FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:### Bank Reconciliation Journal Entry

**Scenario:**

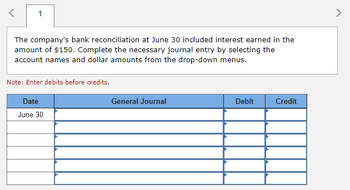

The company's bank reconciliation at June 30 included interest earned in the amount of $150. The task is to complete the necessary journal entry by selecting the account names and dollar amounts from the drop-down menus.

**Instructions:**

- Enter debits before credits.

**Table Layout:**

| Date | General Journal | Debit | Credit |

|---------|-----------------|-------|--------|

| June 30 | | | |

| | | | |

| | | | |

| | | | |

| | | | |

This table is used to record the journal entry for the interest earned, ensuring that the correct accounts and amounts are chosen to reflect the transaction accurately. Debits and credits should balance, reflecting the increase in cash flow due to the interest earned.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The bank statement for Jeffrey Co. indicates a balance of $8,785 on October 31. After the journals for October had been posted, the cash account had a balance of $8,998. a. Cash sales of $945 had been erroneously recorded in the cash receipts journal as $495. b. Deposits in transit not recorded by bank, $778. c. Bank debit memo for service charges, $40. d. Bank credit memo for note collected by bank, $23,985 plus $885 interest. e. Bank debit memo for $756 NSF (not sufficient funds) check from Calin Sams, a customer. f. Checks outstanding, $1,860. Record the appropriate journal entries that would be necessary for Jeffrey Co. Record the entry that increases cash first. If an amount box does not require an entry, leave it blank.arrow_forwardvable Prepare Jun's journal entry assuming the note is honored by the customer on October 31 of that same year. (Do not round intermediate calculations. Round your answers to nearest whole dollar value. Use 360 days a year.) View transaction list Journal entry worksheet 1 Record cash received on note plus interest.arrow_forwardAs of June 30, Year 1, the bank statement showed an ending balance of $18,181. The unadjusted Cash account balance was $17,028. The following information is available: 1. Deposit in transit, $2,795. 2. Credit memo in bank statement for interest earned in June: $14. 3. Outstanding check: $3,946. 4. Debit memo for service charge: $12. Required: Determine the true cash balance by preparing a bank reconciliation as of June 30, Year 1, using the preceding information. Note: Negative amounts should be indicated with minus sign. Bank Reconciliation Unadjusted bank balance 6/30/Year 1 True cash balance 6/30/Year 1 Unadjusted book balance 6/30/Year 1 True cash balance 6/30/Year 1 $ $ $ 18,181 18,181 4 0arrow_forward

- A company's Cash account shows a balance of $3,460 at the end of the month. Comparing the company's Cash account with the monthly bank statement reveals several additional cash transactions such as bank service fees ($50), an NSF check from a customer ($370), a customer's note receivable collected by the bank ($1,600), and interest earned ($130). Required: Record the necessary entry(ies) to adjust the company's balance for cash. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the items that increase cash. 2 Note: Enter debits before credits. Transaction Record entry General Journal Clear entry Debit Credit View general Journalarrow_forwardThe accompanying table, Data table Date Deposit (Withdrawal) Date Deposit (Withdrawal) 1/1/20 $8,000 1/1/22 $3,272 1/1/21 $(6,540) 1/1/23 $5,255 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) , shows a series of transactions in a savings account. The account pays 5% simple interest, and the account owner withdraws interest as soon as it is paid. Calculate the following: a. The account balance at the end of each year. (Assume that the account balance at December 31, 2019, is zero.) b. The interest earned each year. c. The true rate of interest that the investor earns in this account. Question content area bottom Part 1 a. The account balance at the end of 2020 is $8,0008,000. (Round to the nearest dollar.) Part 2 The account balance at the end of 2021 is $1,9531,953. (Round to the nearest dollar.)arrow_forwardBefore reconciling its bank statement, Rollin Corporation's general ledger had a month-end balance in the cash account of $5.750. The bank reconciliation for the month contained the following items: Deposits in transit Outstanding checks Interest earned NSF check returned to bank Bank service charge Given the above information, what is the up-to-date ending cash balance Rollin should report at month-end? Multiple Choice $4,980. O $5,300. $ 770 495 20 120 20 $5,630.arrow_forward

- Please help mearrow_forward1arrow_forwardAccompanying a bank statement for Santee Company is a credit memo for $24,516 representing the principal ($22,700) and interest ($1,816) on a note that had been collected by the bank. The company had been notified by the bank at the time of the collection but had made no entries. Required: On March 1, journalize the entry that should be made by the company to bring the accounting records up to date. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education