Concept explainers

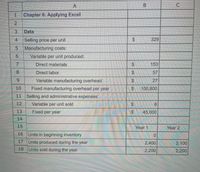

The Chapter 6 Form worksheet is to be used to create your own worksheet version of the Review Problem in the text.

If your formulas are correct, you should get the correct answers to the following questions.

(a) What is the net operating income (loss) in Year 1 under absorption costing?

(b) What is the net operating income (loss) in Year 2 under absorption costing?

(c) What is the net operating income (loss) in Year 1 under variable costing?

(d) What is the net operating income (loss) in Year 2 under variable costing?

(e) The net operating income (loss) under absorption costing is less than the net operating income (loss) under variable costing in Year 2 because: (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.)

check all that apply

- Units were left over from the previous year.

- The cost of goods sold is always less under variable costing than under absorption costing.

- Sales exceeded production so some of the fixed manufacturing

overhead of the period was released from inventories under absorption costing.

3.

Make a note of the absorption costing net operating income (loss) in Year 2.

At the end of Year 1, the company’s board of directors set a target for Year 2 of net operating income of $80,000 under absorption costing. If this target is met, a hefty bonus would be paid to the CEO of the company. Keeping everything else the same from part (2) above, change the units produced in Year 2 to 4,200 units.

(a) Would this change result in a bonus being paid to the CEO?

multiple choice 1

-

Yes

-

No

(b) What is the net operating income (loss) in Year 2 under absorption costing?

(c) Would this doubling of production in Year 2 be in the best interests of the company if sales are expected to continue to be 2,200 units per year?

multiple choice 2

-

Yes

-

No

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

- Below is a list of costs. Please identify each cost as either a product or period cost. Dragged and dropped options on the right-hand side will be automatically saved. For keyboard navigation... SHOW MORE ✓ Depreciation on office copier Depreciation on office building Insurance on office building Metal used in building a car Salary of CEO Salary of production manager Salary of assembly line workers Utilities of office building = = Product Period = Period = Period = Product = Product = = Period Periodarrow_forwardRequired information [The following information applies to the questions displayed below.] The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Finished goods inventory, beginning Work in process inventory, beginning. Raw materials inventory, beginning Rental cost on factory equipment Direct labor Finished goods inventory, ending Work in process inventory, ending Raw materials inventory, ending Factory utilities General and administrative expenses. Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Accounts receivable, net Garcon Company $ 12,700 18,800 8,900 27,500 21,600 20,150 23,800 7,600 11,400 24,500 14,200 7,700 43,500 53,200 294,720 30,000 15,200 Pepper Company $ 19,750 22,350 14,700 23,500 44,200 14,100 18,400 9,600 16,250 52,000 13,120 3,700 58,000 54,700 391,1801 24,200 20,700 1. Compute the total prime costs for both Garcon Company and Pepper Company. 2. Compute the total conversion…arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- Convert the accompanying database to an Excel table to find: a.The total cost of all orders. b.Thetotal quantity of airframe fasteners purchased. c. The total cost of all orders placed with Manley Valve. Question content area bottom Part 1 a. The total cost of all orders is $?????? enter your response here.arrow_forwardPLEASE ANSWER THIS WITH 5 paragraphs. Write it as if you're a memo. Concepts of Relevant cost.arrow_forwardPlease explain proper steps by Step and Do Not Give Solution In Image Format ? And Fast Answering Please ?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education