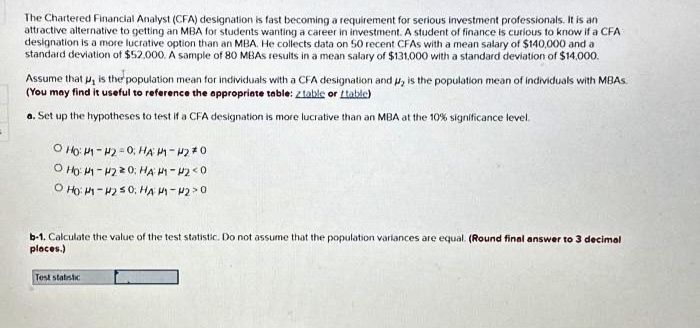

The Chartered Financial Analyst (CFA) designation is fast becoming a requirement for serious investment professionals. It is an attractive alternative to getting an MBA for students wanting a career in investment. A student of finance is curious to know if a CFA designation is a more lucrative option than an MBA. He collects data on 50 recent CFAs with a mean salary of $140,000 and a standard deviation of $52.000. A sample of 80 MBAS results in a mean salary of $131,000 with a standard deviation of $14,000. Assume that p, is the population mean for individuals with a CFA designation and p, is the population mean of individuals with MBAS (You may find it useful to reference the appropriate table: 2table or table) a. Set up the hypotheses to test if a CFA designation is more lucrative than an MBA at the 10% significance level. O Ho: M1-H2=0, HAM1-42*0 Ho: M1-220 HA H1-H2<0 OHO: M1-H250, HAM-M20 b-1. Calculate the value of the t places.) Test statistic tistic. Do not assume that the population variances are equal. (Round final answer to 3 decimal

The Chartered Financial Analyst (CFA) designation is fast becoming a requirement for serious investment professionals. It is an attractive alternative to getting an MBA for students wanting a career in investment. A student of finance is curious to know if a CFA designation is a more lucrative option than an MBA. He collects data on 50 recent CFAs with a mean salary of $140,000 and a standard deviation of $52.000. A sample of 80 MBAS results in a mean salary of $131,000 with a standard deviation of $14,000. Assume that p, is the population mean for individuals with a CFA designation and p, is the population mean of individuals with MBAS (You may find it useful to reference the appropriate table: 2table or table) a. Set up the hypotheses to test if a CFA designation is more lucrative than an MBA at the 10% significance level. O Ho: M1-H2=0, HAM1-42*0 Ho: M1-220 HA H1-H2<0 OHO: M1-H250, HAM-M20 b-1. Calculate the value of the t places.) Test statistic tistic. Do not assume that the population variances are equal. (Round final answer to 3 decimal

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.4: Distributions Of Data

Problem 19PFA

Related questions

Question

Transcribed Image Text:The Chartered Financial Analyst (CFA) designation is fast becoming a requirement for serious investment professionals. It is an

attractive alternative to getting an MBA for students wanting a career in investment. A student of finance is curious to know if a CFA

designation is a more lucrative option than an MBA. He collects data on 50 recent CFAs with a mean salary of $140,000 and a

standard deviation of $52,000. A sample of 80 MBAS results in a mean salary of $131,000 with a standard deviation of $14,000.

Assume that is the population mean for individuals with a CFA designation and p, is the population mean of individuals with MBAS.

(You may find it useful to reference the appropriate table: zlable or table)

a. Set up the hypotheses to test if a CFA designation is more lucrative than an MBA at the 10% significance level.

O Ho: M1-H2=0; HA M-H2*0

O Ho: M1-H220;HA H1-H2 <0

о но р-н250; на н-н2>0

b-1. Calculate the value of the test statistic. Do not assume that the population variances are equal. (Round final answer to 3 decimal

ploces.)

Test statistic

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 13 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill