FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Changes in current operating assets and liabilities:

Increase in accounts receivable

2,000 X

Decrease in merchandise inventory

Increase in prepaid expenses

Increase in accounts payable

Decrease in wages payable

2,270 x

Net cash flow from operating activities

135,900 x

Feedback

V Check My Work

a. Calculate the increases and decreases in the current asset/liability accounts over the period. Determine what affect these changes

would have on cash.

b. Cash flows from operating activities differ from net income because it does not use the

of accounting. For example

revenues are recorded on the income statement when

Feedback

V Check My Work

b. Review the definition of accrual accounting. How does this differ with the concept of cash flow payments and receipts?

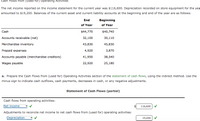

Transcribed Image Text:Cash Flows from (Used for) Operating Activities

The net income reported on the income statement for the current year was $116,600. Depreciation recorded on store equipment for the yea

amounted to $19,200. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows:

End

Beginning

of Year

of Year

Cash

$44,770

$40,740

Accounts receivable (net)

32,100

30,110

Merchandise inventory

43,830

45,830

Prepaid expenses

4,920

3,870

Accounts payable (merchandise creditors)

41,950

38,540

Wages payable

22,920

25,180

a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the

minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.

Statement of Cash Flows (partial)

Cash flows from operating activities:

Net income

116,600

Adjustments to reconcile net income to net cash flows from (used for) operating activities:

Depreciation

19,200 v

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following is the trial balance relates to the business of Sam a sole trader as at31 December 2021: Sam Trial Balance as at 31 December 2021 Land and Buildings Motor Vehicles Depreciation of motor vehicles Sales Sales return Capital Machinery Carriage inwards Depreciation of Machinery Purchases Purchases Returns Inventory 1 January 2021 Selling Expenses Wages and salaries Miscellaneous expenses Loan from NCB Receivables and Payables Bank Account Rent Received DR Drawings $ Administration expenses 150,000 700,000 400,000 15,000 750,000 6,000 950,000 165,000 260,000 78,000 56,000 246,000 120,000 370,000 4,266,000 CR $ 60,000 3,100,000 600,000 70,000 20,000 230,000 160,000 26,000 4,266,000arrow_forwardAccounts payable 919 Accounts receivable 631 Accumulated depreciation 1,813 Cash 729 Common stock 1,387 Cost of goods sold 7,578 Current portion of long-term debt 24 Depreciation expense 108 Dividends 13 Goodwill and other long-term assets 2,627 Income tax expense 24 Income taxes payable 12 Interest expense 54 Interest revenue 11 Inventories 930 Long-term liabilities 1,585 Prepaid expenses and other current assets 65 Property and equipment 2,389 Retained earnings 825 Sales 9,710 Selling, general, and administrative expenses 2,276 Unearned revenue 990 Wages payable 148 Prepare two closing journal entriesarrow_forwardThe following balance sheet information was provided by Western Company: Assets Cash Accounts receivable Inventory Multiple Choice O 110.6 days Assuming Year 2 net credit sales totaled $132,000, what was the company's average days to collect receivables? Note: Use 365 days in a year. Do not round your intermediate calculations. 52.5 days 55.3 days Year 2 58.1 days $3,200 $21,000 $36,000 Year 1 $2,700 $19,000 $42,000arrow_forward

- On November 1, 2025, Marin Inc. had the following account balances. The company uses the perpetual inventory method. Cash Accounts Receivable Supplies Equipment 22 25 27 28 29 29 10 29 11 12 During November, the following summary transactions were completed. 15 Debit 19 $27,000 20 6,720 2,580 75,000 $111,300 Accumulated Depreciation-Equipment Accounts Payable Unearned Service Revenue Salaries and Wages Payable Common Stock Nov. 8 Paid $10,650 for salaries due employees, of which $5,550 is for November and $5,100 is for October. Received $5,700 cash from customers in payment of account. Purchased merchandise on account from Dimas Discount Supply for $24,000, terms 2/10, n/30. Sold merchandise on account for $16,500, terms 2/10, n/30. The cost of the merchandise sold was $12,000. Received credit from Dimas Discount Supply for merchandise returned $900. Received collections in full, less discounts, from customers billed on sales of $16,500 on November 12. Paid Dimas Discount Supply in…arrow_forwardThe net income reported on the income statement for the current year was $282,126. Depreciation recorded on fixed assets and amortization of patents for the year were $33,351, and $9,402, respectively. Balances of current asset and current liability accounts at the end and at the beginning of the year are as follows: End Beginning Cash $37,370 $64,930 Accounts receivable 106,715 123,079 Inventories 80,207 102,432 Prepaid expenses 8,982 4,271 Accounts payable (merchandise creditors) 77,139 54,111 What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method? Select the correct answer. $303,001 $363,468 $381,785 $306,304arrow_forwardThe following figures appear on LaGrange’s financial statements for the most recent fiscalyear: Cost of Goods Sold $1,960,000 Beginning Inventory 238,000 Ending Inventory 278,000 Accounts Payable 182,000 What is the age of this company’s accounts payable? Responses 33.2 days 35.3 days 34.7 days 33.9 daysarrow_forward

- [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Current Year 1 Year Ago 2 Years Ago Assets $ 33,783 $ 39,888 71,898 89,474 10,785 286,555 $ 39,900 56,491 58,411 4,616 256,082 Cash Accounts receivable, net Merchandise inventory 97,913 125,594 10,989 310,097 Prepaid expenses Plant assets, net Total assets $ 578,376 $ 498,600 $ 415,500 Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings $ 144,016 $ 54,298 $81,735 113,531 163,500 139,834 109,822 163,500 91,826 163,500 105,876 161,038 Total liabilities and equity $ 578,376 $ 498,600 $ 415,500 For both the current year and one year ago, compute the following ratios: Exercise 17-11 (Algo) Analyzing profitability LO P3 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Current Year 1 Year Ago Sales $ 751,889 $ 593,334 $ 458,652 Cost of goods sold…arrow_forwardPreparation of Operating Activities Section—Indirect Method, Periodic Inventory) The income statement of Dunne Company is shown below.Dunne Company Income Statement For the Year Ended December 31, 2020Sales revenue $ 8,900,000 Cost of goods sold 5,700,000 Gross profit 3,200,000 Operating expenses Selling expenses 550,000 Administrative expenses 725,000 1,275,000 Net income 1,925,000 1. Accounts receivable increased 340,000 during the year2. Inventory decreased $200,000 during the year3. Prepaid expenses increased $150,000 during the year4. Accounts payable to suppliers decreased $310,000 during the year5. Accrued expenses payable increased $70,000 during the year6. Administrative expenses include depreciation expense of $60,000 Prepare the operating activities section of the statement of cash flows for the year ended Dec 31, 2020 for Dunne company, using the indirect methodarrow_forwardGive me answer this questionarrow_forward

- Accounts payable 919 Accounts receivable 631 Accumulated depreciation 1,813 Cash 729 Common stock 1,387 Cost of goods sold 7,578 Current portion of long-term debt 24 Depreciation expense 108 Dividends 13 Goodwill and other long-term assets 2,627 Income tax expense 24 Income taxes payable 12 Interest expense 54 Interest revenue 11 Inventories 930 Long-term liabilities 1,585 Prepaid expenses and other current assets 65 Property and equipment 2,389 Retained earnings 825 Sales 9,710 Selling, general, and administrative expenses 2,276 Unearned revenue 990 Wages payable 148 Prepare the balance sheet.arrow_forwardBlythe Industries reports the following account balances: inventory of $417,600, equipment of $2,028,300, accounts payable of $224,700, cash of $51,900, and accounts receivable of $313,900. What is the amount of the current assets? a. $46,700 b. $783,400 c. $56,000 d. $975,000 e. $699,700arrow_forwardPrepare a multiple-step income statement for November.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education