Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Financial accounting

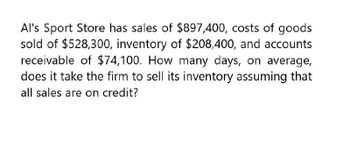

Transcribed Image Text:Al's Sport Store has sales of $897,400, costs of goods

sold of $528,300, inventory of $208,400, and accounts

receivable of $74,100. How many days, on average,

does it take the firm to sell its inventory assuming that

all sales are on credit?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Up-Towner has sales of $913,400, costs of goods sold of $579,300, inventory of $123,900, and accounts receivable of $78,900. How many days, on average, does it take the firm to sell its inventory assuming that all sales are on credit? A) 74.19 days B) 84.69 days C) 78.07 days D) 96.46 days E) 71.01 daysarrow_forwardThe up towner has sales of $913,400 costs of goods sold of $579,300 inventory of $123,900 and accounts receivable of $78,900. How many days, on average, does it take the firm to sell its inventory assuming that all sales are on credit?arrow_forwardA firm has Sales of $2,820, Cost of Goods Sold of $2,160, Inventory of $504, and Accounts Receivable of $430. How many days does it take for the firm to sell its Inventory?arrow_forward

- Mario's Home Systems has sales of $2,830, costs of goods sold of $2,170, inventory of $506, and accounts receivable of $431. How many days, on average, does it take Mario's to sell its inventory?arrow_forwardCompany C Industries has sales of $6,100, cost of goods sold of $4,100, accounts receivable of $800, and inventory of $600. Approximately how many days does it take the firm to collect payments on sales?arrow_forwardBlackwell Co. has credit sales of $317,428, costs of goods sold of $151,217, and average accounts receivable of $28,744. How long on average does it take the firm's credit customers to pay for their purchases? Multiple Choice 33.05 days 27.99 days 31.37 days 29.95 days 38.23 daysarrow_forward

- On average, your firm sells $32,300 of items on credit each day. The average inventory period is 27 days and your operating cycle is 47 days. What is the average accounts receivable balance? $872,100 $1.292.000 $904,400 $646,000 $1,518,100arrow_forwardMentha Company currently has the following statistics: . Days required to sell inventory: 80 Days required to collect accounts receivable: 68 What is the company's operating cycle?arrow_forwardA sole proprietorship firm has taxable income of $128,200. Assume this is the sole source of income for the owner. Taxable Tax Rate Income 9,525 10 % %$4 9,526 38,700 12 38,701 82,500 22 82,501 157,500 24 157,500 – 200,000 32 The marginal tax rate is percentarrow_forward

- Bhupatbhaiarrow_forwardWayne's Wells has sales for the year of P48,900 and an average inventory 21 of P8,800. The cost of goods sold id equal to 60 percent of sales and the profit margin is five percent. How many days on the average does it take the firm to sell an inventory item?arrow_forwardFalafel Hut has sales of $512,630. The cost of goods sold is equal to 60 percent of sales. The beginning accounts receivable balance is $22,970, and the ending accounts receivable balance is $28,214. How long on average does it take the firm to collect its receivables?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning