Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

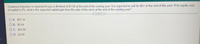

Transcribed Image Text:Credenza Industries is expected to pay a dividend of $1.50 at the end of the coming year. It is expected to sell for $61 at the end of the year. If its equity cost

of capital is 9%, what is the expected capital gain from the sale of this stock at the end of the coming year?

....

O A. $57.34

O B. $5.04

OC. $55.96

O D. $3.66

..

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose Kennedy Corp. just paid a dividend (Do) of $1.42 per share. This dividend is expected to grow at a rate of 15% per year for the next four years and then at 6% per year thereafter. What is the expected dividend per share six years from now (D)? (A) $1.44 B) $1.73 C) $2.09 D) $2.33 (E) $2.79arrow_forwardBC Corporation has a weighted average cost of capital of 16%. What is its value if it will provide earnings to investors of P100,000 for the first year, P200,000 for the second year and P250,000 for every year onwards. a. P1,396,031.51 b. P1,225,861.02 c. P1,797,339.48 d. P1,617,271.54 e. None among the other choicesarrow_forwardi need the answer quicklyarrow_forward

- Von Bora Corporation (VBC) is expected to pay a $3.50 dividend at the end of this year. If you expect VBC's dividend to grow by 6% per year forever and VBC's equity cost of capital is 13%, then the value of a share of VBS stock is closest to OA. $18.42 B. $50.00 C. $30.00 OD. $20.00arrow_forwardA company is expected to pay out 40% of its expected earnings per share of €0.5 next year as dividends. The earnings are expected to grow 2% per year in perpetuity and the cost of equity is 7%. Supposing that the company is a stable growth dividend paying, calculate the expected PE ratio. P/E=Payout ratio*(1+g)/(r-g) A. 4 B. 8 C. 10 D. 20 E. 25arrow_forwardJumbuck Exploration has a current stock price of $2.55 and is expected to sell for $2.68 in one year's time, immediately after it pays a dividend of $0.31. Which of the following is closest to Jumbuck Exploration's equity cost of capital? OA. 10.36% OB. 21.58% OC. 8.63% OD. 17.26%arrow_forward

- IBM expects to pay a dividend of $4 next year and expects these dividends to grow at 7% a year. The price of IBM is $90 per share. What is IBM's cost of equity capital? A. 9.65% B. 10.23% C. 12.36% D. 11.44% E. 10.89%arrow_forwardMatilda Industries pays a dividend of $2.50 per share and is expected to pay this amount indefinitely. If Matilda's equity cost of capital is 12%, which of the following would be expected to be closest to Matilda's stock price? A. $12.50 B. $16.66 C. $20.83 D. $26.04arrow_forwardVaccine Development Corp (VDC) has a current stock price of $15.35 and is expected to trade for $16.50 in 1 year. Of VDC's equity cost of capital is 13%, what is its expected dividend in 1 yeararrow_forward

- Gillette Corporation will pay an annual dividend of $ 0.63 one year from now. Analysts expect this dividend to grow at 1 1.1 % per year thereafter until the 6th year. Thereafter, growth will level off at 1.6 % per year. According to the dividend- discount model, what is the value of a Gillette share if the firm's equity cost of capital is 8.4 %? Question content area bottom Part 1 The value of a Gillette share is $ enter your response here. (Round to the nearest cent.)arrow_forwardTopstone Industries just paid an annual dividend of $2.00 per share this year. This dividend, along with the firm's earnings, is expected to grow at a rate of 5% per annum forever. If the current market price for a share of Topstone is $38.61, what is the implied cost of equity? O A. O B. 10.44% O D. 11.22% O C. 10.71% 10.18% OE. 5.36% 7arrow_forwardRylan Industries is expected to pay a dividend of $5.70 year for the next four years. If the current price of Rylan stock is $31.33, and Rylan's equity cost of capital is 15%, what price would you expect Rylan's stock to sell for at the end of the four years? O A. $26.33 B. $73.72 OC. $21.06 OD. $47.39arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education