FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

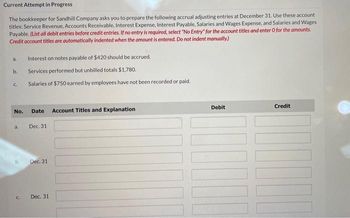

Transcribed Image Text:Current Attempt in Progress

The bookkeeper for Sandhill Company asks you to prepare the following accrual adjusting entries at December 31. Use these account

titles: Service Revenue, Accounts Receivable, Interest Expense, Interest Payable, Salaries and Wages Expense, and Salaries and Wages

Payable. (List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.

Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

a.

b..

C

No.

a.

b.

C.

D

Interest on notes payable of $420 should be accrued.

Services performed but unbilled totals $1,780.

Salaries of $750 earned by employees have not been recorded or paid.

Date Account Titles and Explanation

Dec. 31

Dec. 31

Dec. 31

Debit

Credit

www

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 11. Subject :- Accountingarrow_forwardA credit sale is made on July 10 for $800, terms 4/10, n/30. On July 12, $150 of goods are returned for credit. Give the journal entry on July 19 to record the receipt of the balance due within the discount period. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation July 19 Debit Creditarrow_forwardAt the end of the year, Dahir Incorporated’s balance of Allowance for Uncollectible Accounts is $1,100 (debit) before adjustment. The company estimates future uncollectible accounts to be $5,500. What is the adjustment Dahir would record for Allowance for Uncollectible Accounts? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forward

- Novak Corporation, during the year ended October 31, 2024, had the following transactions for money-market instruments purchased to earn interest: Jan. 2 Purchased a 110-day, $38,800 treasury bill maturing on May 1 for $38,567. May Aug. 1 Aug. 31 Sept. 30 Oct. 1 1 Oct. 15 The treasury bill matured. Invested $63,100 in a money-market fund. Received notification that $158 of interest had been earned and added to the fund. Received notification that $158 of interest had been earned and added to the fund. Purchased a 90-day, 3.10%, $29,100 treasury bill for $28,876. Cashed the money-market fund and received $63,495.arrow_forwardit was wrong i need helparrow_forwardAllowance for Uncollectible Accounts is a contra asset account, which means that its normal balance is a credit. However, it is possible for the account to have a debit balance before year-end adjustments are recorded. Explain how this could happen. How does an accountant calculate the year-end adjustment for Allowance for Uncollectible Accounts with a debit balance before year-end adjustments recorded? Please explain both answers in good detail answerarrow_forward

- Selected accounts of Beam Electrical, Inc., at November 30, 2018, follow. (Click the icon to view the accounts.) Read the requirements. Requirement 1. Prepare the entity's closing entries. Begin by closing out the revenue accounts. (Record debits first, then credits. Exclude explanations from any journal entries.) Journal Entry Date Accounts Debit Credit Novarrow_forwardOn July 1, 2025, Novak Co. pays $10,200 to Splish Insurance Co. for a 2-year insurance policy. Both companies have fiscal years ending December 31. Journalize the entry on July 1 and the adjusting entry on December 31 for Splish Insurance Co. Splish uses the accounts Unearned Service Revenue and Service Revenue. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Creditarrow_forwardWhispering Steel Company, as lessee, signed a lease agreement for equipment for 5 years, beginning December 31, 2020. Annual rental payments of $54,000 are to be made at the beginning of each lease year (December 31). The interest rate used by the lessor in setting the payment schedule is 6%; Whispering's incremental borrowing rate is 8%. Whispering is unaware of the rate being used by the lessor. At the end of the lease, Whispering has the option to buy the equipment for $5,000, considerably below its estimated fair value at that time. The equipment has an estimated useful life of 7 years, with no salvage value. Whispering uses the straight-line method of depreciation on similar owned equipment. Click here to view factor tables.arrow_forward

- The following are selected 2020 transactions of Culver Corporation. Sept. Purchased inventory from Encino Company on account for $46,800. Culver records purchases gross and uses a periodic inventory system. 1 Issued a $46,800, 12-month, 8% note to Encino in payment of account. Oct. 1 Oct. 1 Prepare journal entries for the selected transactions above. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record entries in the order displayed in the problem statement.) Date tember 1 Borrowed $46,800 from the Shore Bank by signing a 12-month, zero-interest-bearing $49,920 note. tember 1 V er 1 Account Titles and Explanation Purchases Accounts Payable Accounts Payable Notes Payable Cash Discount on Notes Payable Notes Payable Debit 46800 46800 46800 3120 Credit 46800 46800 49920arrow_forwardSubject: accountingarrow_forwardPlease help me to solve this problemarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education