FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

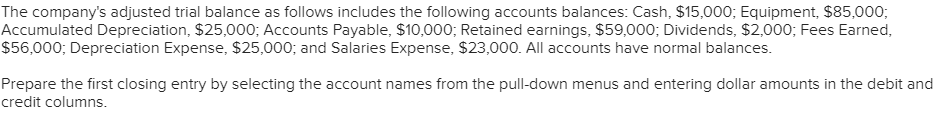

Transcribed Image Text:The company's adjusted trial balance as follows includes the following accounts balances: Cash, $15,000; Equipment, $85,000;

Accumulated Depreciation, $25,000; Accounts Payable, $10,000; Retained earnings, $59,000; Dividends, $2,000; Fees Earned,

$56,000; Depreciation Expense, $25,000; and Salaries Expense, $23,000. All accounts have normal balances.

Prepare the first closing entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and

credit columns.

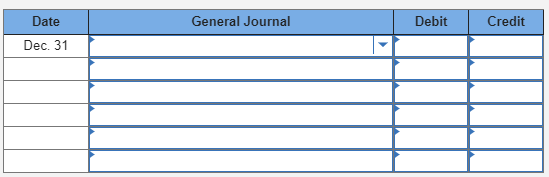

Transcribed Image Text:Date

General Journal

Debit

Credit

Dec. 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- The Allowance for Bad Debts account had a balance of $6,700 at the beginning of the year and $8,900 at the end of the year. During the year (including the year-end adjustment), bad debts expense of $12,200 was recognized. Required: Calculate the total amount of past-due accounts receivable that were written off as uncollectible during the year. (Hint: Make a T-account for the Allowance for Bad Debts account, plug in the amounts that you know, and solve for the missing amount.)arrow_forwardThe net income reported on the income statement for the current year was $262,100. Depreciation recorded on equipment and a building amounted to $78,400 for the year. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: End of Year Beginning of Year Cash $71,030 $75,290 Accounts receivable (net) 90,070 92,910 Inventories 177,580 160,070 Prepaid expenses 9,870 10,620 Accounts payable (merchandise creditors) 79,340 84,020 Salaries payable 11,440 10,470 a. Prepare the "Cash Flows from Operating Activities" section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.arrow_forwardWeatarrow_forward

- Wolfpack Corp. has determined it should record depreciation expense of $40,000 for the year ending 12/31/X7. Required: In the general journal below, complete the year-end entry to record depreciation. Debit Credit Dec 31 ? 40,000 ? 40,000arrow_forwardMaxwell Inc., analyzed its accounts receivable balances at December 31, and arrived at the aged balances listed below, along with the percentage that is estimated to be uncollectible: % Considered Age Group Balance Uncollectible 0-30 days past due $300,000 1% 31-60 days past due 54,000 3% 61-120 days past due 60,000 6% 121-180 days past due 21,000 10% Over 180 days past due 6,000 20% $441,000 The company handles credit losses using the allowance method. The credit balance of the Allowance for Doubtful Accounts is $2,520 on December 31, before any adjustments. a. Determine the amount of the adjustment for estimated credit losses on December 31. b. Determine the financial statement effect of a write off of Porter Company's account on the following May 12, in the amount of $1,440. Use negative signs with answers, when appropriate. If a transaction increases and decreases the same Balance Sheet category, enter the increase amount in the first row and the decrease amount directly below (in…arrow_forwardAt the end of the prior year, Durney's Outdoor Outfitters reported the following information. Accounts Receivable, December 31, prior year Accounts Receivable (Gross) (A) $ 48,283 Allowance for Doubtful Accounts (XA) 8,474 Accounts Receivable (Net) (A) $ 39,809 During the current year, sales on account were $306,673, collections on account were $290,750, write-offs of bad debts were $7,059, and the bad debt expense adjustment was $4,775. Required: 1-a. Complete the Accounts Receivable and Allowance for Doubtful Accounts T-accounts to determine the balance sheet values. 1-b. Complete the amounts related to Accounts Receivable and Bad Debt Expense that would be reported on the income statement for the current year. 1-c. Complete the amounts related to Accounts Receivable and Bad Debt Expense that would be reported on the balance sheet for the current year.arrow_forward

- At December 31 of the current year, a company reported the following: Total sales for the current year: $960,000 includes $610,000 in cash sales Accounts receivable balance at Dec. 31, end of current year: $64,000 Allowance for Doubtful Accounts balance at January 1, beginning of current year: $4,100 credit Bad debts written off during the current year: $6,200. Prepare the necessary adjusting journal entry to record bad debts expense assuming this company's bad debts are estimated to equal 8% of credit sales:arrow_forwardThe company estimates future uncollectible accounts. The company determines $16,000 of accounts receivable on January 31 are past due, and 30% of these accounts are estimated to be uncollectible. The remaining accounts receivable on January 31 are not past due, and 4% of these accounts are estimated to be uncollectible. (Hint: Use the January 31 accounts receivable balance calculated in the general ledger.)arrow_forwardThe net income reported on the income statement for the current year was $282,126. Depreciation recorded on fixed assets and amortization of patents for the year were $33,351, and $9,402, respectively. Balances of current asset and current liability accounts at the end and at the beginning of the year are as follows: End Beginning Cash $37,370 $64,930 Accounts receivable 106,715 123,079 Inventories 80,207 102,432 Prepaid expenses 8,982 4,271 Accounts payable (merchandise creditors) 77,139 54,111 What is the amount of cash flows from operating activities reported on the statement of cash flows prepared by the indirect method? Select the correct answer. $303,001 $363,468 $381,785 $306,304arrow_forward

- At the beginning of the year, the balance in the Allowance for Doubtful Accounts is a credit of $774. During the year, $346 of previously written off accounts were reinstated and accounts totaling $845 are written off as uncollectible. The end of the year balance in the Allowance for Doubtful Accounts should be the one listed below. Select the correct answer. $275 $346 $774 $845arrow_forwardAt the end of the current year, using the aging of receivable method, management estimated that $24,750 of the accounts receivable balance would be uncollectible. Prior to any year-end adjustments, the Allowance for Doubtful Accounts had a credit balance of $465. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?arrow_forwardprepare these entries for Sarah's plant services. prepare general journal entries for the needed balance dy adjustments for the year ending 30/6/21: A stocktake of the inventory on hand was completed on 30/6/21. The value of the stocktake was $17,000. The inventory asset account as at 30/6/21 before adjustments was $18,000 The allowance for Doubtful debts should be 5% of the balance of Accounts Receivable. The accounts receivable balance at 30/6/21 is $76,120 and the balance of the Allowance for Doubtful Debts was $3,450arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education