FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

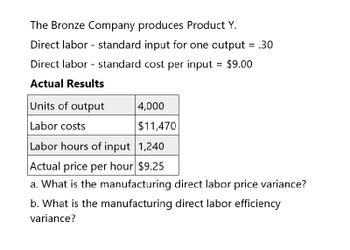

Transcribed Image Text:The Bronze Company produces Product Y.

Direct labor standard input for one output = .30

Direct labor standard cost per input = $9.00

Actual Results

Units of output

4,000

Labor costs

$11,470

Labor hours of input 1,240

Actual price per hour $9.25

a. What is the manufacturing direct labor price variance?

b. What is the manufacturing direct labor efficiency

variance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 7. Materials, Labor and Overhead Variances (Comprehensive Problem, Reconstruction) Standard variable costs per unit: A) Materials: 4 pounds @ (1) B) Direct Labor: (3) hours @ P 12.00 C) Variable overhead: P 8 per direct labor hour Production Materials purchases, 32,000 pounds Materials used at standard prices, 31,200 pounds Direct labor (actual): (6) hours Material purchase price variance Material use variance Direct labor rate variance Direct labor efficiency variance Variable overhead spending variance Variable overhead efficiency variance Actual variable overhead cost REQUIRED: Compute for the missing amounts (1) to (10). (2) P 6.00 (4) 8,000 units P 62,000 (5) P 47,200 P 2,000 adverse (7) P 2,000 favorable (8) P 1,500 credit (9) (10)arrow_forwardNeed help with the following question,arrow_forward1.3 REQUIRED Use the information provided below to calculate the following variances. Each answer must indicate whether the variance is favourable or unfavourable. 1.3.1 Material quantity variance 1.3.2 Labour rate variance 1.3.3 Variable manufacturing overheads efficiency variance INFORMATION The standard variable costs per unit (with a standard quantity of 25 000 units), set by Kidman Manufacturers, for Product M are as follows: Materials Labour Variable overhead 4 kg at R10 per kg 2 hours at R20 per hour 2 hours at R12 per hour The actual costs for October 2022 are as follows: Materials Materials Labour Variable overhead 100 000 kg were purchased for R980 000 78 000 kg were used to produce 20 000 units of Product M 41 000 labour hours at R19.60 per hour R500 200 incurredarrow_forward

- Fast answer pleasearrow_forwardUnder the three variance method for analyzing factory overhead, the difference between the actual factory overhead and the budget allowance based on actual hours is the * efficiency variance spending variance volume variance idle capacity variancearrow_forwardDirect Material Direct Labor Standard Cost Data per 1 Unit Quantity Price 3 lbs $2.00/lb 2 hrs $4.00/hr Actual Data: Units produced Material purchase & usage Direct Labor Show all computations. 25 100 lbs at $2.20 per lb 30 hrs; total cost $129 a) Compute price variance, quantity variance, direct material variance b) Compute rate variance, efficiency variance, direct labor variancearrow_forward

- Data on Gantry Company's direct labor costs are given below: Standard direct labor-hours Actual direct labor-hours Direct labor efficiency variance-favorable Direct labor rate variance-favorable Total direct labor payroll What was Gantry's actual direct labor rate? re to search Multiple Choice $7.80 $3.40 IIarrow_forwardSubject: acountingarrow_forwardFind the values of the missing items (a) through (x). Assume the actual sales volume equals actual production volume. Marketing and Administrative Sales Price Variance Variance Units Sales Revenue Less: Variable Manufacturing Costs Variable marketing and administrative costs Contribution margin Fixed manufacturing costs Fixed marketing and administrative costs Operating Profit PreviousNext Reported income statement (based on actual sales volume) Manufacturing variance (a) (g) (n) (q) (r) (t) $4,320 $3,600 (0) $1,800 U $ 400 F (u) (p) (s) (v) (w) $3,600 F (X) $3,600 F Flexible Budget (based on actual sales volume (b) (h) (m) Sales Activity Variance 4,000 F (1) $19,200 (i) $4,800 $800 U $12,000 (k) $3,000 $4,000 (1) Master Budget (based on budgeted sales volume) 20,000 $30,000 (c) (d) (e) (f) $16,000 $10,000arrow_forward

- The direct labor rate variance is calculated by multiplying the standard hours that should have been worked for the actual output by the difference between the standard labor rate and the actual labor rate. O True O Falsearrow_forwardDirect Labor Actual Data: Units produced Direct Labor Standard Cost Data per 1 Unit Quantity Price 2 hrs $41/hr SHOW ALL COMPUTATIONS. 20 units 39 hrs; total cost $1560 Compute rate variance, efficiency variance, direct labor variancearrow_forwardDon't provide answers in image formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education