,500 $ 624,000 78,000 546,000 Total assets $ 1,229,500 Liabilities and Equity Liabilities Accounts payable Loan payable Taxes payable (due March 15) $ 355,000 11,000 88,000 454,000 Equity Common stock Retained earnings $ 474,500 301,000 775,500 Total liabilities and equity $ 1,229,500 To prepare a master budget for January, February, and March, use the following information. a. The company's single product is purchased for $30 per unit and resold for $58 per unit. The inventory level of 4,750 units on December 31 is more than management's desired level, which is 20% of the next month's budgeted sales units. Budgeted sales are January, 6,500 units; February, 9,000 units; March, 11,000 units; and April, 10,000 units. All sales are on credit. b. Cash receipts from sales are budgeted as follows: January, $233,100; February, $722,857; March, $519,245. c. Cash…arrow_forward

- Changes in Current Operating Assets and Liabilities Blue Circle Corporation's comparative balance sheet for current assets and liabilities was as follows: Dec. 31, Year 2 Dec. 31, Year 1 Accounts receivable $20,300 $25,000 Inventory 85,100 76,000 Accounts payable 18,100 22,100 Dividends payable 24,000 23,000 Adjust net income of $104,000 for changes in operating assets and liabilities to arrive at net cash flows from operating activities.arrow_forwardAssume a company had net Income of $72,000 and provided the following excerpts from its balance sheet: This Year Last Year Current assets: $40,000 $53,000 $13,000 $46,000 $50,000 $11,000 Accounts receivable Inventory Prepaid expenses Current liabilities: $38,000 $18,000 $13,000 $44,000 $15,000 $10,000 Accounts payable Accrued liabilities Income taxes payable If the company did not sell any noncurrent assets during the period and the credits to its accumulated depreciation account were $21,000, then based solely on the informatlon provlded, the company's net cash provided by (used in) operating activities would be: Multiple Cholce $94,000. $52,000. $68,000. $92,000.arrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education