Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

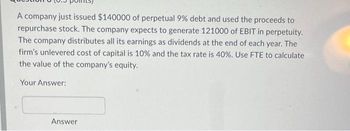

Transcribed Image Text:A company just issued $140000 of perpetual 9% debt and used the proceeds to

repurchase stock. The company expects to generate 121000 of EBIT in perpetuity.

The company distributes all its earnings as dividends at the end of each year. The

firm's unlevered cost of capital is 10% and the tax rate is 40%. Use FTE to calculate

the value of the company's equity.

Your Answer:

Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Yoarrow_forwardMitsui Ltd has 1 million issued shares and expects unlevered after-tax cash flows of $300,000 every year, forever. The company is all-equity financed, and its cost of capital is 12% p.a. The company's tax rate is 30%. The company has just announced its intention to borrow an additional $1,400,000 of perpetual debt (at a 7% p.a. interest rate) and use the proceeds to repurchase shares? a) Calculate the price per share of Mitsui Ltd immediately before the repurchase announcement. b) Calculate the price of a share in Mitsui Ltd immediately after the repurchase announcement but before the new borrowings occur (assuming that the market expects repurchase to occur with certainty and that there are no other information effects). c) Calculate the cost of equity capital for Mitsui Ltd after the share repurchase (ignoring other information effects).arrow_forwardCould you please solve these questions?arrow_forward

- RDJ Corp. has expected earnings before interest and taxes (EBIT) of $5,000 (assumed to continue forever). Its unlevered cost of capital is 13.0% and its corporate tax rate is 35%. The company would like to borrow debt that amounts to $2,000 and use the proceeds to buy back shares. This debt has a 7.0% annual interest rate and pays interests annually. What is the firm's cost of equity, after this capital conversion? O A. O B. O C. O E. 10.05% 13.33% 15.14% OD. 13.82% 12.65% B 10 19 28 37 46 Finisarrow_forwardXYZ anticipates earning $1,000,000 and paying $200,000 in dividends this year. XYZ's capital structure is 20% debt and 80% equity and its tax rate is 35%. Compute the equity breakpoint to the nearest dollar. Your Answer:arrow_forwardA company just issued $453000 of perpetual 5% debt and used the proceeds to repurchase stock. The company expects to generate 107000 of EBIT in perpetuity. The company distributes all its earnings as dividends at the end of each year. The firm's unlevered cost of capital is 14% and the tax rate is 25%. Use APV method to calculate the value of the company with leverage. Your Answer: Answerarrow_forward

- A company finances its operations with 57 percent debt and the rest using equity. The annual yield on the company's debt is 6% and the required rate of return on the stock is 14.6%. What is company's WACC? Assume the tax rate is 30%arrow_forwardJohnson Tire Distributors has debt with both a face and a market value of $90,000,000. This debt has a coupon rate of 7 percent and pays interest annually. The expected earnings before interest and taxes is a constant $50,000,000 in perpetuity. The company's tax rate is 25 percent, and the unlevered cost of capital is 25 percent. What is the firm's cost of equity? Write your answer as a percent rounded to two digits, but don't include the % sign (i.e. enter 12.63, not 0.1263). HINT: You need to use both M&M propositions. Numeric Responsearrow_forwardXYZ anticipates earning $1,500,000 and paying $300,000 in dividends this year. XYZ's capital structure is 20% debt and 80% equity and its tax rate is 35%. Compute the equity breakpoint to the nearest dollar. Your Answer:arrow_forward

- Assume that you are on the financial staff of Vanderheiden Inc., and you have collected the following data: The yield on the company’s outstanding bonds is 7.75%, its tax rate is 25%, the next expected dividend is $0.65 a share, the dividend is expected to grow at a constant rate of 6.00% a year, the price of the stock is $14.00 per share, the flotation cost for selling new shares is F = 10%, and the target capital structure is 45% debt and 55% common equity. What is the firm's WACC, assuming it must issue new stock to finance its capital budget? 9.96% 7.98% 10.12% 8.75% 8.23%arrow_forwardAshely Corporation has 80 million outstanding equity shares and the following projected financial information for the next four years. The tax rate is 25%. Ashely’s cost of capital is 13%. Assume Ashely is fully financed with equity. Year 1 2 3 4 Earnings Forecast ($millions) 1 Sales 474.28 520.31 571.88 728.99 2 Cost of Goods Sold 269.53 308.19 335.68 490.25 3 Selling, General & Admin. 102.05 108.25 105.24 135.76 4 Depreciation 12.00 15.00 12.50 15.50 5 Net Income 68.03 66.65 88.85 65.61 Capital Requirements ($millions) 6 Capital Expenditures 8.80 11.50 10.60 12.50 7 Increase in Net Working Capital 6.80 7.20 8.25 9.15 Ashely’s CFO wants to use P/E ratio to value the stock’s terminal value in year 4. The CFO forecasts the industry P/E ratio in year 4 is 20. Based on the forecasted P/E ratio, what is the…arrow_forwardAssume that you are on the financial staff of Jerry Inc., and you have collected the following data: The yield on the company's outstanding bonds is 8.75%; its tax rate is 40%; the next expected dividend is $0.75 a share; the dividend is expected to grow at a constant rate of 7.00% a year; the price of the stock is $15.00 per share; and the target capital structure is 40% debt and 60% common equity. What is the firm's WACC? 9.04% 9.80% 8.44% O7.64% 9.30%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education