Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

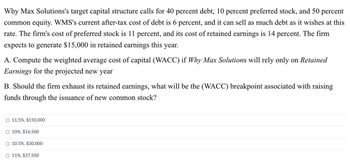

Transcribed Image Text:Why Max Solutions's target capital structure calls for 40 percent debt, 10 percent preferred stock, and 50 percent

common equity. WMS's current after-tax cost of debt is 6 percent, and it can sell as much debt as it wishes at this

rate. The firm's cost of preferred stock is 11 percent, and its cost of retained earnings is 14 percent. The firm

expects to generate $15,000 in retained earnings this year.

A. Compute the weighted average cost of capital (WACC) if Why Max Solutions will rely only on Retained

Earnings for the projected new year

B. Should the firm exhaust its retained earnings, what will be the (WACC) breakpoint associated with raising

funds through the issuance of new common stock?

O 11.5%, $150,000

O 10%, $16,500

10.5%, $30,000

O 11%, $37,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Altamonte Telecommunications has a target capital structure that consist of 70% debt and 30% equity. The company anticipates that its capital budget for the upcoming year will be $2,000,000. If Altamonte reports net income of $1,100,000 end it follows a residual, dividend, payout policy, what will be its dividend payout ratio? Round your answer to two decimal places.arrow_forwardBarton Industries expects that its target capital structure for raising funds in the future for its capital budget will consist of 40% debt, 5% preferred stock, and 55% common equity. Note that the firm's marginal tax rate is 25%. Assume that the firm's cost of debt, rd, is 10.4%, the firm's cost of preferred stock, rp, is 9.6% and the firm's cost of equity is 13.0% for old equity, rs, and 13.3% for new equity, re. What is the firm's weighted average cost of capital (WACC1) if it uses retained earnings as its source of common equity? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardThe Black Bird Company plans an expansion. The expansion is to be financed by selling $21 million in new debt and $57 million in new common stock. The before-tax required rate of return on debt is 9.77% percent and the required rate of return on equity is 13.11% percent. If the company is in the 34 percent tax bracket, what is the weighted average cost of capital?arrow_forward

- New Energy’s capital structure today is $1,347 million in Long Term Debt and $1,655 million in Common Equity. If its debt were issued today, New Energy would pay an interest rate of 8.2%/year (before tax). New Energy’s Cost of Equity is estimated to be 12%/year. Given a tax rate of 30%, what is New Energy’s Weighted Average Cost of Capital (WACC)? (Your answer should be a % carried to 2 places.)arrow_forwardStevenson's Bakery is an all-equity firm that has projected perpetual EBIT of $183,000 per year. The cost of equity is 13.1 percent and the tax rate is 21 percent. The firm can borrow perpetual debt at 6.3 percent. Currently, the firm is considering converting to a debt–equity ratio of .93. What is the firm's levered value? MM assumptions hold. A. $829,786 B. $1,215,262 C. $1,155,579 D. $997,511 E. $921,985arrow_forwardA company is trying to establish its optimal capital structure. Its current capital structure consists of 25% debt and 75% equity; however, the CEO believes that the firm should use more debt. The risk-free rate, rRF, is 6%; the market risk premium, RPM, is 6%; and the firm's tax rate is 40%. Currently, the company’s cost of equity is 14%, which is determined by the CAPM. What would be the companies estimated cost of equity if it changed its capital structure to 50% debt and 50% equity? Round your answer to two decimal places. Do not round intermediate steps.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education