FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Provide the Ans of Question no-3 only.

Transcribed Image Text:Chapter 6 Homework

1. Determine the type of costs described below

a. Costs that can be traced directly to the cost object

b. Costs which change in proportion to changes in volume

c. The cost of the next best thing

d. Costs which do not change in proportion to changes in volume

e. Costs which management can influence in the short term in some capacity

f. Costs which are different between multiple alternative choices

HA260

Wilson-Sommers

g. Costs which are the result of a past decision and cannot be changed

2. Determine if each of the following is a direct or indirect cost for a hotel food

department. Then determine if it is a fixed or variable cost as well.

a. Utilities for the building-

b. Depreciation on kitchen appliances-

c. Wages for kitchen staff preparing meals-

d. Property taxes for the hotel-

e. Cost of food inventory -

Overhead

Cost Area

Admin and

General

Info and

Telecomm

Sales and

Marketing

Utilities

Prop Maint

Total

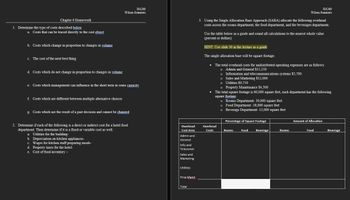

3. Using the Single Allocation Base Approach (SABA) allocate the following overhead

costs across the rooms department, the food department, and the beverages department.

Use the table below as a guide and round all calculations to the nearest whole value

(percent or dollars)

HINT: Use slide 30 in the lecture as a guide

The single allocation base will be square footage.

The total overhead costs for undistributed operating expenses are as follows:

o Admin and General $15,250

●

o Information and telecommunications systems $5,700

o

Sales and Marketing $12,000

o Utilities $9,750

o Property Maintenance $4,300

The total square footage is 60,000 square feet, each department has the following

square footage

Overhead

Costs

O Rooms Department- 30,000 square feet

o Food Department -18,000 square feet

o Beverage Department- 12,000 square feet

Percentage of Square Footage

Rooms

HA260

Wilson-Sommers

Food

Beverage

Rooms

Amount of Allocation

Food

Beverage

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assess the circumstances in which an S election versus C may be involuntarily terminated.arrow_forwardCompare and contrast a condition precedent and condition subsequent. Provide an example of each.arrow_forwardQuestion: What are the key features of the objection and appeal process against the Commissioner’s decision?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education