Economics (MindTap Course List)

13th Edition

ISBN: 9781337617383

Author: Roger A. Arnold

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

The greater young expert Hand written solution is not allowed

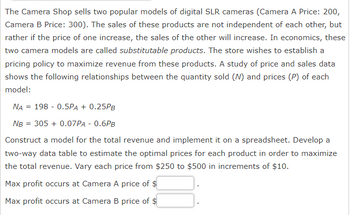

Transcribed Image Text:The Camera Shop sells two popular models of digital SLR cameras (Camera A Price: 200,

Camera B Price: 300). The sales of these products are not independent of each other, but

rather if the price of one increase, the sales of the other will increase. In economics, these

two camera models are called substitutable products. The store wishes to establish a

pricing policy to maximize revenue from these products. A study of price and sales data

shows the following relationships between the quantity sold (N) and prices (P) of each

model:

NA 198 0.5PA + 0.25PB

NB = 305 + 0.07PA - 0.6PB

Construct a model for the total revenue and implement it on a spreadsheet. Develop a

two-way data table to estimate the optimal prices for each product in order to maximize

the total revenue. Vary each price from $250 to $500 in increments of $10.

Max profit occurs at Camera A price of $

Max profit occurs at Camera B price of $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardPanini, a popular sandwich shop, offers 3 types of sandwiches: Grill vegetables, grilled chicken and pastrami. The table below provides demand data: Pastrami Grilled Vegetables Grilled Chicken Demand per hour 25 25 10 There are up to five steps in the process of making sandwiches, listed below with activity times. Only 50% of customers want their sandwich toasted, no matter which sandwich is ordered. Step Grilled Vegetables Grilled Chicken Pastrami Cut bread 75 minutes .75 minutes .75 minutes Grill 1.9 minutes 1.9 minutes Slice meat 3 minutes Toast 2 minutes 2 minutes 2 minutes Wrap .75 minutes .75 minutes .75 minutes Suppose Panini employs 1 worker at each step. What is the implied utilization of the bottleneck of this process?arrow_forwardNoticing that profits on college text books are very high, the Beast Book Store (BBS), with the help of a venture capitalist, has gone into text book publishing. In its current production range its average total cost is approximately equal to its marginal cost which it estimates to be about $25. It has estimated that price elasticity of demand for its books at current price levels to be about -1.5. The manager of BBS uses mark-up pricing to price the books that it sells using a 150% mark-up (even with this mark-up BBS can still underprice most other book publishers). Assuming that BBS wants to maximize short-term profits on its book sales and initially enjoys a monopoly in the local college textbook production market, is this a good pricing procedure? Harvard and other local colleges soon start publishing companies of their own increasing competition and causing the price elasticity of demand for BBS books to increase to -2.0. Assuming that BBS’s demand curve that generates this -2.0…arrow_forward

- Aruna owns Pottery Plus, a small firm that produces terra cotta pots for sale in the Edmonton area. The graph below shows Aruna's demand curve. Price ($) 40 36 32 28 24 20 16 12 8 4 8 12 16 20 24 28 32 36 40 Quantity per period Search 3 of 6 SAMSUNG Next > 4arrow_forwardVijay Dairy is selling flavored milk and buttermilk in packets of 150 ml. The dairysells 2000 packets of flavored milk and 1000 packets of buttermilk every day. Theformer is priced at Rs 6 and the latter is at Rs 4. A market survey estimates the crossprice elasticity (both ways) to be + 1.8 and the own price elasticity of flavored milk tobe -1.3. The dairy is contemplating a 10 per cent reduction in the price of flavoredmilk. Should it go ahead with price reduction? Why are why not? Show all theworkingarrow_forwardPlease solve Fast i give 2 like The managers of Movies Plus, a large movie theater, want to practice third-degree price discrimination. The managers have learned that college students have an own price elasticity of demand of 1.5 for tickets at Movies Plus and adults have an own price elasticity of 1.2. If the managers have correctly determined the third-degree profit-maximizing price for adults is $15, what is the third-degree profit-maximizing price to charge students? Group of answer choices (1)$13.50 (2)$10.00 (3)$7.50 (4)$8.50arrow_forward

- 6.10. SpokenWord. Your software company has just completed the first version of Spo- kenWord, a voice-activated word processor. As marketing manager, you have to decide on the pricing of the new software. You commissioned a study to determine the poten- tial demand for SpokenWord. From this study, you know that there are essentially two market segments of equal size, professionals and students (one million each). Profes- sionals would be willing to pay up to $400 and students up to $100 for the full version of the software. A substantially scaled-down version of the software would be worth $50 to consumers and worthless to professionals. It is equally costly to sell any version. In fact, other than the initial development costs, production costs are zero. Although you know there are two market segments, you cannot directly identify a consumer as belonging to a specific market segment. (a) What are the optimal prices for each version of the software? Suppose that, instead of the…arrow_forwardP t onces In a statement to P&G shareholders, the Chief executive officer (CEO) of Gillette (which is owned by P&G) indicated, "Despite several new product launches, Gillette's advertising-to-sales declined dramatically... to 5 percent last year. Gillette's advertising spending, in fact, is one of the lowest in our peer group of consumer product companies." If the elasticity of demand for Gillette's consumer products is similar to other firms in its peer group (which averages -4.5), what is Gillette's advertising elasticity? Instructions: Enter your response rounded to two decimal places. Is Gillette's demand more or less responsive to advertising than other firms in its peer group? O Less responsive More responsive It responds the same.arrow_forwardCreative Homework/Short Project Assume that you arean entrepreneur who runs a bakery that sells glutenfree breads and cakes. You believe that the currenteconomic conditions merit an increase in the price ofyour baked goods. You are concerned. however, thatincreasing the price might not be profitable becauseyou are unsure of the price elasticity of demand for yourproducts. Develop a plan for the measurement of priceelasticity of demand for your products. What findingswould lead you to increase the price? What findingswould cause you to rethink the decision to increaseprices? Develop a presentation for your class outlining(I) the concept of elasticity of demand, (2) why raisingprices without undetstanding the elasticity would bea bad move. (3) your recommendations for measurement. and (4) the potential impact on profits for elasticand inelastic demandarrow_forward

- Macmillan Learning You have been appointed head of marketing for Barry's Younique Yachts. Barry, the CEO, is interested in determining whether offering his yachts at a lower price would increase the firm's revenue. He asks you for advice. Using your knowledge of elasticity, you should tell Barry that he should increase his prices. Demand for yachts is perfectly inelastic, so a price increase will cause total revenue to increase. that he should reduce his prices. Yachts are luxury goods and therefore exhibit a high price elasticity of demand. Thus, reducing prices would increase revenue. that he should increase his prices. Demand for yachts is likely to be elastic because they are so much fun to drive. Thus, increasing prices would increase revenue. that he should reduce his prices. Yachts are a necessity and therefore have a low price elasticity of demand. Thus, reducing prices would increase revenue.arrow_forwardOnly typed answerarrow_forwardMelCo’s Xamoff The global pharmaceuticals giant, MelCo, has had great success with Xamoff, and over-thecounter medicine that reduces exam-related anxiety. A patent currently protects Xamoff from competition, although rumors persist that similar products are in development. Two years ago, MelCo sold 25 million units for a price of $10 for a package of ten. Last year it raised the price to $11, and sales fell to 22 million units. Finally, a financial analyst estimates the cost of production at $2 per package. (a) Estimate the elasticity of demand for this product at $10. Is this price too high or too low? (b) Estimate the elasticity of demand for this product at $11. Is this price too high or too low? (c) Based on your answers to (a) and (b), what can we say about MelCo’s profit-maximizing price?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning