FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

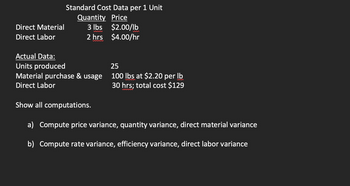

Transcribed Image Text:Direct Material

Direct Labor

Standard Cost Data per 1 Unit

Quantity Price

3 lbs $2.00/lb

2 hrs

$4.00/hr

Actual Data:

Units produced

Material purchase & usage

Direct Labor

Show all computations.

25

100 lbs at $2.20 per lb

30 hrs; total cost $129

a) Compute price variance, quantity variance, direct material variance

b) Compute rate variance, efficiency variance, direct labor variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please don't provide answer in image format thanksarrow_forwardAcme Inc. has the following information available: Actual price paid for material Standard price for material Actual quantity purchased and used in production Standard quantity for units produced Actual labor rate per hour Standard labor rate per hour Actual hours Standard hours for units produced Variance Material Price NOTE: All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). For the variance conditions, your answer is either "F" (for Favorable) or "U" (for Unfavorable) - capital letter and no quotes. Complete the following table of variances and their conditions: Material Quantity Total DM Cost Variance Labor Rate Labor Efficiency Total DL Cost Variance $1.00 $0.90 100 90 15 14 Variance Amount $ $ 200 190 Favorable (F) or Unfavorable (U)arrow_forwardRahularrow_forward

- Information about direct materials cost follows for a local company: Standard price per materials gram Actual quantity used Standard quantity allowed for production $ 2,450 grams 2,600 grams $19,600 F 19 Price variance Required: What was the actual purchase price per gram? Actual purchase price per gramarrow_forwardPlease do not give solution in image format thankuarrow_forwardRequirement 1. Record Brookman's direct labor journal entry (use Wages Payable). Journalize the incurrence and assignment of direct labor costs, including the related variances. (Prepare a single compound journal entry. Record debits first, then credits. Select the explanations on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit - X Data Table AC x AQ SC x AQ SC x SQ $13.00 per DLHr $16.00 per DLHR $16.00 per DLHr 1,650 DLHF 1,650 DLHR 1.200 DLHr $21,450 $26.400 $19,200 Requirements 1. Record Brookman's direct labor journal entry (use Wages Payable). 2. Explain what management will do with this variance information. Cost Efficiency Variance Variance $4.950 F S7,200 U Print Done Print Donearrow_forward

- Please use letters and numbers seen in pictures for formulas. Need help with formulasarrow_forwardA company's standard is 2 hours of direct labor per unit at a rate of $45 per hour. The company shows the following for the year. Actual units produced Actual direct labor used 5,120 units 10,040 hours Actual cost of direct labor used AH = Actual Hours SH=Standard Hours AR= Actual Rate SR Standard Rate Complete this question by entering your answers in the tabs below. Required A Required B Compute the direct labor rate variance, direct labor efficiency variance, and the total direct labor variance. For each variance, indicate whether it is favorable or unfavorable. Note: Indicate the effect of each variance by selecting favorable, unfavorable, or no variance. Actual Cost $ $ 471,880 0 $ 0 0 Standard Costarrow_forwardPlease solve a and barrow_forward

- ACTUAL Direct Materials Direct Labor Summary Mat. Req. No. Description Amount Time Ticket No. Description Amount Item Amount Direct Materials 132 360 meters at $32 H9 18 hours at $19 Direct Labor 134 50 meters at $32 H12 18 hours at $19 Factory Overhead Total Total Total Cost Feedback V Check My Work 1 & 2. Include the estimated and actual direct materials and direct labor. Include the estimated and applied factory overhead. What is the best explanation for the variances between actual costs and estimated costs. For this purpose, assume that the additional meters of material used in the job were spoiled, the factory overhead rate has proven to be satisfactory, and an inexperienced employee performed the work. a. The direct materials cost exceeded the estimate by $40 because 2 meters of materials were spoiled. b. Management didn't provide enough direction to complete tasks on budget. c. The direct materials cost exceeded the estimate by $320 because 10 meters of materials were spoiled.…arrow_forwardNeed helparrow_forwardTrini Company set the following standard costs per unit for its single product Direct materials (30 pounds @ $4.40 per pound) Direct labor (6 hours @ $14 per hour) Variable overhead (6 hours @ $8 per hour) Fixed overhead (6 hours @ $11 per hour) $ 132.00 84.00 48.00 66.00 $ 330.00 Standard cost per unit Overhead is applied using direct labor hours. The standard overhead rate is based on a predicted activity level of 80% of the company's capacity of 50,000 units per quarter. The following additional information is available. Production (in units) Standard direct labor hours (6 DLH per unit) Budgeted overhead (flexible budget) Fixed overhead Variable overhead Operating Levels 70% 80% 90% 35,000 210,000 40,000 240,000 45,000 270,000 $ 2,640,000 $ 1,680,000 $ 2,640,000 $ 2,640,000 $ 1,920,000 $ 2,160,000 During the current quarter, the company operated at 90% of capacity and produced 45,000 units; actual direct labor totaled 266,000 hours. Units produced were assigned the following…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education