EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Financial Accounting

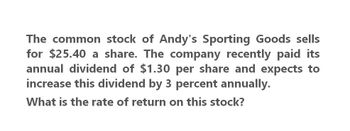

Transcribed Image Text:The common stock of Andy's Sporting Goods sells

for $25.40 a share. The company recently paid its

annual dividend of $1.30 per share and expects to

increase this dividend by 3 percent annually.

What is the rate of return on this stock?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The common stock of Bethel Baked Goods is valued at $8.76 a share. The company increases its dividend by 1.5 percent annually and expects its next dividend to be $.65 per share. What is the required rate of return on this stock?arrow_forwardThe common stock of Dayton Repair sells for $40.39 a share. The stock is expected to pay $2.01 per share next year when the annual dividend is distributed. The company increases its dividends by 2.00 percent annually. What is the market rate of return on this stock?arrow_forwardThe common stock of Dayton Repair sells for $43.19 a share. The stock is expected to pay $2.28 per share next year when the annual dividend is distributed. The firm has established a pattern of increasing its dividends by 3.25 percent annually and expects to continue doing so. What is the required rate of return on this stock? O 7.65% O 8.70% 8.53% O 7.53%arrow_forward

- Jefferson's recently paid an annual dividend of $5 per share. The dividend is expected to decrease by 2% each year. How much should you pay for this stock today if your required return is 10% (in $ dollars)? $______. give the answer with decimalsarrow_forwardRoy's Welding Supplies common stock sells for $39 a share and pays an annual dividend that increases by 4 percent annually. The market rate of return on this stock is 8.60 percent. What is the amount of the last dividend paid? show your solutionsarrow_forwardKellyAnne Public Relations is expected to pay an annual dividend of $1.27 on its common stock next year and increases its dividend by 3.4 percent annually. What is the rate of return on this stock if the current stock price is $38.56 a share?arrow_forward

- Tinicum Air Freight Inc. will pay an annual dividend of S4.85 a share next year with future dividends increasing by 2.12 percent annually. What is the stock's Cost of Equity if the stock is currently selling for $34.57 a share?arrow_forwardYou purchased one share of Footwear Inc. common stock for $30 today. If thestock pays a dividend of $6.50 in one year, and sells for $32.50 at that time, what will the dividend yield, growth rate, and total rate of return be for the year?arrow_forwardIron Manufacturers made two announcements concerning its common stock today. First, the company announced that the next annual dividend will be $2.10 a share. Secondly, all dividends after that will increase by 2.5 percent annually. What is the maximum amount you should pay to purchase a share of this stock today if you require a 10 percent rate of return? Solve using Excelarrow_forward

- The common stock of Shepard Auto sells for $47.92 per share. The stock is expected to pay $2.28 per share next year when the annual dividend is distributed. The company increases its dividends by 1.65 percent annually. What is the market rate of return on this stock? 4.84% O 6.41% O 9.92% O 6.14% A Moving to another question will save this response. Question 10 of 30arrow_forwardThe common stock of Auto Deliveries sells for $28.16 a share. The stock just paid an annual dividend of $1.35 per share. The firm has established a pattern of increasing its dividends by 3 percent annually and expects to continue doing so. What is the market rate of return on this stock?arrow_forwardthe stock of midway cement is currently selling for $20 a share and is expected to pay a $1.5 divident at the end of the year. if you bought the stock now and sold it for 24$ after reciving the divident, what rate of return would you earn?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning