Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

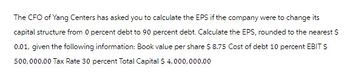

Transcribed Image Text:The CFO of Yang Centers has asked you to calculate the EPS if the company were to change its capital structure from 0 percent debt to 90 percent debt. Calculate the EPS, rounded to the nearest $0.01, given the following information: Book value per share $8.75, Cost of debt 10 percent, EBIT $500,000.00, Tax Rate 30 percent, Total Capital $4,000,000.00.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Company ABC needs 200,000$. Company decided to borrow 80,000 $ at 8% interest rate and sale equity shares at price of 20$ per share to earn 120,000$. Earning before interest and tax are estimated to be 25,000$. The tax rate is 50%. Calculate the earning per share. Select one: a. 1.55 b. 1.70 c. 1.36 d. 3.05arrow_forwardTerrell Trucking Company is in the process of setting its target capital structure. The CFO believes that the optimal debt-to-capital ratio is somewhere between 20% and 50%, and her staff has compiled the following projections for EPS and the stock price at various debt levels: Debt/Capital Ratio Projected EPS Projected Stock Price 20% $3.15 $32.50 30 3.50 36.00 40 3.75 38.00 50 3.55 32.00 Assuming that the firm uses only debt and common equity, what is Terrell's optimal capital structure? Choose from the options provided above. Round your answers to two decimal places. % debt % equity At what debt-to-capital ratio is the company's WACC minimized? Choose from the options provided above. Round your answer to two decimal places. %arrow_forwardA company just issued $140000 of perpetual 9% debt and used the proceeds to repurchase stock. The company expects to generate 121000 of EBIT in perpetuity. The company distributes all its earnings as dividends at the end of each year. The firm's unlevered cost of capital is 10% and the tax rate is 40%. Use FTE to calculate the value of the company's equity. Your Answer: Answerarrow_forward

- d) Calculate the after-tax Weighted Average Cost of Capital (WACC) for each capital structure.arrow_forwardColdstream Corp. is comparing two different capital structures. Plan I would result in 10,000 shares of stock and $100,000 in debt. Plan II would result in 5,000 shares of stock and $200,000 in debt. The interest rate on the debt is 6 percent. a. Ignoring taxes, compare both of these plans to an all-equity plan assuming that EBIT will be $60,000. The all-equity plan would result in 15,000 shares of stock outstanding. What is the EPS for each of these plans? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) EPS Plan I $ Plan II $ All equity $ b. In part (a), what are the break-even levels of EBIT for each plan as compared to that for an all-equity plan? (Do not round intermediate calculations.) EBIT Plan I and all-equity $ Plan II and all-equity $ c. Ignoring taxes, at what level of EBIT will EPS be identical for Plans I and II? (Do not round intermediate calculations.) EBIT…arrow_forwardCan i please get help with the practice question, i attached it below. Thank you. I need it soon tooarrow_forward

- You are given the following information concerning a firm:Assets required for operation: $5,600,000Revenues: $8,700,000Operating expenses: $7,900,000Income tax rate: 40%. Management faces three possible combinations of financing: 100% equity financing 35% debt financing with a 8% interest rate 70% debt financing with a 8% interest rate What is the net income for each combination of debt and equity financing? Round your answers to the nearest dollar. 1 2 3 Net income $ $ $ What is the return on equity for each combination of debt and equity financing? Round your answers to one decimal place. 1 2 3 Return on equity % % % If the interest rate had been 16 percent instead of 8 percent, what would be the return on equity for each combination of debt and equity financing? Round your answers to one decimal place. 1 2 3 Return on equity % % % What is the implication of the use of financial leverage…arrow_forwardChearrow_forwardPlease provide Solutionsarrow_forward

- Please answer ASAParrow_forwardNeed answer pleasearrow_forwardA company just issued $453000 of perpetual 5% debt and used the proceeds to repurchase stock. The company expects to generate 107000 of EBIT in perpetuity. The company distributes all its earnings as dividends at the end of each year. The firm's unlevered cost of capital is 14% and the tax rate is 25%. Use APV method to calculate the value of the company with leverage. Your Answer: Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education