Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

What must total assets turnover.?

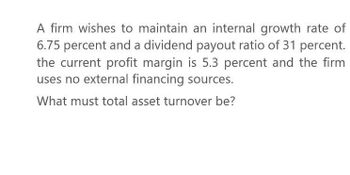

Transcribed Image Text:A firm wishes to maintain an internal growth rate of

6.75 percent and a dividend payout ratio of 31 percent.

the current profit margin is 5.3 percent and the firm

uses no external financing sources.

What must total asset turnover be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- A firm wishes to maintain an internal growth rate of 7.9 percent and a dividend payout ratio of 20 percent. The current profit margin is 6.3 percent, and the firm uses no external financing sources. What must total asset turnover be? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Total asset turnover timesarrow_forwardA firm wishes to maintain an internal growth rate of 8.25 percent and a dividend payout ratio of 37 percent. The current profit margin is 5.9 percent and the firm uses no external financing sources. What must total asset turnover be? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Total asset turnover timesarrow_forwardA firm wishes to maintain an internal growth rate of 6.4 percent and a dividend payout ratio of 25 percent. The current profit margin is 5.7 percent, and the firm uses no external financing sources. What must total asset turnover be? Internal growth rate 6.40% Payout ratio 25% Profit margin 5.70% Calculate Plowback ratio Return on assets Total asset turnoverarrow_forward

- Which of the following statements is correct? A. a. Since accounts payable and accruals must eventually be paid, as these accounts increase, AFN also increases. B. b. Suppose a firm is operating its fixed assets below 100 percent capacity but is at 100 percent with respect to current assets. If sales grow, the firm can offset the needed increase in current assets with its idle fixed assets capacity. C. c. If a firm retains all of its earnings, then it will not need any additional funds to support sales growth. D. d. Additional funds needed are typically raised from some combination of notes payable, long-term bonds, and common stock. These accounts are nonspontaneous in that they require an explicit financing decision to increase them. E. e. All of the statements above are false.arrow_forwardGet correct answer accountingarrow_forwardYou've collected the following information about Groot, Inc.: Profit margin Total asset turnover Total debt ratio Payout ratio = 4.44% = 3.50 = .25 = 29% a. What is the sustainable growth rate for the company? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the ROA? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Sustainable growth rate b. ROA % 15.54 %arrow_forward

- Which of the following is true? I. If there is no change in gross fixed assets from one year to the next, then net fixed assets would have to have decreased. II. For firms with lower P/E ratios, investors are valuing each dollar of earnings more than for firms with higher P/E ratios. III. A increase in the current ratio indicates an improvement in a firm's long-term solvency condition.arrow_forwardWhen the company is working at full capacity, the assets in the AFN equation is the total assets True False Considering each action independently and holding other things constant, which of the following actions would reduce a firm’s need for additional capital? a. An increase in the dividend payout ratio. b. A decrease in the days sales outstanding. c. An increase in expected sales growth. d. A decrease in the profit margin.arrow_forwardQ. 4 A firm wishes to maintain an internal growth rate of 6.75% and a dividend payout ratio of 31%. The current profit margin is 5.3% and the frim uses no external financing sources. What must total asset turnover be? (DO NOT round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16) Total asset turnover ? timesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT