Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What is the capital gain rate if the company maintain a constant dividend??

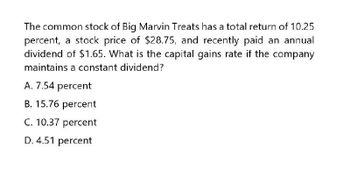

Transcribed Image Text:The common stock of Big Marvin Treats has a total return of 10.25

percent, a stock price of $28.75, and recently paid an annual

dividend of $1.65. What is the capital gains rate if the company

maintains a constant dividend?

A. 7.54 percent

B. 15.76 percent

C. 10.37 percent

D. 4.51 percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Castle Company recently reported net profits after taxes of $15.8 million. It has 2.5 million shares of common stock outstanding and pays preferred dividends of $1 million a year. The company’s stock currently trades at $60 per share. Compute the stock’s earnings per share (EPS). What is the stock’s P/E ratio? Determine what the stock’s dividend yield would be if it paid $1.75 per share to common stockholders.arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)arrow_forwardThe co. recently paid a $2.80 annual dividend (Do). This dividend increases at the rate of 3.8%/year. The stock price = $26.91 / share. What is the market rate of return? A. 13.88%B. 14.03 %C. 14.21 %D. 14.60 %arrow_forward

- Provide answer this accounting questionarrow_forwardA company is expected to pay a dividend of $6.73 in the following period. If the expected growth rate of this dividend is 4.00% and the expected rate of return or discount rate for this stock is 11.00%, the current share price in dollars is closest to: O A. $99.99 O B. $61.18 O C. $96.14arrow_forwardCredenza Industries is expected to pay a dividend of $1.50 at the end of the coming year. It is expected to sell for $61 at the end of the year. If its equity cost of capital is 9%, what is the expected capital gain from the sale of this stock at the end of the coming year? .... O A. $57.34 O B. $5.04 OC. $55.96 O D. $3.66 ..arrow_forward

- Suppose a stock had an initial price of $47 per share, paid a dividend of $0.63 per share during the year, and had an ending share price of $38. What was the capital gains yield? O-19.15 percent -23.68 percent 20.31 percent 17.39 percent -18.53 percentarrow_forwardW Kiefer Service Co. common stock sells for $23.97 per share and has a market rate of return of 7.32 percent. The company just paid an annual dividend of $.84 per share. What is the dividend growth rate? O 4.37 percent O 5.08 percent O 4.21 percent O 3.69 percent O 3.63 percentarrow_forwardThe Co. pays an annual dividend that is expected to increase by 4.1%/year. The stock’s return = 12.6% and sells for $24.9/share. Calculate the next dividend (D1) A. $2.03B. $2.12C. $3.17D. $2.20arrow_forward

- A stock is bought for $21.00 and sold for $26.00 one year later, immediately after it has paid a dividend of $1.50. What is the capital gain rate for thistransaction? A. 4.76% B. 19.05% C. 11.91% D. 23.81%arrow_forwardAssuming the following: 1. 4mm outstanding shares 2. $40mm of pre-tax Net Income 3. $9mm of Depreciation 4. PE multiple of 16x 5. $1.75 quarterly dividend which is expected to grow by 4.23% 6. Book value of $115mm 7. Current share price of $125 8. Tax rate of 25% 9. EBITDA Multiple of 7x. What is the market value of equity? A form of the correct answer would be $53mm.arrow_forward1. If the dividends to be paid in one year from now on a common stock issue are $3.8 per share expected growth rate in dividends is 4.03%, what is the cost of common stock? If the answer is 10.52%, enter 10.52arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning