FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

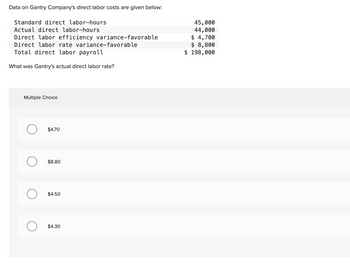

Transcribed Image Text:Data on Gantry Company's direct labor costs are given below:

Standard direct labor-hours

Actual direct labor-hours

Direct labor efficiency variance-favorable

Direct labor rate variance-favorable

Total direct labor payroll

What was Gantry's actual direct labor rate?

Multiple Choice

O

O

O

$4.70

$8.80

$4.50

$4.30

45,000

44,000

$ 4,700

$ 8,800

$ 198,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Preparing a standard cost income statement Use the following information to prepare a standard cost income statement for Whitmer Company for 2021. Cost of Goods Sold at standard $ 367,000 Direct Labor Efficiency Variance $ 18,000 F Sales Revenue at standard 550,000 Variable Overhead Efficiency Variance 3,400 U Direct Materials Cost Variance 8,000 U Fixed Overhead Volume Variance 12,000 F Direct Materials Efficiency Variance 2,800 U Selling and Administrative Expenses 77,000 Direct Labor Cost Variance 42,000 U Variable Overhead Cost Variance 700 F Fixed Overhead Cost Variance 1,900 Farrow_forwardThe standard number of hours that should have been worked for the output attained is 10,000 direct labor hours and the actual number of direct labor hours worked was 10,500. If the direct labor rate variance was P10,500 unfavorable, and the standard rate of pay was P12 per direct labor hour, what was the actual rate of pay for direct labor? A. P11 per hour B. P9 per hour C. P13 per hour D. P12 per hourarrow_forwardA company's standard is 2 hours of direct labor per unit at a rate of $45 per hour. The company shows the following for the year. Actual units produced Actual direct labor used 5,120 units 10,040 hours Actual cost of direct labor used AH = Actual Hours SH=Standard Hours AR= Actual Rate SR Standard Rate Complete this question by entering your answers in the tabs below. Required A Required B Compute the direct labor rate variance, direct labor efficiency variance, and the total direct labor variance. For each variance, indicate whether it is favorable or unfavorable. Note: Indicate the effect of each variance by selecting favorable, unfavorable, or no variance. Actual Cost $ $ 471,880 0 $ 0 0 Standard Costarrow_forward

- The following information pertains to Ft. Collins Company's direct labor for March 2019: Standard direct labor hours 42,000 Actual direct labor hours 40,000 Favorable direct labor rate variance $16,800 Standard direct labor rate per hour $6.30 What was Ft. Collins' total actual direct labor cost for March 2019? $235,200 $268,000 $268,800arrow_forward23. Consider the following information: Actual direct labor hours Standard direct labor hours Total actual direct labor cost Direct-labor efficiency variance The direct-labor rate variance is: 34,000 34,600 $159,800 $2,460Farrow_forwardValaarrow_forward

- The Cost Officer of a company that manufactures a product came up with the following information: Direct materials: 30% of Sales Direct wages (Variable): 20% of Sales Production overhead (Fixed): Same as direct wages Production overhead (Variable): 25% of direct wages Administration overhead (Fixed): 10 % of Sales Selling overheads (Note 1): Same as Production overhead (Variable) Note 1: The behaviour of selling overhead in relation to changes in sales volume (units) is as follows: Normal activity: M65 000 90% of normal activity: M63 050 110% of normal activity: M66 950. The company uses an absorption costing system to value inventory. The predetermined absorption rates are based on normal level of activity. During November and December, 2021 of the financial year, the production and sales expressed as percentages of normal activity, were as follows: November December Sales 80% 100% Production 100% 80% The actual selling price and variable costs per unit were as budgeted. It is the…arrow_forwardA company reports the following information for its direct labor. Actual hours of direct labor used 64,000 Actual rate of direct labor per hour $ 15 Standard rate of direct labor per hour $ 13 Standard hours of direct labor for units produced 65,300 AH = Actual HoursSH = Standard HoursAR = Actual RateSR = Standard Rate Compute the direct labor rate and efficiency variances and identify each as favorable or unfavorable.arrow_forwardThe standard number of hours that should have been worked for the output attained is 6000 direct labor hours and the actual number of direct labor hours worked was 6300. If the direct labor price variance was $3150 unfavorable and the standard rate of pay was $8.0 per direct labor hour, what was the actual rate of pay for direct labor? $7.50 per direct labor hour $6.50 per direct labor hour $8.50 per direct labor hour O $8.00 per direct labor hourarrow_forward

- Ll.96.arrow_forwardData on Gantry Company's direct labor costs are given below: Standard direct labor-hours Actual direct labor-hours Direct labor efficiency variance-favorable Direct labor rate variance-favorable Total direct labor payroll What was Gantry's actual direct labor rate? 35,000 34,000 $ 4,100 $ 6,800 $ 132,600 Multiple Choice $4.10 $3.70 $3.90 $6.80arrow_forwardA company uses a standard costing system and applies overhead to production based on direct labor-hours. It provided the following information for its most recent year. $300,000 $276,000 60,000 56,000 56,500 Budgeted fixed overhead cost for the year Actual fixed overhead cost for the year Budgeted direct labor-hours (denominator hours) Actual direct labor-hours Standard direct labor-hours al1lowed for actual output What is the fixed overhead volume variance? Multiple Cholce $20,000 F $17,500 U $20,000 U MacBook Air 吕口 豐arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education